Answered step by step

Verified Expert Solution

Question

1 Approved Answer

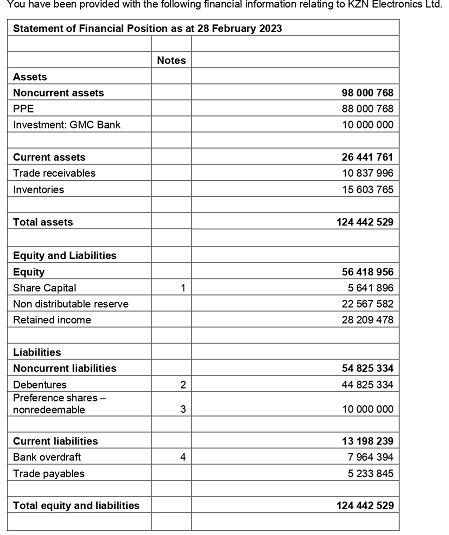

You have been provided with the following financial information relating to KZN Electronics Ltd. Statement of Financial Position as at 28 February 2023 Assets

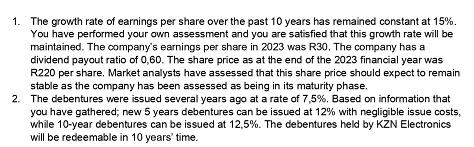

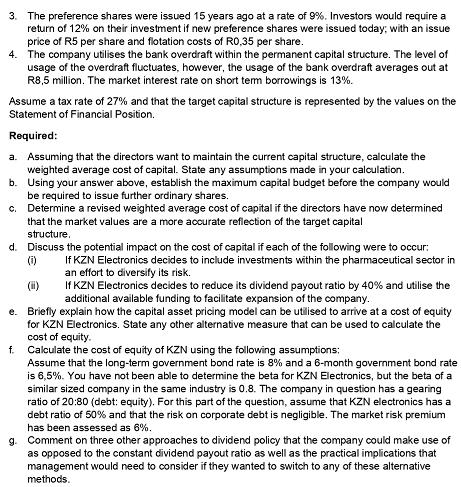

You have been provided with the following financial information relating to KZN Electronics Ltd. Statement of Financial Position as at 28 February 2023 Assets Noncurrent assets PPE Investment: GMC Bank Current assets Trade receivables Inventories Total assets Equity and Liabilities Equity Share Capital Non distributable reserve Retained income Liabilities Noncurrent liabilities. Debentures Preference shares- nonredeemable Current liabilities Bank overdraft Trade payables Total equity and liabilities Notes 1 2 3 4 98 000 768 88 000 768 10 000 000 26 441 761 10 837 996 15 603 765 124 442 529 56 418 956 5 641 896 22 567 582 28 209 478 54 825 334 44 825 334 10 000 000 13 198 239 7 964 394 5 233 845 124 442 529 1. The growth rate of earnings per share over the past 10 years has remained constant at 15%. You have performed your own assessment and you are satisfied that this growth rate will be maintained. The company's earnings per share in 2023 was R30. The company has a dividend payout ratio of 0,60. The share price as at the end of the 2023 financial year was R220 per share. Market analysts have assessed that this share price should expect to remain stable as the company has been assessed as being in its maturity phase. 2. The debentures were issued several years ago at a rate of 7,5%. Based on information that you have gathered; new 5 years debentures can be issued at 12% with negligible issue costs, while 10-year debentures can be issued at 12,5%. The debentures held by KZN Electronics will be redeemable in 10 years' time. 3. The preference shares were issued 15 years ago at a rate of 9 %. Investors would require a return of 12% on their investment if new preference shares were issued today; with an issue price of R5 per share and flotation costs of R0,35 per share. 4. The company utilises the bank overdraft within the permanent capital structure. The level of usage of the overdraft fluctuates, however, the usage of the bank overdraft averages out at R8,5 million. The market interest rate on short term borrowings is 13%. Assume a tax rate of 27% and that the target capital structure is represented by the values on the Statement of Financial Position. Required: a. Assuming that the directors want to maintain the current capital structure, calculate the weighted average cost of capital. State any assumptions made in your calculation. Using your answer above, establish the maximum capital budget before the company would be required to issue further ordinary shares. b. c. Determine a revised weighted average cost of capital if the directors have now determined that the market values are a more accurate reflection of the target capital structure. d. Discuss the potential impact on the cost of capital if each of the following were to occur: If KZN Electronics decides to include investments within the pharmaceutical sector in an effort to diversify its risk. (1) If KZN Electronics decides to reduce its dividend payout ratio by 40% and utilise the additional available funding to facilitate expansion of the company. (ii) e. Briefly explain how the capital asset pricing model can be utilised to arrive at a cost of equity for KZN Electronics. State any other alternative measure that can be used to calculate the cost of equity. f. Calculate the cost of equity of KZN using the following assumptions: Assume that the long-term government bond rate is 8% and a 6-month government bond rate is 6,5%. You have not been able to determine the beta for KZN Electronics, but the beta of a similar sized company in the same industry is 0.8. The company in question has a gearing ratio of 20:80 (debt: equity). For this part of the question, assume that KZN electronics has a debt ratio of 50% and that the risk on corporate debt is negligible. The market risk premium has been assessed as 6%. g. Comment on three other approaches to dividend policy that the company could make use of as opposed to the constant dividend payout ratio as well as the practical implications that management would need to consider if they wanted to switch to any of these alternative methods.

Step by Step Solution

★★★★★

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the weighted average cost of capital WACC we need to determine the cost of each component of capital equity debentures and preference shares and their weight in the capital structure As...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started