Answered step by step

Verified Expert Solution

Question

1 Approved Answer

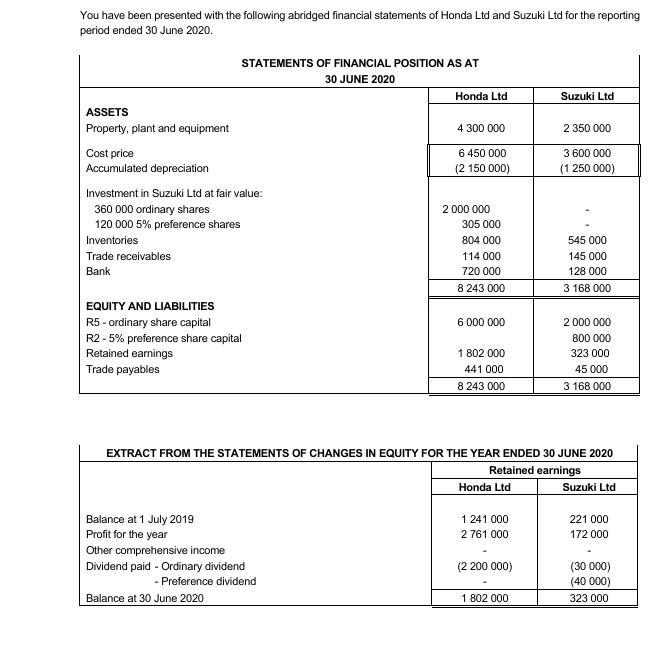

You have been presented with the following abridged financial statements of Honda Ltd and Suzuki Ltd for the reporting period ended 30 June 2020.

