Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been reading about the Madison Computer Company (MCC), which currently retains 82 percent of its earnings ($5 a share this year). It

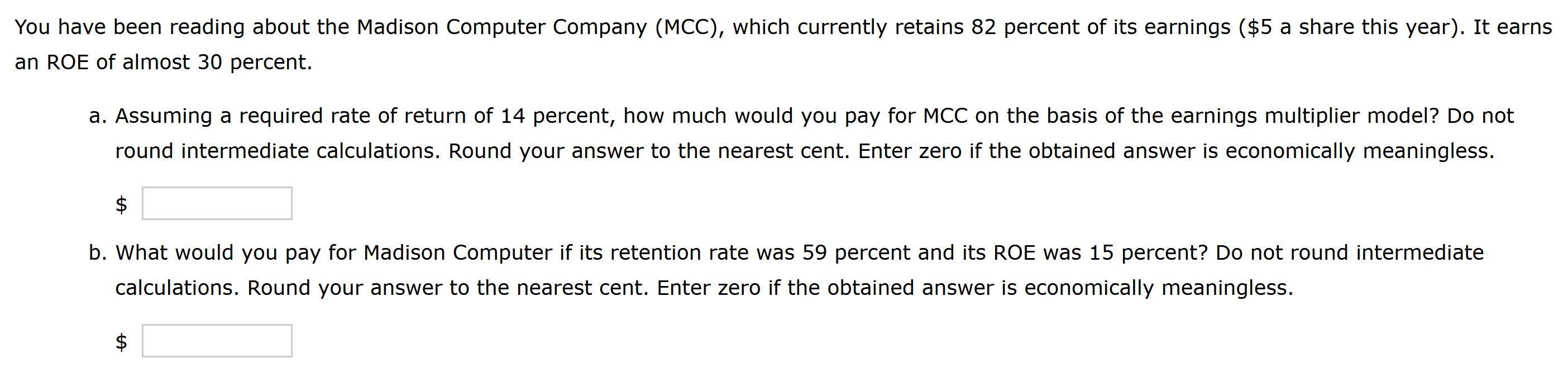

You have been reading about the Madison Computer Company (MCC), which currently retains 82 percent of its earnings ($5 a share this year). It earns an ROE of almost 30 percent. a. Assuming a required rate of return of 14 percent, how much would you pay for MCC on the basis of the earnings multiplier model? Do not round intermediate calculations. Round your answer to the nearest cent. Enter zero if the obtained answer is economically meaningless. b. What would you pay for Madison Computer if its retention rate was 59 percent and its ROE was 15 percent? Do not round intermediate calculations. Round your answer to the nearest cent. Enter zero if the obtained answer is economically meaningless. LA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Earnings multiplier model The formula for the earnings multiplier mode...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started