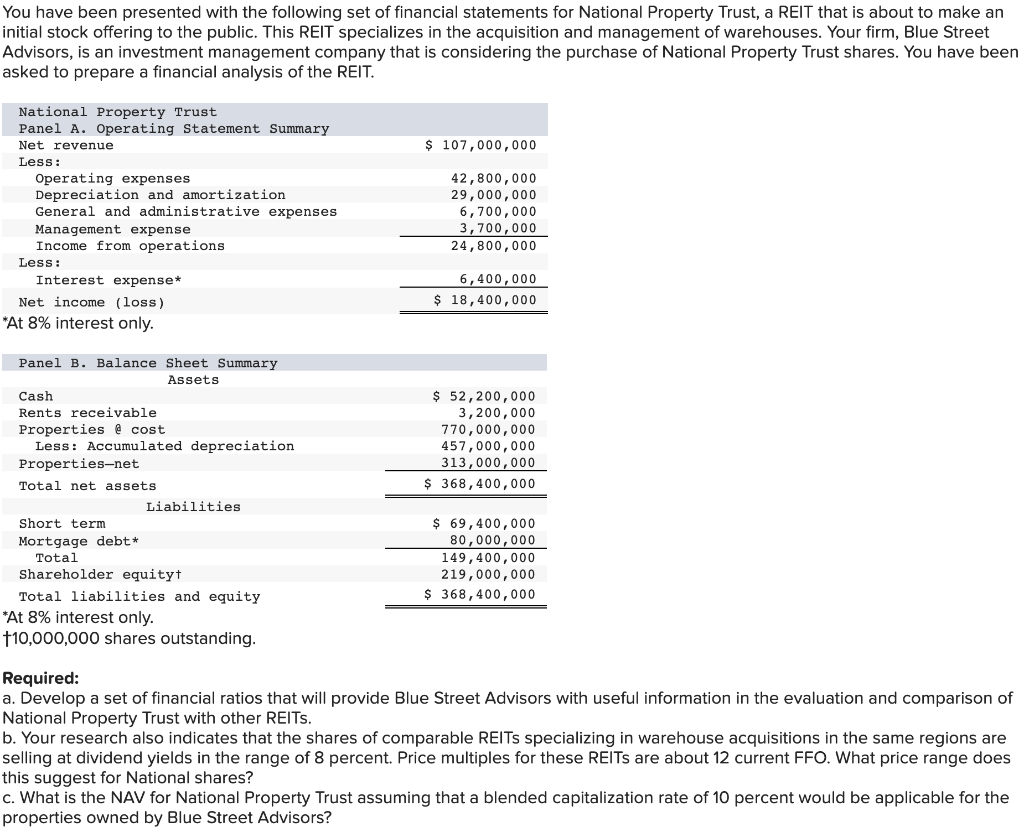

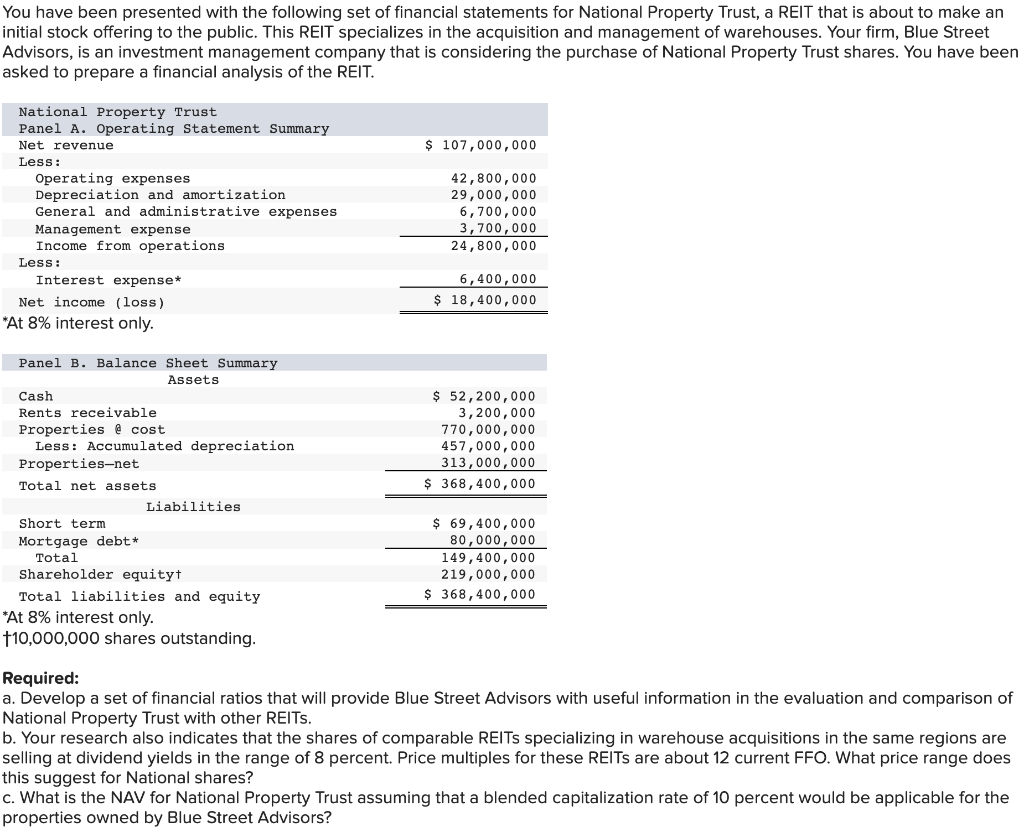

You have been presented with the following set of financial statements for National Property Trust, a REIT that is about to make an initial stock offering to the public. This REIT specializes in the acquisition and management of warehouses. Your firm, Blue Street Advisors, is an investment management company that is considering the purchase of National Property Trust shares. You have been asked to prepare a financial analysis of the REIT. National Property Trust Panel A. Operating Statement Summary Net revenue $ 107,000,000 Less: Operating expenses Depreciation and amortization General and administrative expenses Management expense Income from operations Less: Interest expense* Net income (loss) *At 8% interest only. 42,800,000 29,000,000 6,700,000 3,700,000 24,800,000 6,400,000 $ 18,400,000 $ 52,200,000 3,200,000 770,000,000 457,000,000 313, 0,000 $ 368,400,000 Panel B. Balance Sheet Summary Assets Cash Rents receivable Properties @ cost Less: Accumulated depreciation Properties-net Total net assets Liabilities Short term Mortgage debt Total Shareholder equityt Total liabilities and equity *At 8% interest only. 10,000,000 shares outstanding. $ 69,400,000 80,000,000 149,400,000 219,000,000 $ 368,400,000 Required: a. Develop a set of financial ratios that will provide Blue Street Advisors with useful information in the evaluation and comparison of National Property Trust with other REITs. b. Your research also indicates that the shares of comparable REITs specializing in warehouse acquisitions in the same regions are selling at dividend yields in the range of 8 percent. Price multiples for these REITs are about 12 current FFO. What price range does this suggest for National shares? c. What is the NAV for National Property Trust assuming that a blended capitalization rate of 10 percent would be applicable for the