Answered step by step

Verified Expert Solution

Question

1 Approved Answer

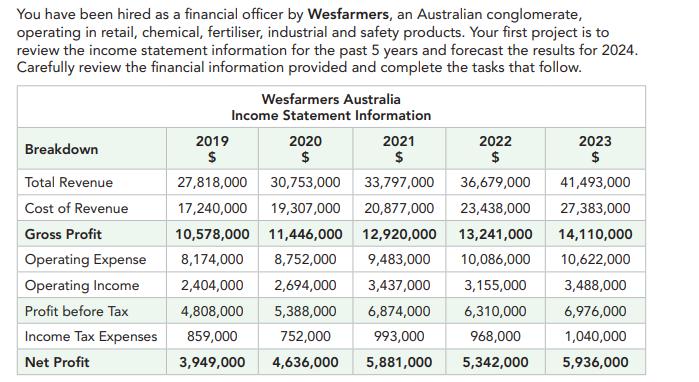

You have been hired as a financial officer by Wesfarmers, an Australian conglomerate, operating in retail, chemical, fertiliser, industrial and safety products. Your first

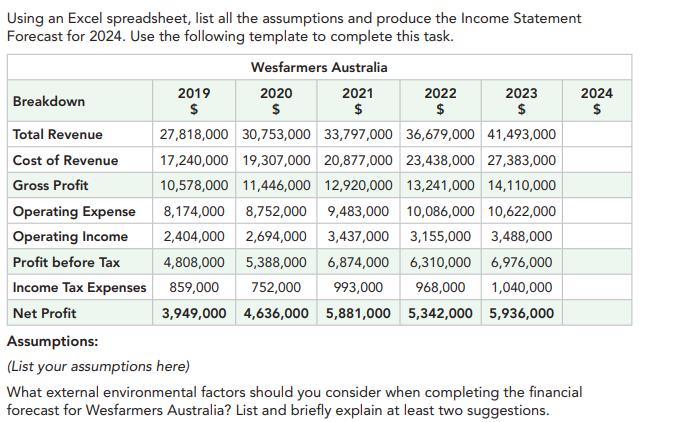

You have been hired as a financial officer by Wesfarmers, an Australian conglomerate, operating in retail, chemical, fertiliser, industrial and safety products. Your first project is to review the income statement information for the past 5 years and forecast the results for 2024. Carefully review the financial information provided and complete the tasks that follow. Wesfarmers Australia Income Statement Information Breakdown 2019 $ 2021 $ Total Revenue Cost of Revenue Gross Profit 2020 $ 27,818,000 30,753,000 33,797,000 36,679,000 41,493,000 17,240,000 19,307,000 20,877,000 23,438,000 27,383,000 10,578,000 11,446,000 12,920,000 13,241,000 14,110,000 2022 2023 $ $ Operating Expense 8,174,000 8,752,000 9,483,000 10,086,000 10,622,000 Operating Income 2,404,000 2,694,000 3,437,000 3,155,000 3,488,000 Profit before Tax 4,808,000 5,388,000 6,874,000 6,310,000 6,976,000 Income Tax Expenses 859,000 752,000 993,000 968,000 1,040,000 Net Profit 3,949,000 4,636,000 5,881,000 5,342,000 5,936,000 Using an Excel spreadsheet, list all the assumptions and produce the Income Statement Forecast for 2024. Use the following template to complete this task. Breakdown Total Revenue Cost of Revenue Gross Profit Operating Expense Operating Income Profit before Tax 2019 $ Wesfarmers Australia 2021 2022 2023 2024 $ $ $ $ 2020 $ 27,818,000 30,753,000 33,797,000 36,679,000 41,493,000 17,240,000 19,307,000 20,877,000 23,438,000 27,383,000 10,578,000 11,446,000 12,920,000 13,241,000 14,110,000 8,174,000 8,752,000 9,483,000 10,086,000 10,622,000 2,404,000 2,694,000 3,437,000 3,155,000 3,488,000 4,808,000 5,388,000 6,874,000 6,310,000 6,976,000 Income Tax Expenses 859,000 752,000 993,000 968,000 1,040,000 3,949,000 4,636,000 5,881,000 5,342,000 5,936,000 Net Profit Assumptions: (List your assumptions here) What external environmental factors should you consider when completing the financial forecast for Wesfarmers Australia? List and briefly explain at least two suggestions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started