Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been given the Texas Instruments Statement of Stockholders' Equity and Balance Sheet below. Answer the following practice questions and include your answers

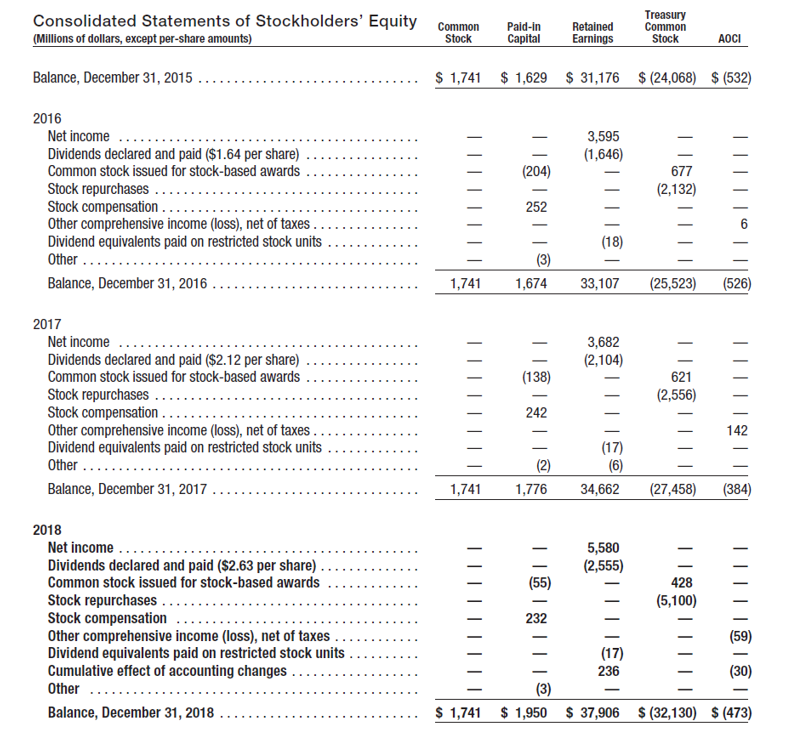

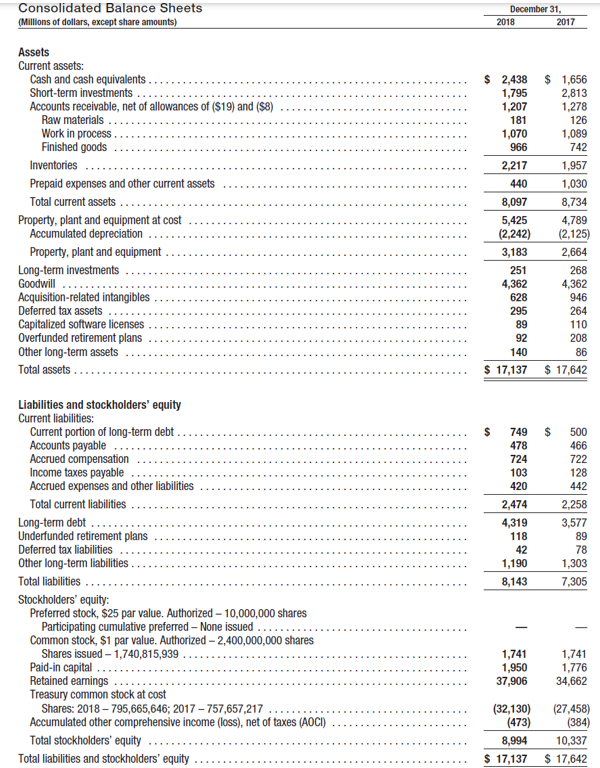

You have been given the Texas Instruments Statement of Stockholders' Equity and Balance Sheet below. Answer the following practice questions and include your answers in the space below. 1. What is the total amount spent on treasury stock during the most recent year? 2. If Texas Instruments were to announce a 2-for-1 stock split, what would be the change in the equity section? 3. What was the value of stock options issued to employees under the stock option plan in the most recent year? 4. Thinking back to module 2, how does stock compensation impact diluted EPS? Consolidated Statements of Stockholders' Equity Common Treasury (Millions of dollars, except per-share amounts) Stock Paid-in Capital Retained Earnings Common Stock AOCI Balance, December 31, 2015.... $1,741 $1,629 $ 31,176 $ (24,068) $ (532) 2016 Net income Dividends declared and paid ($1.64 per share) Common stock issued for stock-based awards Stock repurchases..... Stock compensation. 3,595 (1,646) (204) 677 (2,132) 252 Other comprehensive income (loss), net of taxes. - Dividend equivalents paid on restricted stock units (18) Other ... (3) 1,741 1,674 33,107 (25,523) (526) Balance, December 31, 2016 2017 Net income Dividends declared and paid ($2.12 per share) Common stock issued for stock-based awards Stock repurchases.. Stock compensation... Other comprehensive income (loss), net of taxes. Dividend equivalents paid on restricted stock units Other ..... Balance, December 31, 2017. 2018 Net income Dividends declared and paid ($2.63 per share). Common stock issued for stock-based awards Stock repurchases. Stock compensation Other comprehensive income (loss), net of taxes. Dividend equivalents paid on restricted stock units. Cumulative effect of accounting changes.... Other Balance, December 31, 2018 3,682 (2,104) (138) 242 (2) (17) (6) 1,741 1,776 34,662 621 (2,556) - - (27,458) 5,580 (2,555) (55) 428 (5,100) 232 (17) 236 (3) - 142 (384) (30) $ 1,741 $1,950 $ 37,906 $ (32,130) $ (473) Consolidated Balance Sheets (Millions of dollars, except share amounts) Assets Current assets: December 31, 2018 2017 Cash and cash equivalents. Short-term investments Accounts receivable, net of allowances of ($19) and ($8) Raw materials Work in process Finished goods Inventories Prepaid expenses and other current assets Total current assets Property, plant and equipment at cost Accumulated depreciation. Property, plant and equipment Long-term investments Goodwill Acquisition-related intangibles Deferred tax assets Capitalized software licenses. Overfunded retirement plans Other long-term assets Total assets... Liabilities and stockholders' equity Current liabilities: Current portion of long-term debt Accounts payable Accrued compensation Income taxes payable Accrued expenses and other liabilities Total current liabilities Long-term debt. Underfunded retirement plans Deferred tax liabilities $ 2,438 1,795 $ 1,656 2,813 1,207 1,278 181 126 1,070 1,089 966 742 2,217 1,957 440 1,030 8,097 8,734 5,425 4,789 (2,242) (2,125) 3,183 2,664 251 268 4,362 4,362 628 946 295 264 89 110 92 208 140 86 $ 17,137 $ 17,642 $ 749 $ 500 478 466 724 722 103 128 420 442 2,474 2,258 4,319 3,577 118 89 42 78 Other long-term liabilities 1,190 1,303 Total liabilities.... 8,143 7,305 Stockholders' equity: Preferred stock, $25 par value. Authorized-10,000,000 shares Participating cumulative preferred - None issued | Common stock, $1 par value. Authorized - 2,400,000,000 shares Shares issued-1,740,815,939. 1,741 1,741 Paid-in capital. 1,950 1,776 Retained earnings 37,906 34,662 Treasury common stock at cost Total stockholders' equity Shares: 2018-795,665,646; 2017-757,657,217 Accumulated other comprehensive income (loss), net of taxes (AOCI) Total liabilities and stockholders' equity (32,130) (27,458) (473) 8,994 $ 17,137 (384) 10,337 $ 17,642

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION Based on the information provided in the Consolidated Statements of Stockholders Equity we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started