Answered step by step

Verified Expert Solution

Question

1 Approved Answer

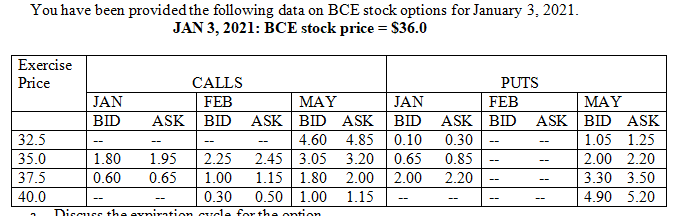

You have been provided the following data on BCE stock options for January 3, 2021. JAN 3, 2021: BCE stock price = $36.0 Exercise

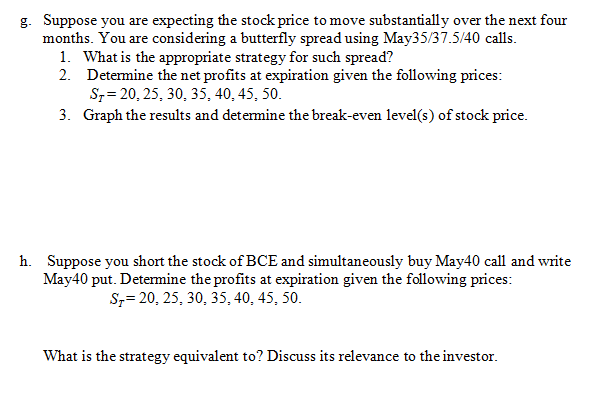

You have been provided the following data on BCE stock options for January 3, 2021. JAN 3, 2021: BCE stock price = $36.0 Exercise Price 32.5 35.0 37.5 40.0 JAN BID ASK CALLS FEB BID - 1.80 1.95 2.25 0.60 0.65 1.00 ASK 2.45 3.05 1.15 1.80 0.30 0.50 1.00 Discuss the evniration cucle for the option MAY JAN FEB BID ASK BID ASK BID ASK 4.60 4.85 0.10 0.30 3.20 0.65 0.85 2.00 2.00 2.20 1.15 PUTS -- -- -- MAY BID ASK 1.05 1.25 2.00 2.20 3.30 3.50 4.90 5.20 g. Suppose you are expecting the stock price to move substantially over the next four months. You are considering a butterfly spread using May35/37.5/40 calls. 1. What is the appropriate strategy for such spread? 2. Determine the net profits at expiration given the following prices: ST= 20, 25, 30, 35, 40, 45, 50. 3. Graph the results and determine the break-even level(s) of stock price. h. Suppose you short the stock of BCE and simultaneously buy May40 call and write May40 put. Determine the profits at expiration given the following prices: ST= 20, 25, 30, 35, 40, 45, 50. What is the strategy equivalent to? Discuss its relevance to the investor.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 The appropriate strategy for a butterfly spread using May3537540 calls is to buy one May 35 call s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started