Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have decided to go into the business of selling Beamers. You decide to operate the business as a corporation, Chris's Beamer Biz, Inc.

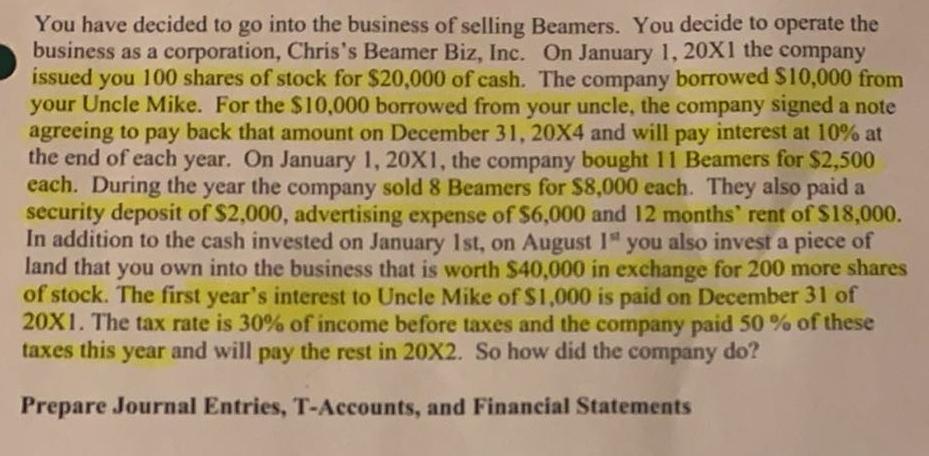

You have decided to go into the business of selling Beamers. You decide to operate the business as a corporation, Chris's Beamer Biz, Inc. On January 1, 20X1 the company issued you 100 shares of stock for $20,000 of cash. The company borrowed $10,000 from your Uncle Mike. For the $10,000 borrowed from your uncle, the company signed a note agreeing to pay back that amount on December 31, 20X4 and will pay interest at 10% at the end of each year. On January 1, 20X1, the company bought 11 Beamers for $2,500 each. During the year the company sold 8 Beamers for $8,000 each. They also paid a security deposit of $2,000, advertising expense of $6,000 and 12 months' rent of $18,000. In addition to the cash invested on January 1st, on August 1" you also invest a piece of land that you own into the business that is worth $40,000 in exchange for 200 more shares of stock. The first year's interest to Uncle Mike of $1,000 is paid on December 31 of 20X1. The tax rate is 30% of income before taxes and the company paid 50% of these taxes this year and will pay the rest in 20X2. So how did the company do? Prepare Journal Entries, T-Accounts, and Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Journal Entries 1 Issuance of stock for cash Cash 20000 Common Stock 20000 2 Borrowing from Uncle Mike Cash 10000 Notes Payable 10000 3 Purchase of 11 Beamers Inventory 27500 Cash 27500 4 Sale of 8 Be...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started