Answered step by step

Verified Expert Solution

Question

1 Approved Answer

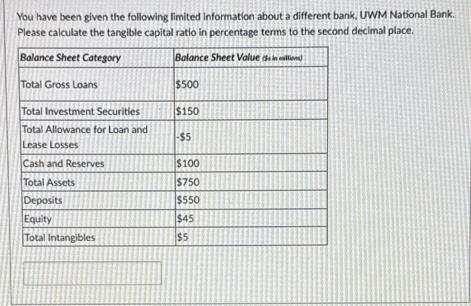

You have been given the following limited Information about a different bank, UWM National Bank. Please calculate the tangible capital ratio in percentage terms

You have been given the following limited Information about a different bank, UWM National Bank. Please calculate the tangible capital ratio in percentage terms to the second decimal place. Balance Sheet Category Balance Sheet Value dinlend $500 $150 -$5 Total Gross Loans Total Investment Securities Total Allowance for Loan and Lease Losses Cash and Reserves Total Assets Deposits Equity Total Intangibles $100 $750 $550 $45 $5 You have been given the following limited information about a different bank, UWM National Bank. Please calculate the reserve ratio in percentage terms to the second decimal place. Use the same information as above You have been given the following limited Information about a different bank, UWM National Bank. Please calculate the tangible capital ratio in percentage terms to the second decimal place. Balance Sheet Category Balance Sheet Value dinlend $500 $150 -$5 Total Gross Loans Total Investment Securities Total Allowance for Loan and Lease Losses Cash and Reserves Total Assets Deposits Equity Total Intangibles $100 $750 $550 $45 $5 You have been given the following limited information about a different bank, UWM National Bank. Please calculate the reserve ratio in percentage terms to the second decimal place. Use the same information as above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the tangible capital ratio we need to first calculate the tangible equit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started