Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been recruited by a former classmate, Susanna Wu, to join the finance team of a company that she founded recently. The company

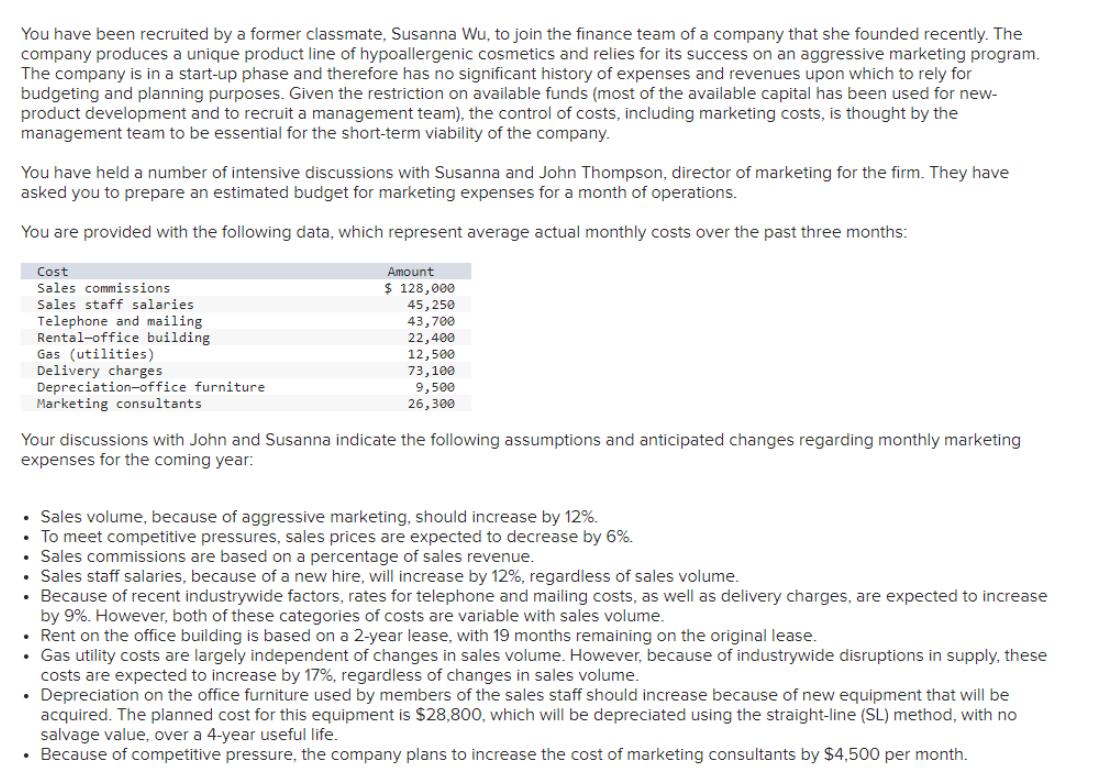

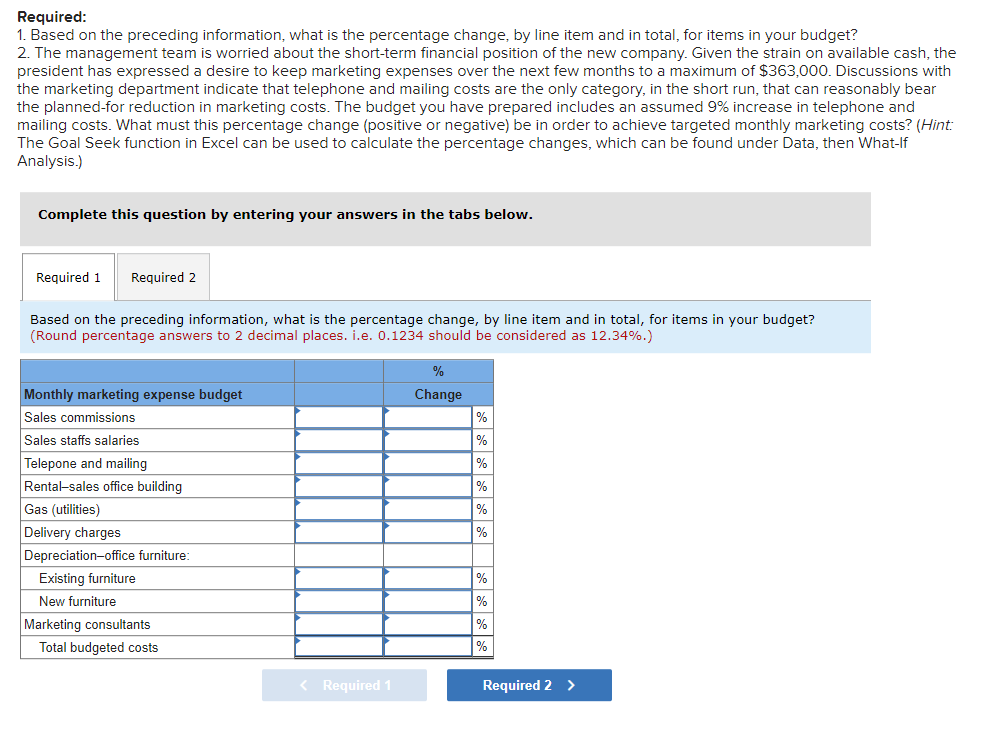

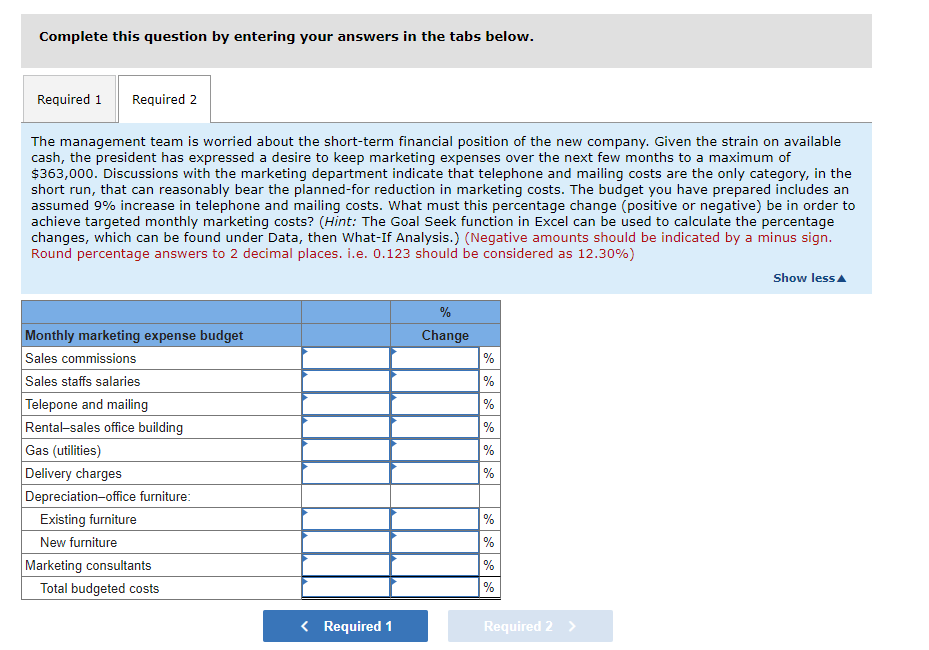

You have been recruited by a former classmate, Susanna Wu, to join the finance team of a company that she founded recently. The company produces a unique product line of hypoallergenic cosmetics and relies for its success on an aggressive marketing program. The company is in a start-up phase and therefore has no significant history of expenses and revenues upon which to rely for budgeting and planning purposes. Given the restriction on available funds (most of the available capital has been used for new- product development and to recruit a management team), the control of costs, including marketing costs, is thought by the management team to be essential for the short-term viability of the company. You have held a number of intensive discussions with Susanna and John Thompson, director of marketing for the firm. They have asked you to prepare an estimated budget for marketing expenses for a month of operations. You are provided with the following data, which represent average actual monthly costs over the past three months: Cost Sales commissions Sales staff salaries Telephone and mailing Rental-office building Gas (utilities) Delivery charges Depreciation-office furniture Marketing consultants Amount $ 128,000 45,250 43,700 22,400 12,500 73,100 9,500 26,300 Your discussions with John and Susanna indicate the following assumptions and anticipated changes regarding monthly marketing expenses for the coming year: Sales volume, because of aggressive marketing, should increase by 12%. To meet competitive pressures, sales prices are expected to decrease by 6%. Sales commissions are based on a percentage of sales revenue. Sales