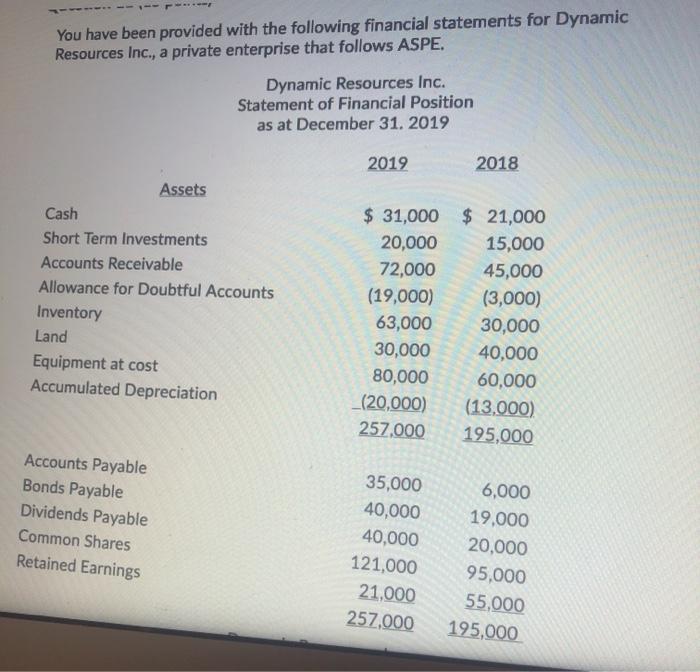

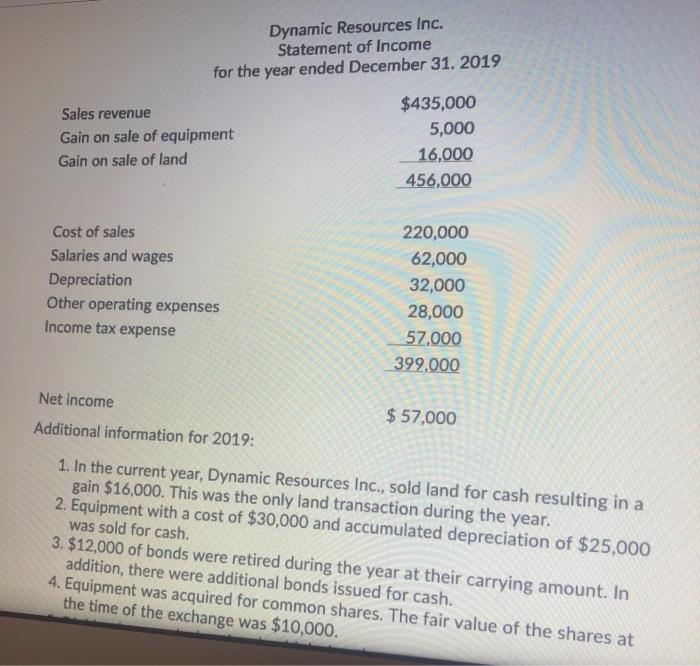

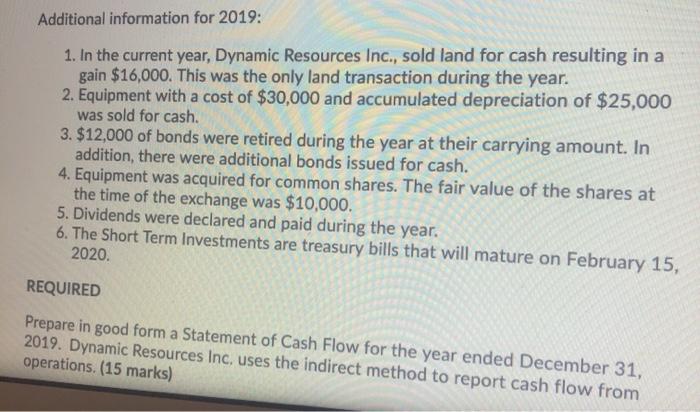

You have been provided with the following financial statements for Dynamic Resources Inc., a private enterprise that follows ASPE. Dynamic Resources Inc. Statement of Financial Position as at December 31. 2019 2019 2018 Assets Cash Short Term Investments Accounts Receivable Allowance for Doubtful Accounts Inventory Land Equipment at cost Accumulated Depreciation $ 31,000 20,000 72,000 (19,000) 63,000 30,000 80,000 (20,000 257.000 $ 21,000 15,000 45,000 (3,000) 30,000 40,000 60,000 (13.000) 195,000 Accounts Payable Bonds Payable Dividends Payable Common Shares Retained Earnings 35,000 40,000 40,000 121,000 21,000 257.000 6,000 19,000 20,000 95,000 55,000 195,000 Dynamic Resources Inc. Statement of Income for the year ended December 31. 2019 Sales revenue Gain on sale of equipment Gain on sale of land $435,000 5,000 16,000 456,000 Cost of sales Salaries and wages Depreciation Other operating expenses Income tax expense 220,000 62,000 32,000 28,000 57,000 399,000 Net income $ 57,000 Additional information for 2019: 1. In the current year, Dynamic Resources Inc., sold land for cash resulting in a gain $16,000. This was the only land transaction during the year. 2. Equipment with a cost of $30,000 and accumulated depreciation of $25,000 was sold for cash. 3. $12,000 of bonds were retired during the year at their carrying amount. In addition, there were additional bonds issued for cash. 4. Equipment was acquired for common shares. The fair value of the shares at the time of the exchange was $10,000. Additional information for 2019: 1. In the current year, Dynamic Resources Inc., sold land for cash resulting in a gain $16,000. This was the only land transaction during the year. 2. Equipment with a cost of $30,000 and accumulated depreciation of $25,000 was sold for cash. 3. $12,000 of bonds were retired during the year at their carrying amount. In addition, there were additional bonds issued for cash. 4. Equipment was acquired for common shares. The fair value of the shares at the time of the exchange was $10,000. 5. Dividends were declared and paid during the year. 6. The Short Term Investments are treasury bills that will mature on February 15, 2020 REQUIRED Prepare in good form a Statement of Cash Flow for the year ended December 31, 2019. Dynamic Resources Inc, uses the indirect method to report cash flow from operations. (15 marks)