Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been hired to assist the DKFF in determining how to 'optimally' distribute up to $1,750,000 (1750K) in charitable giving to a set

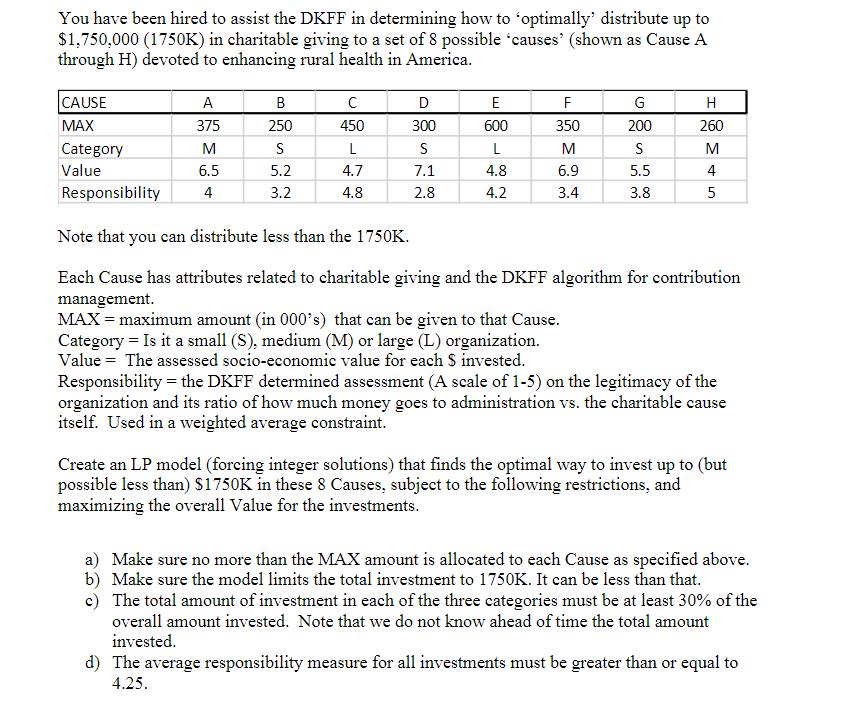

You have been hired to assist the DKFF in determining how to 'optimally' distribute up to $1,750,000 (1750K) in charitable giving to a set of 8 possible 'causes' (shown as Cause A through H) devoted to enhancing rural health in America. CAUSE MAX A 375 M 6.5 4 B 250 S 5.2 3.2 C 450 L 4.7 4.8 D 300 S 7.1 2.8 E 600 L 4.8 4.2 F 350 M 6.9 3.4 G 200 S 5.5 3.8 H 260 M Category Value Responsibility Note that you can distribute less than the 1750K. Each Cause has attributes related to charitable giving and the DKFF algorithm for contribution management. MAX = maximum amount (in 000's) that can be given to that Cause. Category Is it a small (S), medium (M) or large (L) organization. Value The assessed socio-economic value for each $ invested. 4 5 Responsibility = the DKFF determined assessment (A scale of 1-5) on the legitimacy of the organization and its ratio of how much money goes to administration vs. the charitable cause itself. Used in a weighted average constraint. Create an LP model (forcing integer solutions) that finds the optimal way to invest up to (but possible less than) $1750K in these 8 Causes, subject to the following restrictions, and maximizing the overall Value for the investments. a) Make sure no more than the MAX amount is allocated to each Cause as specified above. b) Make sure the model limits the total investment to 1750K. It can be less than that. c) The total amount of investment in each of the three categories must be at least 30% of the overall amount invested. Note that we do not know ahead of time the total amount invested. d) The average responsibility measure for all investments must be greater than or equal to 4.25.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To create a Linear Programming LP model for this charitabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started