staff salaries, because of a new hire, will increase by 12%, regardless of sales volume. Because of recent industrywide factors, rates for telephone and mailing costs, as well as delivery charges, are expected to increase by 9%. However, both of these categories of costs are variable with sales volume. Rent on the office building is based on a 2-year lease, with 19 months remaining on the original lease. Gas utility costs are largely independent of changes in sales volume. However, because of industrywide disruptions in supply, these costs are expected to increase by 17%, regardless of changes in sales volume. Depreciation on the office furniture used by members of the sales staff should increase because of new equipment that will be acquired. The planned cost for this equipment is $28,800, which will be depreciated using the straight-line (SL) method, with no salvage value, over a 4-year useful life. Because of competitive pressure, the company plans to increase the cost of marketing consultants by $4,500 per month. Required: 1. Based on the preceding information, what is the percentage change, by line item and in total, for items in your budget? 2. The management team is worried about the short-term financial position of the new company. Given the strain on available cash, the president has expressed a desire to keep marketing expenses over the next few months to a maximum of $363,000. Discussions with the marketing department indicate that telephone and mailing costs are the only category, in the short run, that can reasonably bear the planned-for reduction in marketing costs. The budget you have prepared includes an assumed 9% increase in telephone and mailing costs. What must this percentage change (positive or negative) be in order to achieve targeted monthly marketing costs? (Hint: The Goal Seek function in Excel can be used to calculate the percentage changes, which can be found under Data, then What-If Analysis.) