Answered step by step

Verified Expert Solution

Question

1 Approved Answer

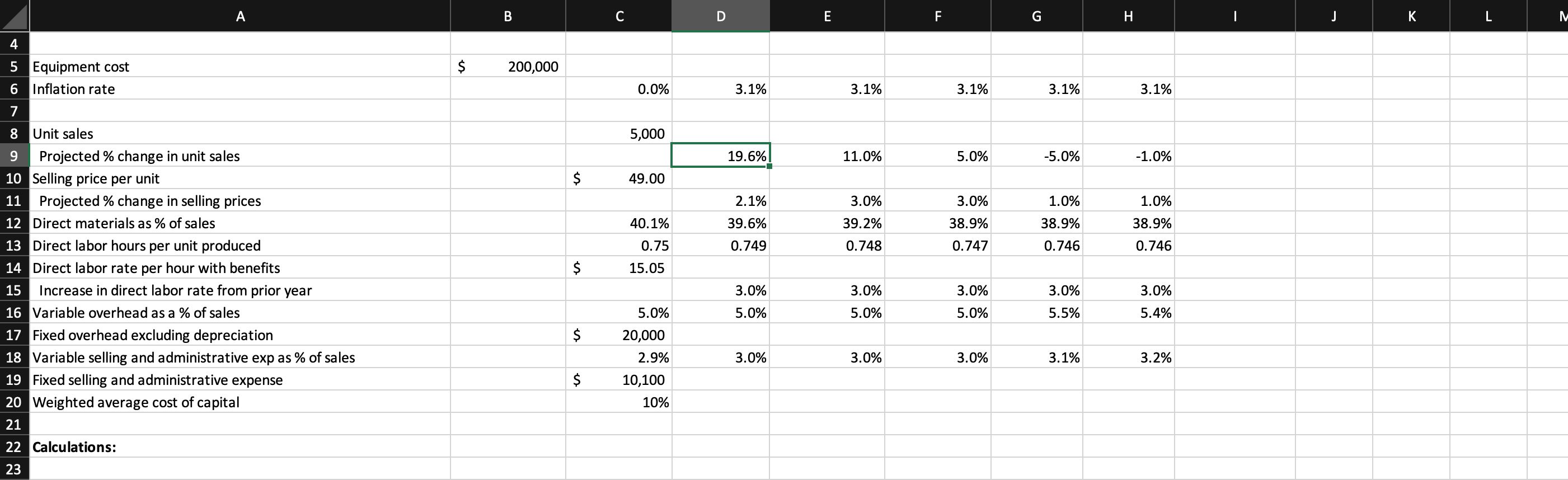

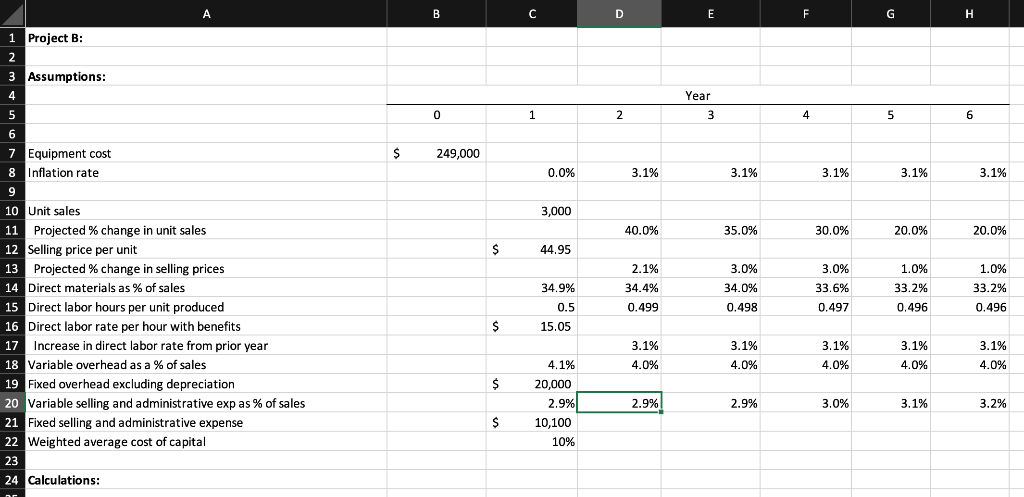

You have been hired by Dynamic Company, Inc. to help them evaluate two projects and help them select the best one. Project A represents an

You have been hired by Dynamic Company, Inc. to help them evaluate two projects and help them select the best one. Project A represents an expansion of an existing product line. Project B involves an entirely new product line. They have provided you with these basic assumptions:

- The weighted average cost of capital is 10.0%

- Expected inflation by year is given in the spreadsheet. That is already built into the variable expenses that are a percent of sales, but not the fixed expenses.

- Both projects will last for six years and the equipment will last until the end of the project.

- They use straight-line depreciation for both book and tax depreciation with no salvage value.

- Dynamic Company will provide information about initial sales expected and annual increases or decreases in sales.

- You will also be provided with select information about expense to allow you to forecast those expenses.

- All fixed expenses except for depreciation will increase at the rate of inflation each year.

- There are not working capital changes.

- The companys average tax rate is 25%.

Additional Instructions:

- Labor rates and selling prices per unit should always be rounded to dollars and cents.

- Revenue and individual expenses should be rounded to the nearest whole dollar each year.

- If the depreciation expense does not total the exact amount adjust it in year 6.

- All percentages should be rounded to the nearest tenth of a percent.

- Show all of your calculations even if you need to provide schedules for the calculations.

- Model your cash flow calculations format after the example I provided to you in class.

Required:

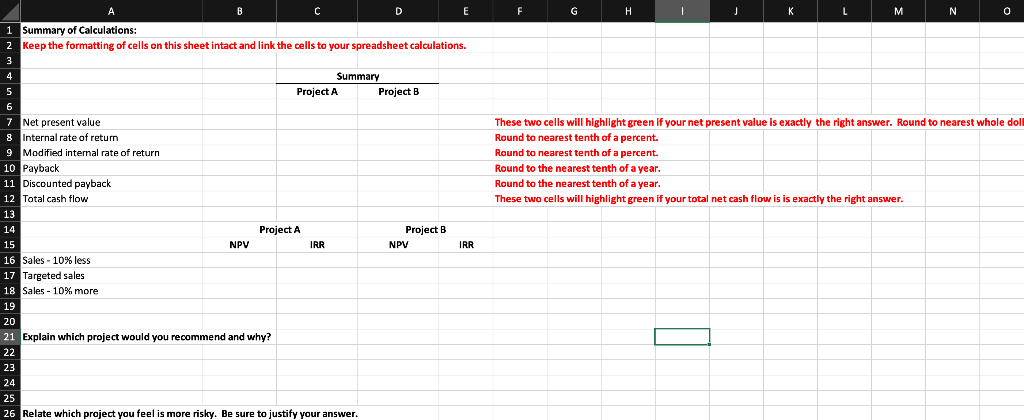

- Calculate the Net Present Value for each project

- Calculate the Internal Rate of Return for each project.

- Calculate the Modified Internal Rate of Return for each project.

- Calculate the Payback Period for each project.

- Calculate the Discounted Payback Period for each project.

- Provide a table for each project showing the Net Present Value and Internal Rate of Return for each of each of the following conditions and list them in the Summary provided:

- With the stated assumptions

- With sales 10% higher

- With sales 10% lower

- Determine which project you would recommend and justify your answer completely.

- Relate which project you feel is more risky and justify your answer completely.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started