Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have bought the exchange-listed convertible bonds of a company today on Jan 2, 20X1, immediately after the coupon payment. The bond has the

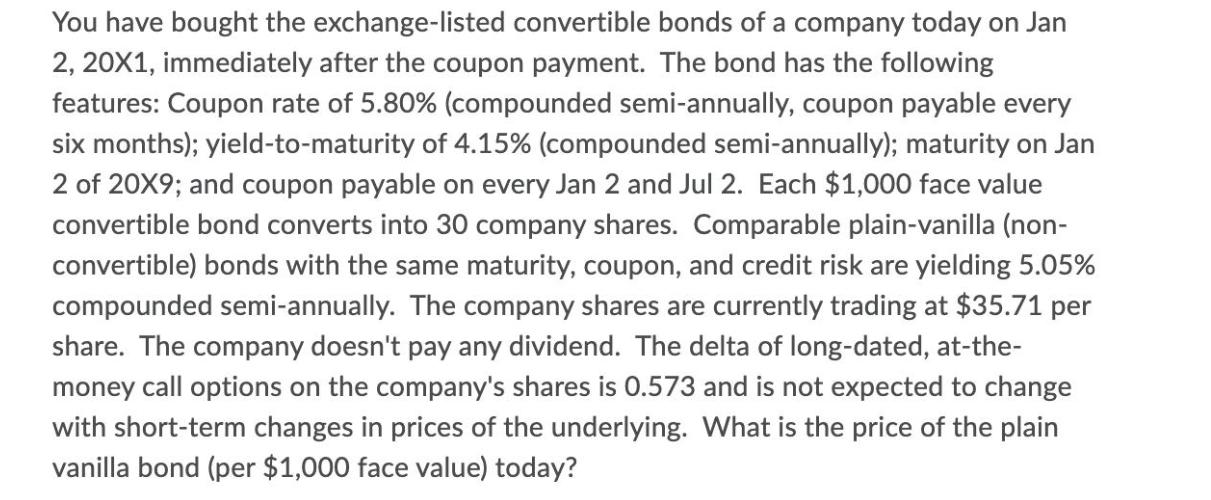

You have bought the exchange-listed convertible bonds of a company today on Jan 2, 20X1, immediately after the coupon payment. The bond has the following features: Coupon rate of 5.80% (compounded semi-annually, coupon payable every six months); yield-to-maturity of 4.15% (compounded semi-annually); maturity on Jan 2 of 20X9; and coupon payable on every Jan 2 and Jul 2. Each $1,000 face value convertible bond converts into 30 company shares. Comparable plain-vanilla (non- convertible) bonds with the same maturity, coupon, and credit risk are yielding 5.05% compounded semi-annually. The company shares are currently trading at $35.71 per share. The company doesn't pay any dividend. The delta of long-dated, at-the- money call options on the company's shares is 0.573 and is not expected to change with short-term changes in prices of the underlying. What is the price of the plain vanilla bond (per $1,000 face value) today?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To find the price of the plain vanilla bond per 1000 face value today well use the yieldtomaturity YTM of the plain vanilla bond as a discount rate to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started