You have been contracted as a consultant by Kakao Ltd. Kakao produces and sells high quality boxes of chocolates. Kakao is managed by its two

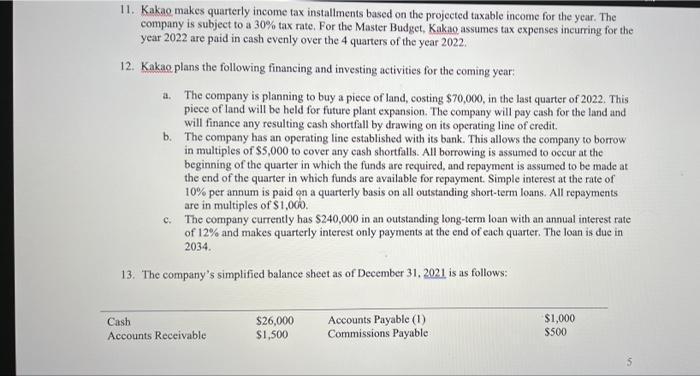

You have been contracted as a consultant by Kakao Ltd. Kakao produces and sells high quality boxes of chocolates. Kakao is managed by its two owners and its fiscal year end is December 31st. It is January 4, 2022, and Kakao just completed its fifth year-end (December 31, 2021). The owners of Kakao are considering using a detailed Master Budget for the 2022 fiscal year to plan and control operations. You have been contracted to complete the following:

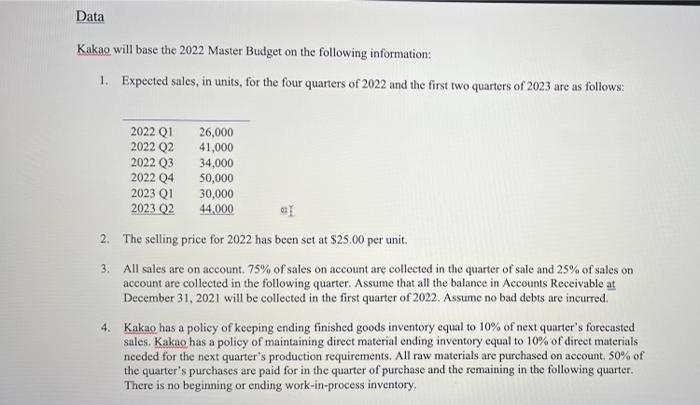

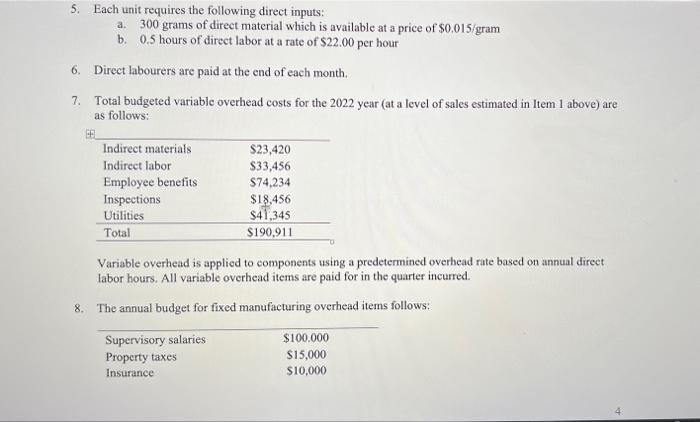

I. Master Budget for Kakao for each quarter of 2022 and for the 2022 fiscal year in total using the information in the “Data” section. The Master Budget will detail each quarter’s activity and the activity for the 2022 fiscal year in total. The following component budgets must be included:

