Answered step by step

Verified Expert Solution

Question

1 Approved Answer

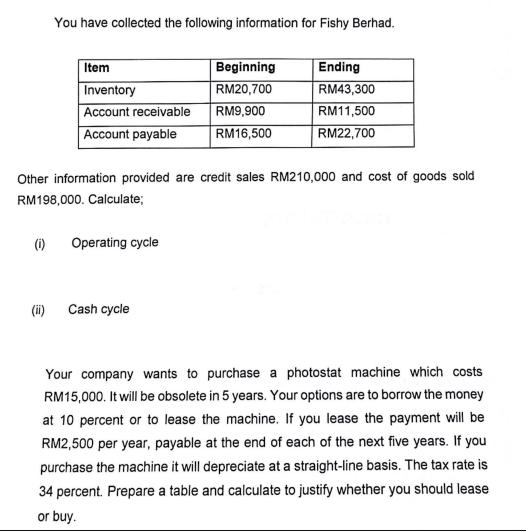

You have collected the following information for Fishy Berhad. Item Inventory Account receivable Account payable (ii) (0) Operating cycle Other information provided are credit

You have collected the following information for Fishy Berhad. Item Inventory Account receivable Account payable (ii) (0) Operating cycle Other information provided are credit sales RM210,000 and cost of goods sold RM198,000. Calculate; Beginning RM20,700 RM9,900 RM16,500 Cash cycle Ending RM43,300 RM11,500 RM22,700 Your company wants to purchase a photostat machine which costs RM15,000. It will be obsolete in 5 years. Your options are to borrow the money at 10 percent or to lease the machine. If you lease the payment will be RM2,500 per year, payable at the end of each of the next five years. If you purchase the machine it will depreciate at a straight-line basis. The tax rate is 34 percent. Prepare a table and calculate to justify whether you should lease or buy.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the operating cycle and cash cycle we need to consider the following formulas Operating cycle Inventory conversion period Accounts receiv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started