properties owned by Blue Street Advisors? You have been presented with the following set of financial statements for National Property Trust, a REIT that is about to make an initial stock offering to the public. This REIT specializes in the acquisition and management of warehouses. Your firm, Blue Street Advisors, is an investment management company that is considering the purchase of National Property Trust shares. You have been asked to prepare a financial analysis of the REIT. National Property Trust Panel A. Operating Statement Summary Net revenue $ 107,000,000 Less: Operating expenses Depreciation and amortization General and administrative expenses Management expense Income from operations Less: Interest expense* Net income (loss) *At 8% interest only. 42,800,000 29,000,000 6,700,000 3,700,000 24,800,000 6,400,000 $ 18,400,000 $ 52,200,000 3,200,000 770,000,000 457,000,000 313, 0,000 $ 368,400,000 Panel B. Balance Sheet Summary Assets Cash Rents receivable Properties @ cost Less: Accumulated depreciation Properties-net Total net assets Liabilities Short term Mortgage debt Total Shareholder equityt Total liabilities and equity *At 8% interest only. 10,000,000 shares outstanding. $ 69,400,000 80,000,000 149,400,000 219,000,000 $ 368,400,000 Required: a. Develop a set of financial ratios that will provide Blue Street Advisors with useful information in the evaluation and comparison of National Property Trust with other REITs. b. Your research also indicates that the shares of comparable REITs specializing in warehouse acquisitions in the same regions are selling at dividend yields in the range of 8 percent. Price multiples for these REITs are about 12 current FFO. What price range does this suggest for National shares? c. What is the NAV for National Property Trust assuming that a blended capitalization rate of 10 percent would be applicable for the properties owned by Blue Street Advisors