Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been hired to provide recommendations on an improved method of estimating costs of production for General Paper Company. Currently the company applies

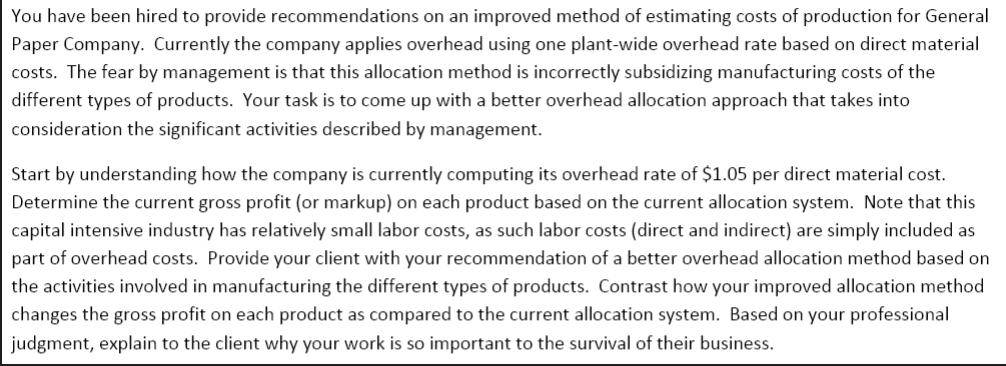

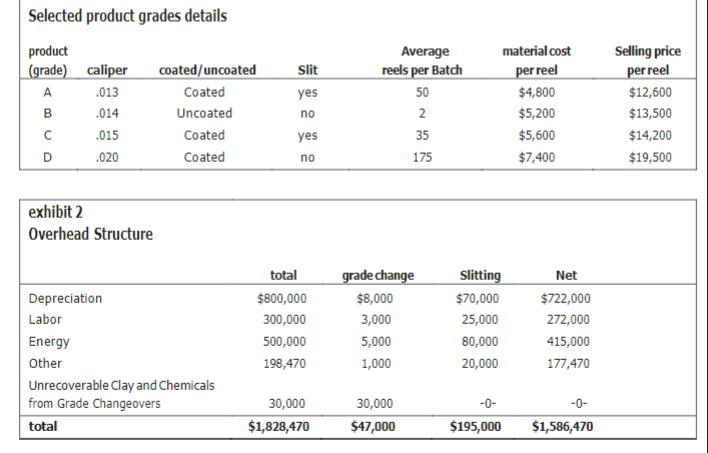

You have been hired to provide recommendations on an improved method of estimating costs of production for General Paper Company. Currently the company applies overhead using one plant-wide overhead rate based on direct material costs. The fear by management is that this allocation method is incorrectly subsidizing manufacturing costs of the different types of products. Your task is to come up with a better overhead allocation approach that takes into consideration the significant activities described by management. Start by understanding how the company is currently computing its overhead rate of $1.05 per direct material cost. Determine the current gross profit (or markup) on each product based on the current allocation system. Note that this capital intensive industry has relatively small labor costs, as such labor costs (direct and indirect) are simply included as part of overhead costs. Provide your client with your recommendation of a better overhead allocation method based on the activities involved in manufacturing the different types of products. Contrast how your improved allocation method changes the gross profit on each product as compared to the current allocation system. Based on your professional judgment, explain to the client why your work is so important to the survival of their business. Selected product grades details product (grade) caliper A B C D .013 .014 .015 .020 exhibit 2 Overhead Structure Depreciation Labor Energy Other coated/uncoated Coated Uncoated Coated Coated Unrecoverable Clay and Chemicals from Grade Changeovers total Slit yes no yes no total $800,000 300,000 500,000 198,470 30,000 $1,828,470 Average reels per Batch 50 2 35 175 grade change $8,000 3,000 5,000 1,000 30,000 $47,000 Slitting $70,000 25,000 80,000 20,000 material cost per reel $4,800 $5,200 $5,600 $7,400 $195,000 Net $722,000 272,000 415,000 177,470 $1,586,470 Selling price per reel $12,600 $13,500 $14,200 $19,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started