Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been recently appointed as the Senior Financial Accountant at University of Zululand (hereafter UNIZULU), a South African public institution of higher learning.

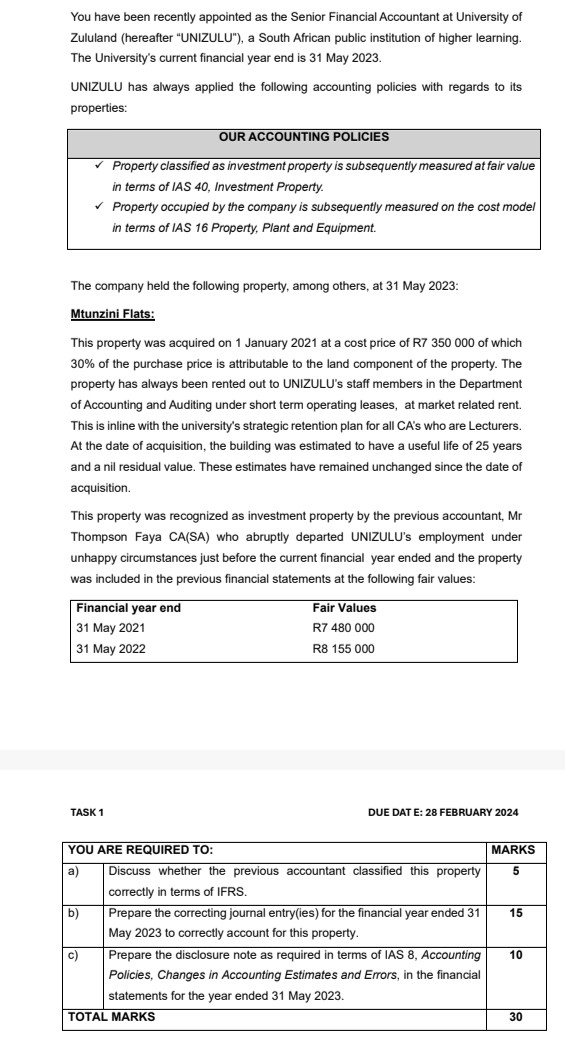

You have been recently appointed as the Senior Financial Accountant at University of Zululand (hereafter "UNIZULU"), a South African public institution of higher learning. The University's current financial year end is 31 May 2023. UNIZULU has always applied the following accounting policies with regards to its properties: OUR ACCOUNTING POLICIES Property classified as investment property is subsequently measured at fair value in terms of IAS 40, Investment Property. Property occupied by the company is subsequently measured on the cost model in terms of IAS 16 Property, Plant and Equipment. The company held the following property, among others, at 31 May 2023: Mtunzini Flats: This property was acquired on 1 January 2021 at a cost price of R7 350 000 of which 30% of the purchase price is attributable to the land component of the property. The property has always been rented out to UNIZULU's staff members in the Department of Accounting and Auditing under short term operating leases, at market related rent. This is inline with the university's strategic retention plan for all CA's who are Lecturers. At the date of acquisition, the building was estimated to have a useful life of 25 years and a nil residual value. These estimates have remained unchanged since the date of acquisition. This property was recognized as investment property by the previous accountant, Mr Thompson Faya CA(SA) who abruptly departed UNIZULU's employment under unhappy circumstances just before the current financial year ended and the property was included in the previous financial statements at the following fair values: Financial year end 31 May 2021 31 May 2022 TASK 1 Fair Values R7 480 000 R8 155 000 DUE DATE: 28 FEBRUARY 2024 YOU ARE REQUIRED TO: MARKS a) Discuss whether the previous accountant classified this property correctly in terms of IFRS. 5 b) Prepare the correcting journal entry(ies) for the financial year ended 31 May 2023 to correctly account for this property. 15 c) Prepare the disclosure note as required in terms of IAS 8, Accounting 10 Policies, Changes in Accounting Estimates and Errors, in the financial statements for the year ended 31 May 2023. TOTAL MARKS 30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started