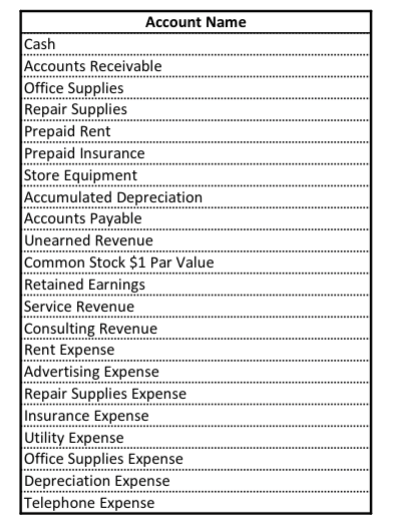

You have decided to establish a computer repair business. You think it likely that you will also provide instructional webinars (for a fee) for various graphic design software packages in small businesses. You name the company P. Mont Computers. You will keep the accounting records yourself, with your first month of operations in January. Since you are both repairing computers and providing instructional webinars, you decide to track revenues using two accounts: Service Revenue for computer repairs and Consulting Revenue for webinars. You begin the company by obtaining a charter from the state, with authorization to issue 100,000 shares of $1 par value common stock. You decide to become an S corporation so that the corporation does not have to pay corporate tax. You will have to pay income taxes on your individual tax return. You use the accrual basis of accounting. You close the books and prepare financial statements each month. Before recording transactions, you set up a Chart of Accounts. A chart of accounts is a list of the accounts that will be in the general ledger that will likely be used during January. This is provided as a separate Excel document that can be referred to while entering transactions during the period. Lab #2 is based upon the material in Chapter 2 that allows you to practice creating journal entries. Lab #3 is a continuation of Lab #2 and is based on Chapter 3 adjusting entries, the creation of financial statements, and several analysis questions.

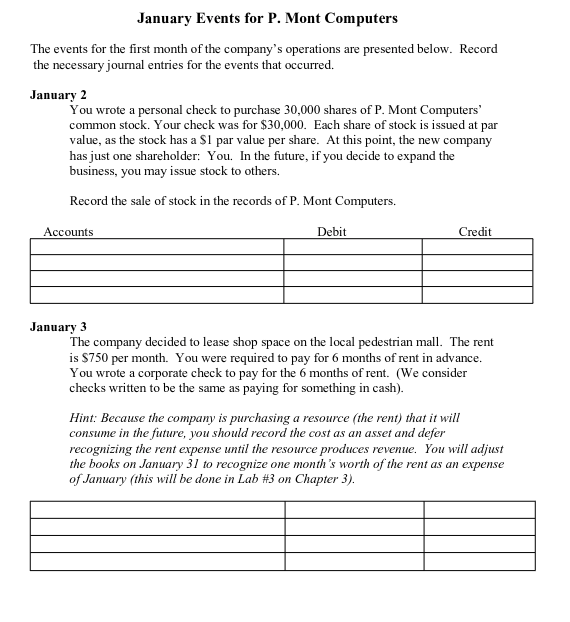

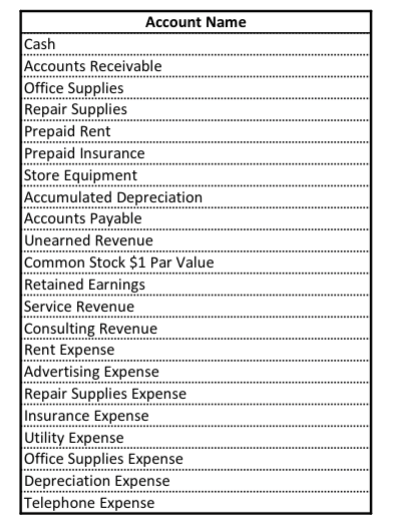

January Events for P. Mont Computers The events for the first month of the companys operations are presented below. Record the necessary journal entries for the events that occurred. January 2 You wrote a personal check to purchase 30,000 shares of P. Mont Computers common stock. Your check was for $30,000. Each share of stock is issued at par value, as the stock has a $1 par value per share. At this point, the new company has just one shareholder: You. In the future, if you decide to expand the business, you may issue stock to others. Record the sale of stock in the records of P. Mont Computers

