Answered step by step

Verified Expert Solution

Question

1 Approved Answer

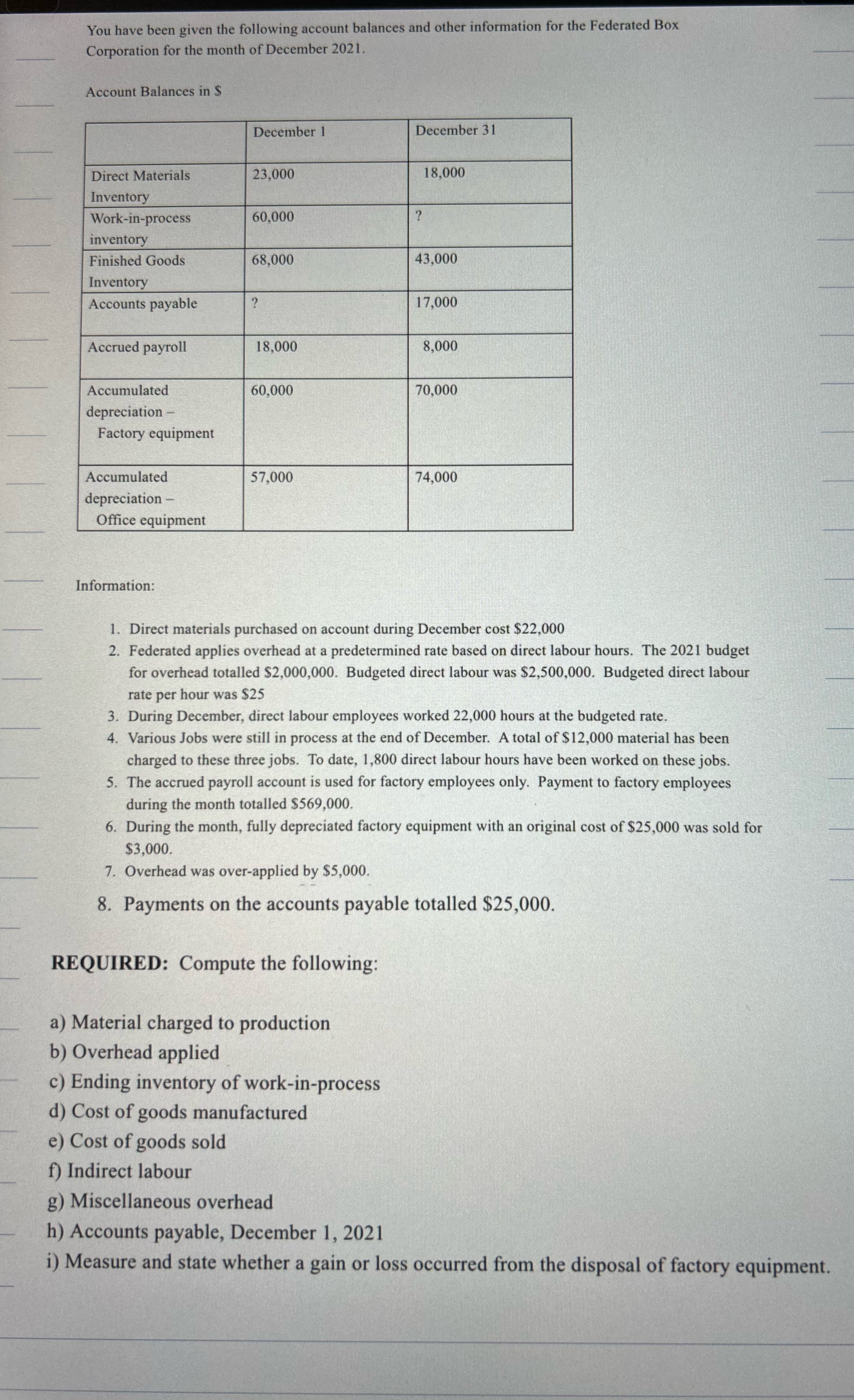

You have been given the following account balances and other information for the Federated Box Corporation for the month of December 2021. Account Balances

You have been given the following account balances and other information for the Federated Box Corporation for the month of December 2021. Account Balances in $ December 1 December 31 Direct Materials 23,000 18,000 Inventory Work-in-process 60,000 ? inventory Finished Goods 68,000 43,000 Inventory Accounts payable ? 17,000 Accrued payroll 18,000 8,000 Accumulated depreciation 60,000 70,000 Factory equipment Accumulated 57,000 74,000 depreciation - Office equipment Information: 1. Direct materials purchased on account during December cost $22,000 2. Federated applies overhead at a predetermined rate based on direct labour hours. The 2021 budget for overhead totalled $2,000,000. Budgeted direct labour was $2,500,000. Budgeted direct labour rate per hour was $25 3. During December, direct labour employees worked 22,000 hours at the budgeted rate. 4. Various Jobs were still in process at the end of December. A total of $12,000 material has been charged to these three jobs. To date, 1,800 direct labour hours have been worked on these jobs. 5. The accrued payroll account is used for factory employees only. Payment to factory employees during the month totalled $569,000. 6. During the month, fully depreciated factory equipment with an original cost of $25,000 was sold for $3,000. 7. Overhead was over-applied by $5,000. 8. Payments on the accounts payable totalled $25,000. REQUIRED: Compute the following: a) Material charged to production b) Overhead applied c) Ending inventory of work-in-process d) Cost of goods manufactured e) Cost of goods sold f) Indirect labour g) Miscellaneous overhead h) Accounts payable, December 1, 2021 i) Measure and state whether a gain or loss occurred from the disposal of factory equipment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started