Answered step by step

Verified Expert Solution

Question

1 Approved Answer

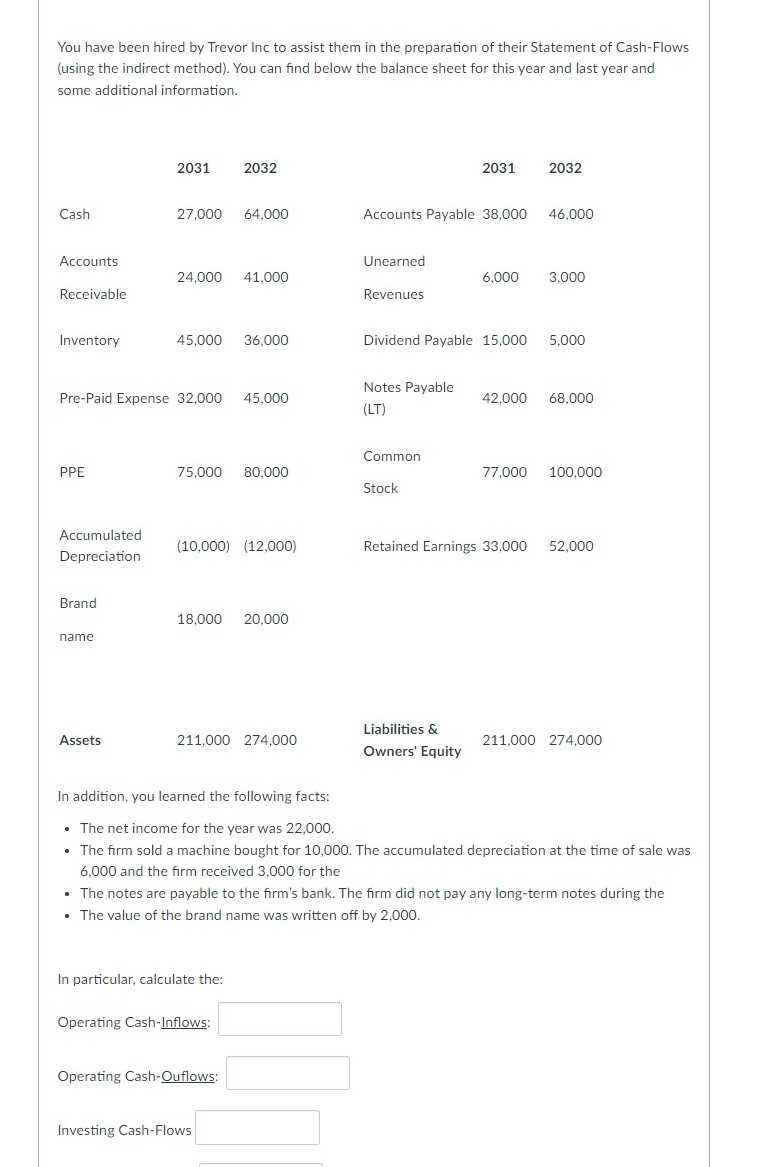

You have been hired by Trevor Inc to assist them in the preparation of their Statement of Cash-Flows (using the indirect method). You can

You have been hired by Trevor Inc to assist them in the preparation of their Statement of Cash-Flows (using the indirect method). You can find below the balance sheet for this year and last year and some additional information. 2031 2032 2031 2032 Cash 27,000 64,000 Accounts Payable 38,000 46,000 Accounts Unearned 24,000 41,000 6,000 3,000 Receivable Revenues Inventory 45,000 36,000 Dividend Payable 15,000 5,000 Notes Payable Pre-Paid Expense 32,000 45,000 42,000 68,000 (LT) Common PPE 75,000 80,000 77,000 100,000 Stock Accumulated Depreciation (10,000) (12,000) Retained Earnings 33,000 52,000 Brand 18,000 20,000 name Assets 211,000 274,000 Liabilities & Owners' Equity 211,000 274,000 In addition, you learned the following facts: The net income for the year was 22,000. The firm sold a machine bought for 10,000. The accumulated depreciation at the time of sale was 6,000 and the firm received 3,000 for the The notes are payable to the firm's bank. The firm did not pay any long-term notes during the The value of the brand name was written off by 2,000. In particular, calculate the: Operating Cash-Inflows: Operating Cash-Ouflows: Investing Cash-Flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started