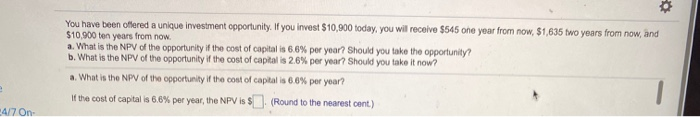

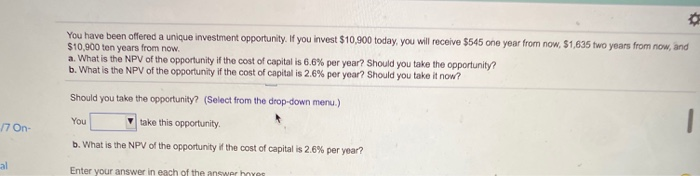

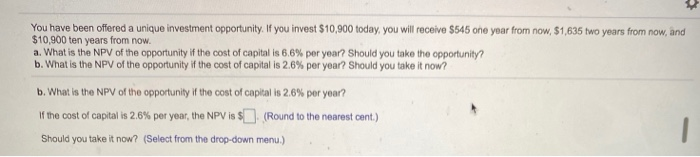

You have been offered a unique investment opportunity. If you invest $10,900 today, you will receive $545 one year from now, $1,635 two years from now, and $10.900 ten years from now. a. What is the NPV of the opportunity if the cost of capital is 6.6% per year? Should you take the opportunity? b. What is the NPV of the opportunity if the cost of capital is 2.6% per year? Should you take it now? a. What is the NPV of the opportunity if the cost of capital is 6.6% per year? of the cost of capital is 6.6% per year, the NPV is $ U. (Round to the nearest cent.) 4/7 On You have been offered a unique investment opportunity. If you invest $10,900 today, you will receive $545 one year from now, $1,635 two years from now, and $10,900 ten years from now. a. What is the NPV of the opportunity if the cost of capital is 6.6% per year? Should you take the opportunity? b. What is the NPV of the opportunity if the cost of capital is 2.6% per year? Should you take it now? Should you take the opportunity? (Select from the drop-down menu.) You take this opportunity 17 On- - b. What is the NPV of the opportunity if the cost of capital is 2.6% per year? al Enter your answer in each of the answer hyes You have been offered a unique investment opportunity. If you invest $10,900 today, you will receive $545 one year from now, $1,635 two years from now, and $10,900 ten years from now. a. What is the NPV of the opportunity if the cost of capital is 6.6% per year? Should you take the opportunity? b. What is the NPV of the opportunity if the cost of capital is 2.6% per year? Should you take it now? b. What is the NPV of the opportunity if the cost of capital is 2.6% per year? If the cost of capital is 2,6% per year, the NPV is $(Round to the nearest cent) Should you take it now? (Select from the drop-down menu.) You have been offered a unique investment opportunity. If you invest $10,900 today, you wil receive $545 one year from now, $1,635 two years from now, and $10,000 ten years from now. a. What is the NPV of the opportunity if the cost of capital is 6.6% per year? Should you take the opportunity? b. What is the NPV of the opportunity if the cost of capital is 2.6% per year? Should you take it now? If the cost of capital is 2.6% per year, the NPV is $(Round to the nearest cont.) Should you take it now? (Select from the drop-down menu.) take this opportunity at the new cost of capital On- You Enter your answer in each of the answer boxes