Question

You have been hired as a financial analyst by Home Scents (HS), manufacturer of scented wax melts. The market for scented wax melts is rapidly

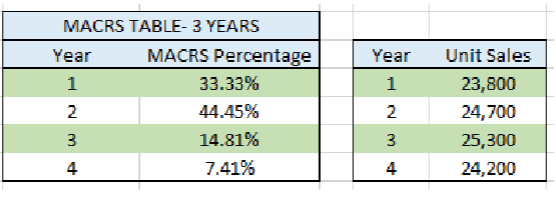

You have been hired as a financial analyst by Home Scents (HS), manufacturer of scented wax melts. The market for scented wax melts is rapidly growing. HS bought some land three years ago for $250,000 with the intent to use it for another project, but has decided against pursuing that project. Based on a recent appraisal, HS believes it could sell the land for $400,000 on an after-tax basis. In four years, the land could be sold for $650,000 after taxes. HS also hired a marketing firm to analyze the wax melt market, at a cost of $35,000. The market report projected unit sales as seen below.

HS believes that they can charge a selling price of $30 per melt, fixed costs for the project will be $125,000 per year, and variable costs are 20% of sales. The equipment necessary for production will costs $750,000 and will be depreciated according to a 3-year MACRS schedule. At the end of the four- year project, the equipment can be scrapped for $100,000. Net working capital of $50,000 will be required immediately. CFL has a 33% tax rate and the required return on the project is 14%.

Part i: What is the NPV of the project?

Part i: What is the NPV of the project?

show work on excel

\begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ MACRS TABLE- 3 YEARS } \\ \hline Year & MACRS Percentage \\ \hline 1 & 33.33% \\ 2 & 44.45% \\ 3 & 14.81% \\ 4 & 7.41% \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline Year & Unit Sales \\ \hline 1 & 23,800 \\ 2 & 24,700 \\ 3 & 25,300 \\ 4 & 24,200 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{ MACRS TABLE- 3 YEARS } \\ \hline Year & MACRS Percentage \\ \hline 1 & 33.33% \\ 2 & 44.45% \\ 3 & 14.81% \\ 4 & 7.41% \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline Year & Unit Sales \\ \hline 1 & 23,800 \\ 2 & 24,700 \\ 3 & 25,300 \\ 4 & 24,200 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started