Answered step by step

Verified Expert Solution

Question

1 Approved Answer

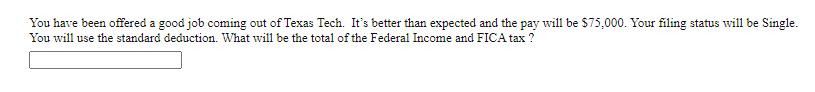

You have been offered a good job coming out of Texas Tech. It's better than expected and the pay will be $75,000. Your filing

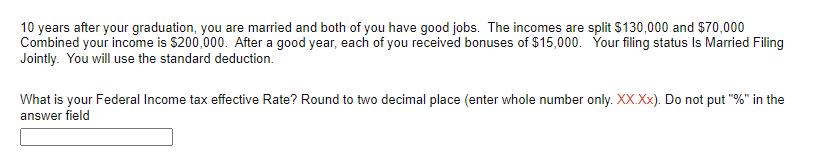

You have been offered a good job coming out of Texas Tech. It's better than expected and the pay will be $75,000. Your filing status will be Single. You will use the standard deduction. What will be the total of the Federal Income and FICA tax ? 10 years after your graduation, you are married and both of you have good jobs. The incomes are split $130,000 and $70,000 Combined your income is $200,000. After a good year, each of you received bonuses of $15,000. Your filing status Is Married Filing Jointly. You will use the standard deduction. What is your Federal Income tax effective Rate? Round to two decimal place (enter whole number only. XX.Xx). Do not put "%" in the answer field

Step by Step Solution

★★★★★

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Answer Description 63000 Taxable Income 9800 Federal Income Tax 5738 FICA ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started