Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been offered a very long-term investment opportunity to increase your money one hundredfold. You can invest $700 today and expect to receive $70,000

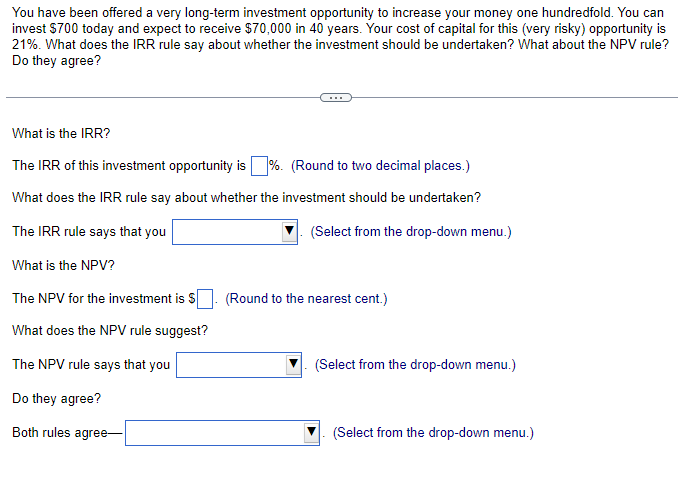

You have been offered a very long-term investment opportunity to increase your money one hundredfold. You can invest $700 today and expect to receive $70,000 in 40 years. Your cost of capital for this (very risky) opportunity is 21%. What does the IRR rule say about whether the investment should be undertaken? What about the NPV rule? Do they agree? What is the IRR? The IRR of this investment opportunity is %. (Round to two decimal places.) What does the IRR rule say about whether the investment should be undertaken? The IRR rule says that you (Select from the drop-down menu.) What is the NPV? The NPV for the investment is $. (Round to the nearest cent.) What does the NPV rule suggest? The NPV rule says that you (Select from the drop-down menu.) Do they agree? Both rules agree- (Select from the drop-down menu.)

You have been offered a very long-term investment opportunity to increase your money one hundredfold. You can invest $700 today and expect to receive $70,000 in 40 years. Your cost of capital for this (very risky) opportunity is 21%. What does the IRR rule say about whether the investment should be undertaken? What about the NPV rule? Do they agree? What is the IRR? The IRR of this investment opportunity is %. (Round to two decimal places.) What does the IRR rule say about whether the investment should be undertaken? The IRR rule says that you (Select from the drop-down menu.) What is the NPV? The NPV for the investment is $. (Round to the nearest cent.) What does the NPV rule suggest? The NPV rule says that you (Select from the drop-down menu.) Do they agree? Both rules agree- (Select from the drop-down menu.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started