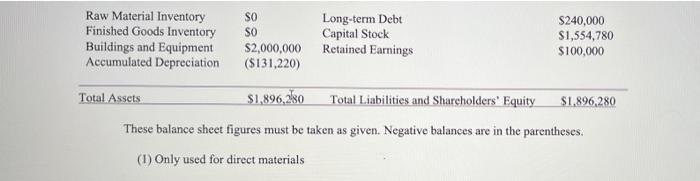

i. Beginning Balance Sheet (“Data” Item 13)

ii. Sales Budget

iii. Schedule of Cash Collections

iv. Production Budget

v. Direct Materials Budget

vi. Schedule of Cash Disbursements for Raw Materials

vii. Direct Labor Budget

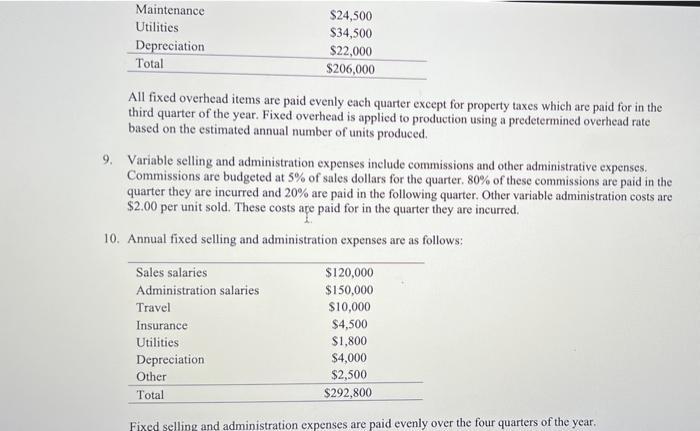

viii. Manufacturing Overhead Budget

i. Include cash disbursements for total overhead expenses

ix. Selling and Administrative Expense Budget

i. Include cash disbursements for selling and administrative expenses

x. Cash Budget

Following for the 2022 fiscal year in total (these should not be quarterly):

xi. Cost of Goods Manufactured Budget

xii. Cost of Goods Sold Budget

xiii. Budgeted Income Statement (using absorption costing)

xiv. Budgeted Balance Sheet

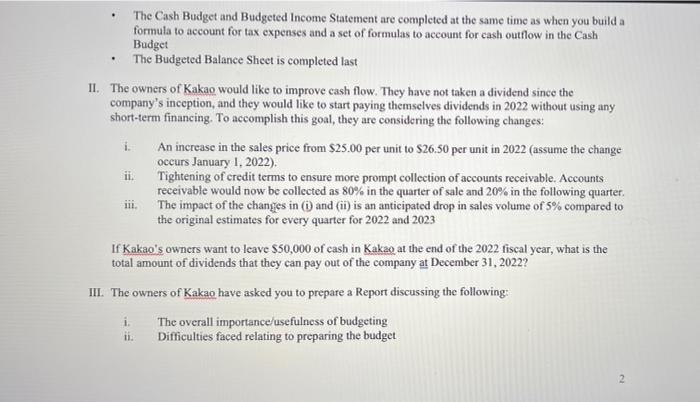

The Cash Budget and Budgeted Income Statement are completed at the same time as when you build a formula to account for tax expenses and a set of formulas to account for cash outflow in the Cash Budget The Budgeted Balance Sheet is completed last II. The owners of Kakao would like to improve cash flow. They have not taken a dividend since the company's inception, and they would like to start paying themselves dividends in 2022 without using any short-term financing. To accomplish this goal, they are considering the following changes: i. ii. III. An increase in the sales price from $25.00 per unit to $26.50 per unit in 2022 (assume the change occurs January 1, 2022). Tightening of credit terms to ensure more prompt collection of accounts receivable. Accounts receivable would now be collected as 80% in the quarter of sale and 20% in the following quarter. The impact of the changes in (i) and (ii) is an anticipated drop in sales volume of 5% compared to the original estimates for every quarter for 2022 and 2023 If Kakao's owners want to leave $50,000 of cash in Kakao at the end of the 2022 fiscal year, what is the total amount of dividends that they can pay out of the company at December 31, 20222 III. The owners of Kakao have asked you to prepare a Report discussing the following: The overall importance/usefulness of budgeting Difficulties faced relating to preparing the budget i. ii. 2

Step by Step Solution

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER BALANCE SHEET TO Kakaos owner i The significance and value of budgeting generally The budget ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started