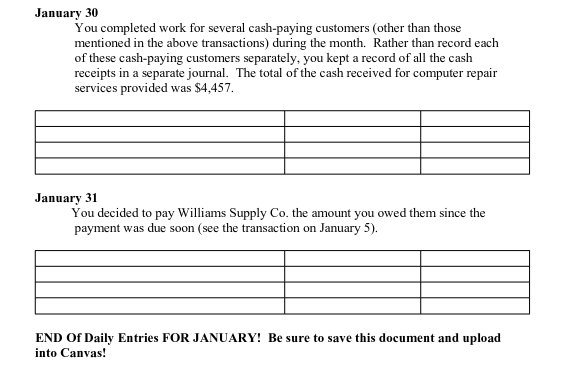

Chart of Accounts

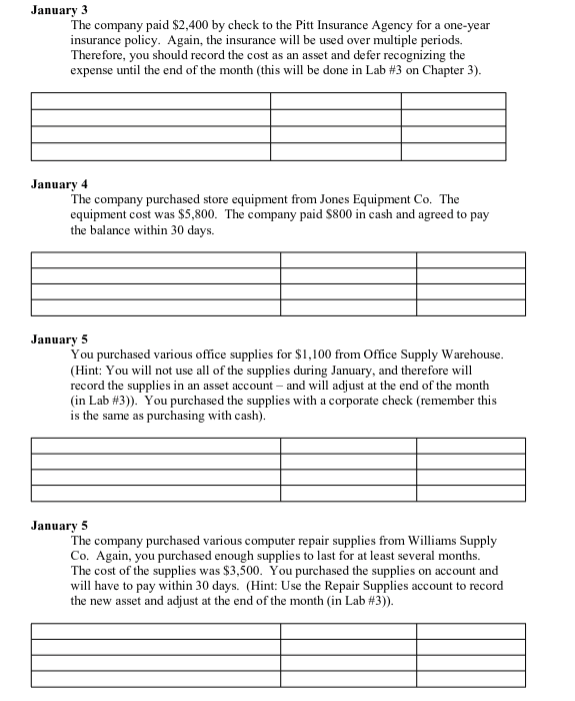

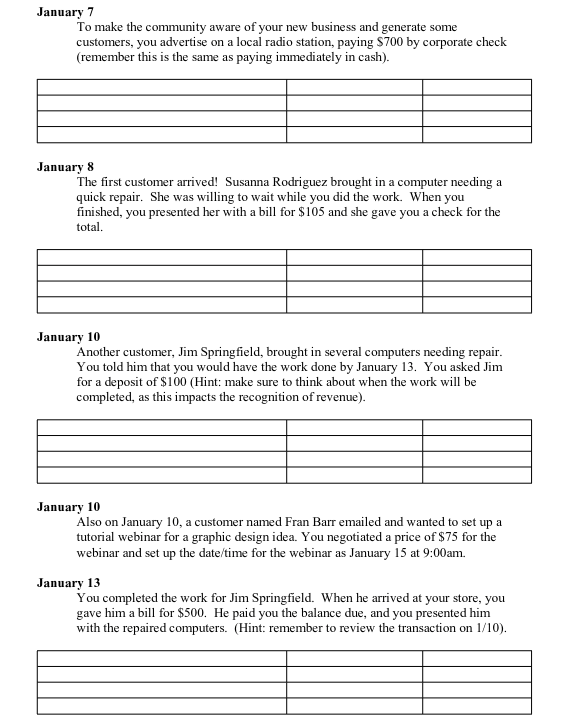

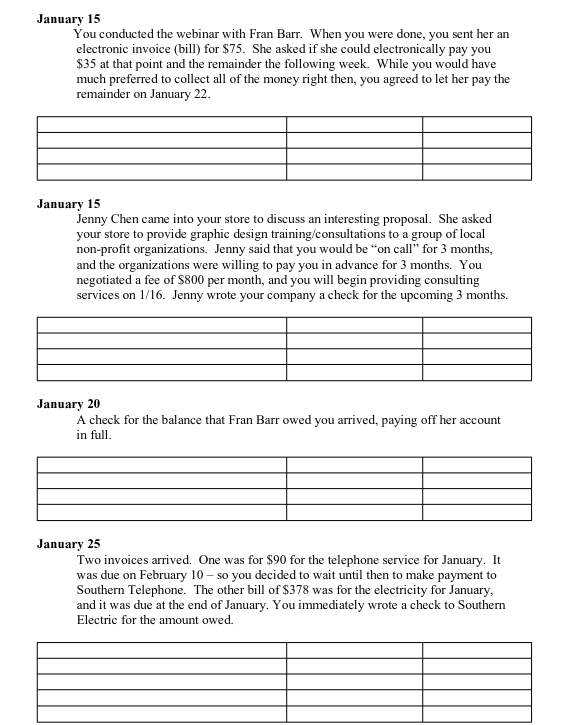

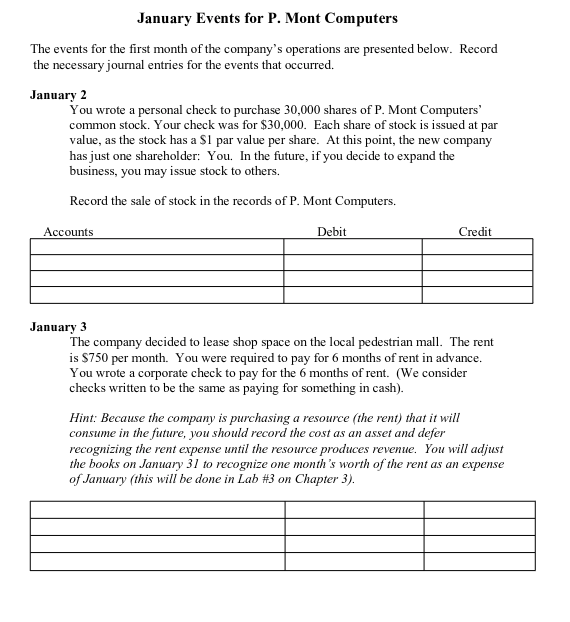

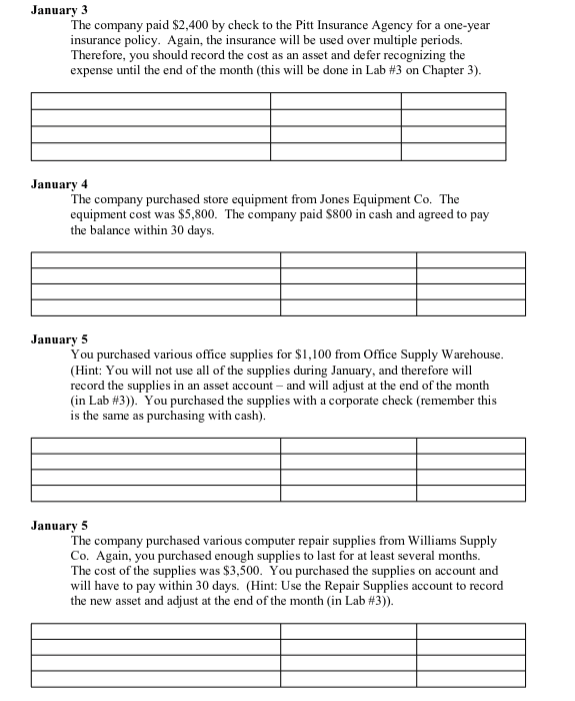

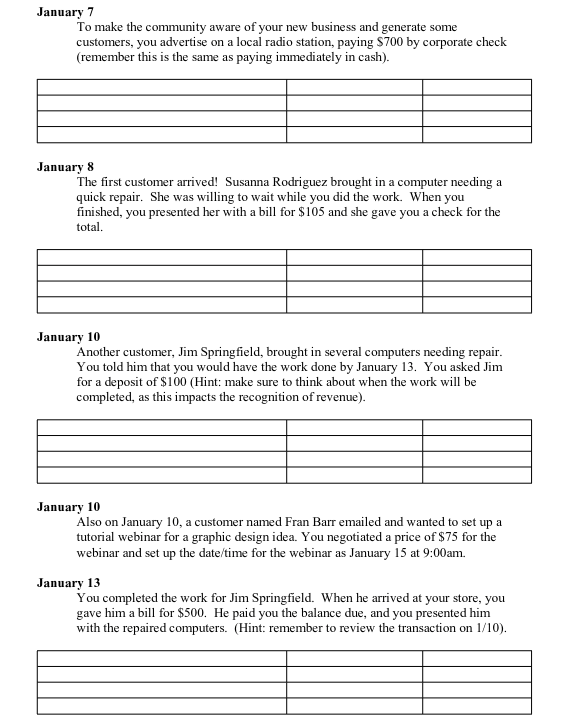

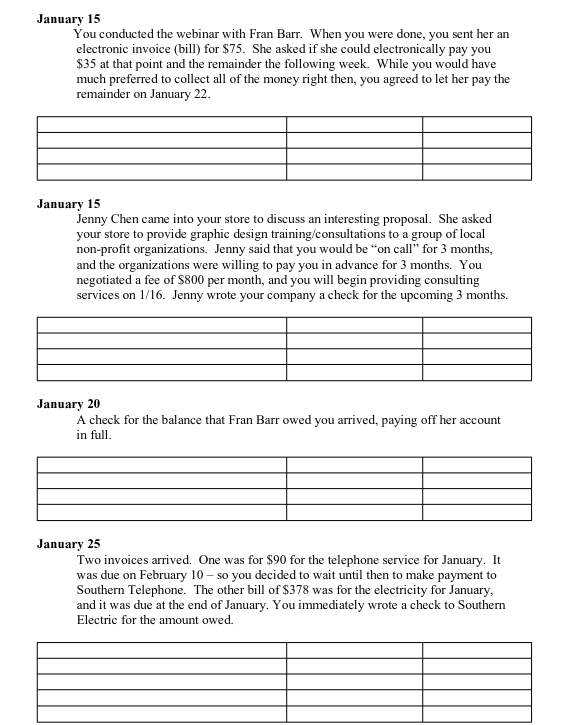

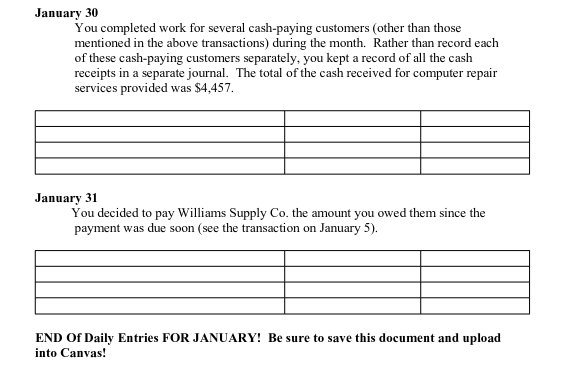

January 2 You wrote a personal check to purchase 30,000 shares of P. Mont Computers' common stock. Your check was for $30,000. Each share of stock is issued at par value, as the stock has a $1 par value per share. At this point, the new company has just one shareholder: You. In the future, if you decide to expand the business, you may issue stock to others. Record the sale of stock in the records of P. Mont Computers. January 3 The company decided to lease shop space on the local pedestrian mall. The rent is $750 per month. You were required to pay for 6 months of rent in advance. You wrote a corporate check to pay for the 6 months of rent. (We consider checks written to be the same as paying for something in cash). Hint: Because the company is purchasing a resource (the rent) that it will consume in the future, you should record the cost as an asset and defer recognizing the rent expense until the resource produces revenue. You will adjust the books on January 31 to recognize one month's worth of the rent as an expense of January (this will be done in Lab #3 on Chapter 3). January 3 The company paid $2,400 by check to the Pitt Insurance Agency for a one-year insurance policy. Again, the insurance will be used over multiple periods. Therefore, you should record the cost as an asset and defer recognizing the expense until the end of the month (this will be done in Lab #3 on Chapter 3 ). January 4 The company purchased store equipment from Jones Equipment Co. The equipment cost was $5,800. The company paid $800 in cash and agreed to pay the balance within 30 days. January 5 You purchased various office supplies for $1,100 from Office Supply Warehouse. (Hint: You will not use all of the supplies during January, and therefore will record the supplies in an asset account - and will adjust at the end of the month (in Lab # 3)). You purchased the supplies with a corporate check (remember this is the same as purchasing with cash). January 5 The company purchased various computer repair supplies from Williams Supply Co. Again, you purchased enough supplies to last for at least several months. The cost of the supplies was $3,500. You purchased the supplies on account and will have to pay within 30 days. (Hint: Use the Repair Supplies account to record the new asset and adjust at the end of the month (in Lab #3)). January 7 To make the community aware of your new business and generate some customers, you advertise on a local radio station, paying $700 by corporate check (remember this is the same as paying immediately in cash). January 8 The first customer arrived! Susanna Rodriguez brought in a computer needing a quick repair. She was willing to wait while you did the work. When you finished, you presented her with a bill for $105 and she gave you a check for the total. January 10 Another customer, Jim Springfield, brought in several computers needing repair. You told him that you would have the work done by January 13. You asked Jim for a deposit of $100 (Hint: make sure to think about when the work will be completed, as this impacts the recognition of revenue). January 10 Also on January 10, a customer named Fran Barr emailed and wanted to set up a tutorial webinar for a graphic design idea. You negotiated a price of $75 for the webinar and set up the date/time for the webinar as January 15 at 9:00am. January 13 You completed the work for Jim Springfield. When he arrived at your store, you gave him a bill for $500. He paid you the balance due, and you presented him with the repaired computers. (Hint: remember to review the transaction on 1/10 ). January 15 You conducted the webinar with Fran Barr. When you were done, you sent her an electronic invoice (bill) for $75. She asked if she could electronically pay you $35 at that point and the remainder the following week. While you would have much preferred to collect all of the money right then, you agreed to let her pay the remainder on January 22 . January 15 Jenny Chen came into your store to discuss an interesting proposal. She asked your store to provide graphic design training/consultations to a group of local non-profit organizations. Jenny said that you would be "on call" for 3 months, and the organizations were willing to pay you in advance for 3 months. You negotiated a fee of $800 per month, and you will begin providing consulting services on 1/16. Jenny wrote your company a check for the upcoming 3 months. January 20 A check for the balance that Fran Barr owed you arrived, paying off her account in full. January 25 Two invoices arrived. One was for $90 for the telephone service for January. It was due on February 10 - so you decided to wait until then to make payment to Southern Telephone. The other bill of $378 was for the electricity for January, and it was due at the end of January. You immediately wrote a check to Southern Electric for the amount owed. January 30 You completed work for several cash-paying customers (other than those mentioned in the above transactions) during the month. Rather than record each of these cash-paying customers separately, you kept a record of all the cash receipts in a separate journal. The total of the cash received for computer repair services provided was $4,457. January 31 You decided to pay Williams Supply Co. the amount you owed them since the payment was due soon (see the transaction on January 5 ). END Of Daily Entries FOR JANUARY! Be sure to save this document and upload into Canvas