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Based on the preceding information, what is the percentage change, by line item and in total, for items in your budget? (Round percentage answers to 2 decimal places. i.e. 0.1234 should be considered as 12.34%.) Monthly marketing expense budget Sales commissions Sales staffs salaries Telepone and mailing Rental-sales office building Gas (utilities) Delivery charges Depreciation-office furniture: Existing furniture New furniture Marketing consultants Total budgeted costs < Required 1 % Change % % % % % % % % % % Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 The management team is worried about the short-term financial position of the new company. Given the strain on available cash, the president has expressed a desire to keep marketing expenses over the next few months to a maximum of $363,000. Discussions with the marketing department indicate that telephone and mailing costs are the only category, in the short run, that can reasonably bear the planned-for reduction in marketing costs. The budget you have prepared includes an assumed 9% increase in telephone and mailing costs. What must this percentage change (positive or negative) be in order to achieve targeted monthly marketing costs? (Hint: The Goal Seek function in Excel can be used to calculate the percentage changes, which can be found under Data, then What-If Analysis.) (Negative amounts should be indicated by a minus sign. Round percentage answers to 2 decimal places. i.e. 0.123 should be considered as 12.30%) Monthly marketing expense budget Sales commissions Sales staffs salaries Telepone and mailing Rental-sales office building Gas (utilities) Delivery charges Depreciation-office furniture: Existing furniture New furniture Marketing consultants Total budgeted costs < Required 1 % Change % % % % % % % % % % Required 2 Show less

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started