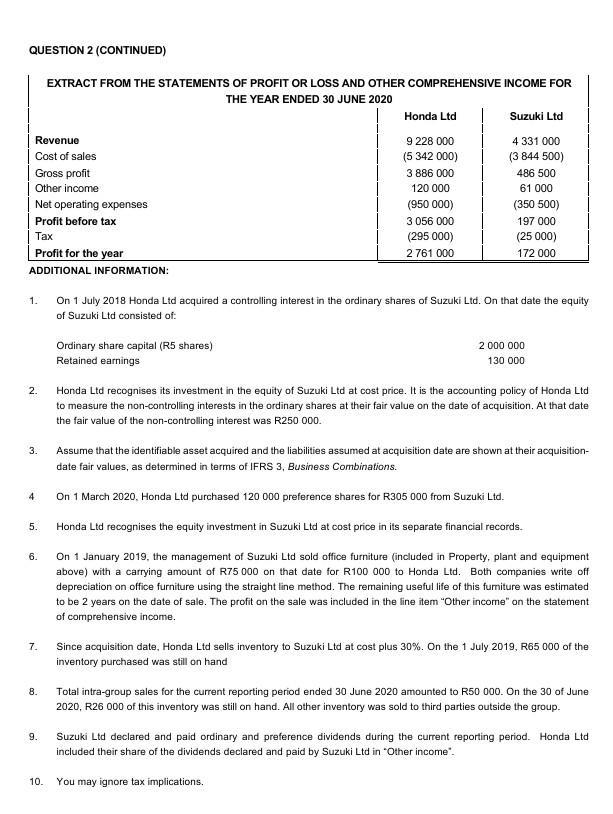

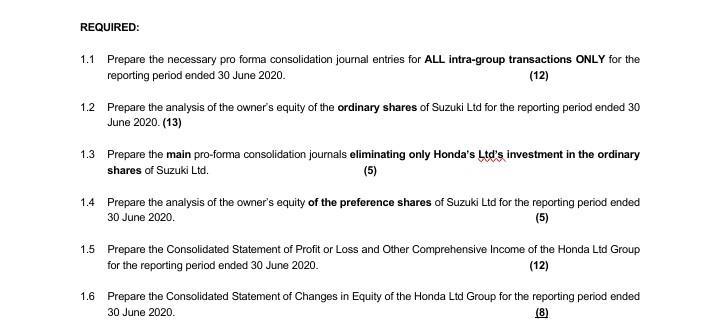

You have been presented with the following abridged financial statements of Honda Ltd and Suzuki Ltd for the reporting period ended 30 June 2020. ASSETS Property, plant and equipment Cost price Accumulated depreciation Investment in Suzuki Ltd at fair value: 360 000 ordinary shares 120 000 5% preference shares Inventories Trade receivables Bank STATEMENTS OF FINANCIAL POSITION AS AT 30 JUNE 2020 EQUITY AND LIABILITIES R5-ordinary share capital R2-5% preference share capital Retained earnings Trade payables Balance at 1 July 2019 Profit for the year Other comprehensive income Honda Ltd Dividend paid - Ordinary dividend - Preference dividend Balance at 30 June 2020 4 300 000 6 450 000 (2 150 000) 2 000 000 305 000 804 000 114 000 720 000 8 243 000 6 000 000 1 802 000 441 000 8 243 000 Honda Ltd EXTRACT FROM THE STATEMENTS OF CHANGES IN EQUITY FOR THE YEAR ENDED 30 JUNE 2020 Retained earnings 1 241 000 2 761 000 Suzuki Ltd (2 200 000) 1 802 000 2 350 000 3 600 000 (1 250 000) 545 000 145 000 128 000 3 168 000 2 000 000 800 000 323 000 45 000 3 168 000 Suzuki Ltd 221 000 172 000 (30 000) (40 000) 323 000 QUESTION 2 (CONTINUED) Revenue Cost of sales Gross profit Other income Net operating expenses Profit before tax Tax Profit for the year ADDITIONAL INFORMATION: 1. 2. 3. 4 5. 6. 7. 8. 9. EXTRACT FROM THE STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE 2020 10. Honda Ltd 9 228 000 (5 342 000) 3 886 000 120 000 (950 000) 3 056 000 (295 000) 2761 000 Ordinary share capital (R5 shares) Retained earnings Suzuki Ltd 4 331 000 (3 844 500) 486 500 61 000 (350 500) 197 000 (25 000) 172 000 On 1 July 2018 Honda Ltd acquired a controlling interest in the ordinary shares of Suzuki Ltd. On that date the equity of Suzuki Ltd consisted of: 2 000 000 130 000 Honda Ltd recognises its investment in the equity of Suzuki Ltd at cost price. It is the accounting policy of Honda Ltd to measure the non-controlling interests in the ordinary shares at their fair value on the date of acquisition. At that date the fair value of the non-controlling interest was R250 000. Assume that the identifiable asset acquired and the liabilities assumed at acquisition date are shown at their acquisition- date fair values, as determined in terms of IFRS 3, Business Combinations. On 1 March 2020, Honda Ltd purchased 120 000 preference shares for R305 000 from Suzuki Ltd. Honda Ltd recognises the equity investment in Suzuki Ltd at cost price in its separate financial records. On 1 January 2019, the management of Suzuki Ltd sold office furniture (included in Property, plant and equipment above) with a carrying amount of R75 000 on that date for R100 000 to Honda Ltd. Both companies write off depreciation on office furniture using the straight line method. The remaining useful life of this furniture was estimated to be 2 years on the date of sale. The profit on the sale was included in the line item "Other income" on the statement of comprehensive income. Since acquisition date, Honda Ltd sells inventory to Suzuki Ltd at cost plus 30%. On the 1 July 2019, R65 000 of the inventory purchased was still on hand Total intra-group sales for the current reporting period ended 30 June 2020 amounted to R50 000. On the 30 of June 2020, R26 000 of this inventory was still on hand. All other inventory was sold to third parties outside the group. Suzuki Ltd declared and paid ordinary and preference dividends during the current reporting period. Honda Ltd included their share of the dividends declared and paid by Suzuki Ltd in "Other income". You may ignore tax implications. REQUIRED: 1.1 Prepare the necessary pro forma consolidation journal entries for ALL intra-group transactions ONLY for the reporting period ended 30 June 2020. (12) 1.2 Prepare the analysis of the owner's equity of the ordinary shares of Suzuki Ltd for the reporting period ended 30 June 2020. (13) 1.3 Prepare the main pro-forma consolidation journals eliminating only Honda's Ltd's investment in the ordinary shares of Suzuki Ltd. (5) 1.4 Prepare the analysis of the owner's equity of the preference shares of Suzuki Ltd for the reporting period ended 30 June 2020. (5) 1.5 Prepare the Consolidated Statement of Profit or Loss and Other Comprehensive Income of the Honda Ltd Group for the reporting period ended 30 June 2020. (12) 1.6 Prepare the Consolidated Statement of Changes in Equity of the Honda Ltd Group for the reporting period ended 30 June 2020. (8)

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

11Honda Ltd Dr Cr Inventory 50000 To Suzuki Ltd Inventory Suzuki Ltd Dr Cr Inventory 26000 To Honda ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started