Answered step by step

Verified Expert Solution

Question

1 Approved Answer

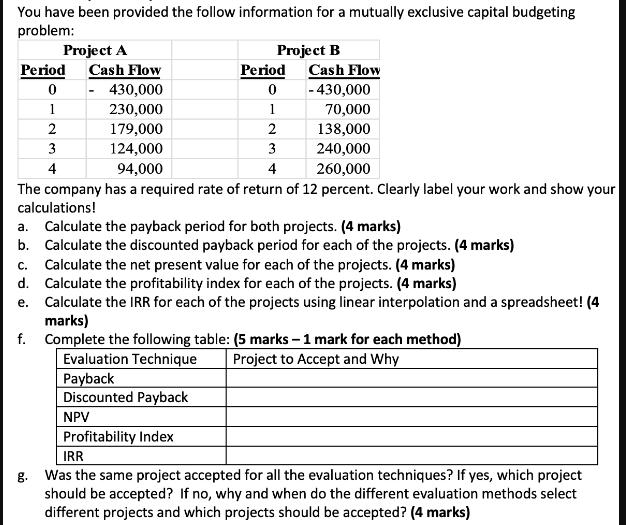

You have been provided the follow information for a mutually exclusive capital budgeting problem: Project A Project B Period Cash Flow Period Cash Flow

You have been provided the follow information for a mutually exclusive capital budgeting problem: Project A Project B Period Cash Flow Period Cash Flow 0 - 430,000 0 -430,000 1 230,000 1 70,000 2 179,000 2 138,000 3 124,000 3 240,000 4 94,000 4 260,000 The company has a required rate of return of 12 percent. Clearly label your work and show your calculations! a. Calculate the payback period for both projects. (4 marks) b. Calculate the discounted payback period for each of the projects. (4 marks) C. Calculate the net present value for each of the projects. (4 marks) d. Calculate the profitability index for each of the projects. (4 marks) e. Calculate the IRR for each of the projects using linear interpolation and a spreadsheet! (4 marks) f. Complete the following table: (5 marks - 1 mark for each method) Evaluation Technique Payback Discounted Payback Project to Accept and Why NPV Profitability Index IRR g. Was the same project accepted for all the evaluation techniques? If yes, which project should be accepted? If no, why and when do the different evaluation methods select different projects and which projects should be accepted? (4 marks)

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Calculating the Payback Period For Project A Initial Investment 430000 Cash Flows 230000 179000 12...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started