Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have decided to open a dog-walking company. Happy Pets was incorporated on January 1st, 2019. The business maintains a retail pet store, providing

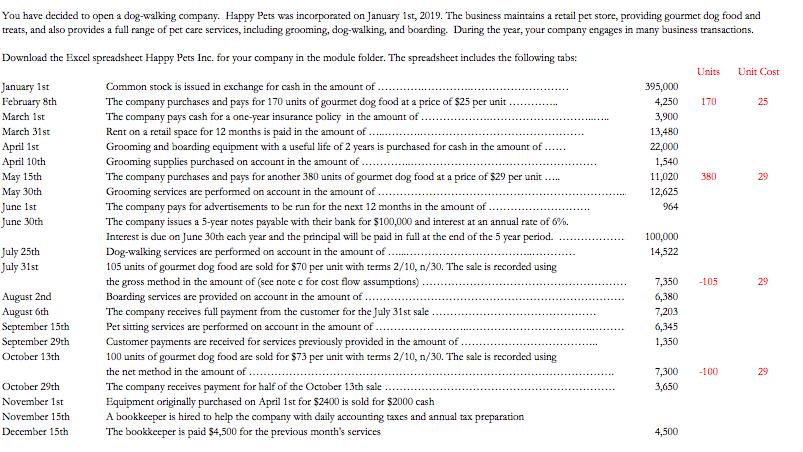

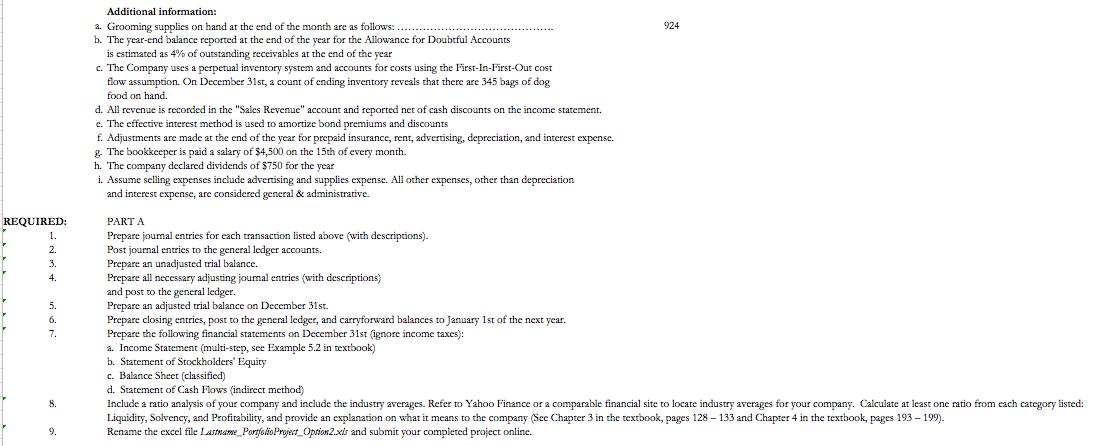

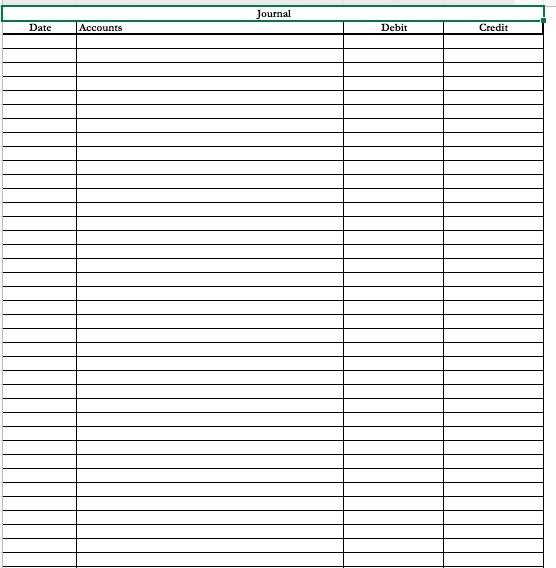

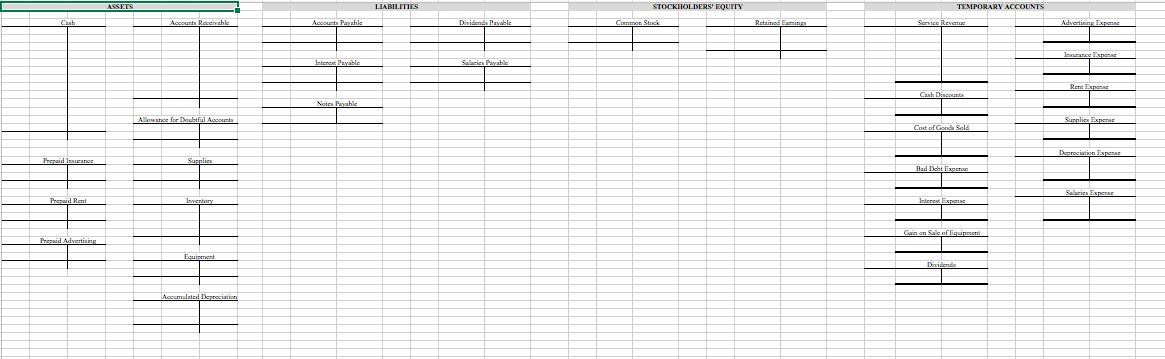

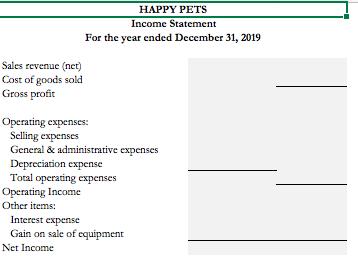

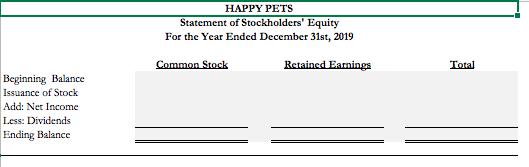

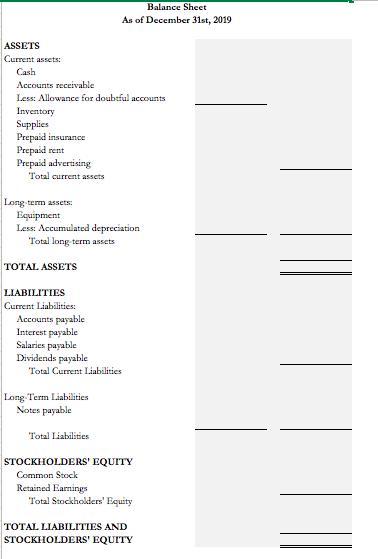

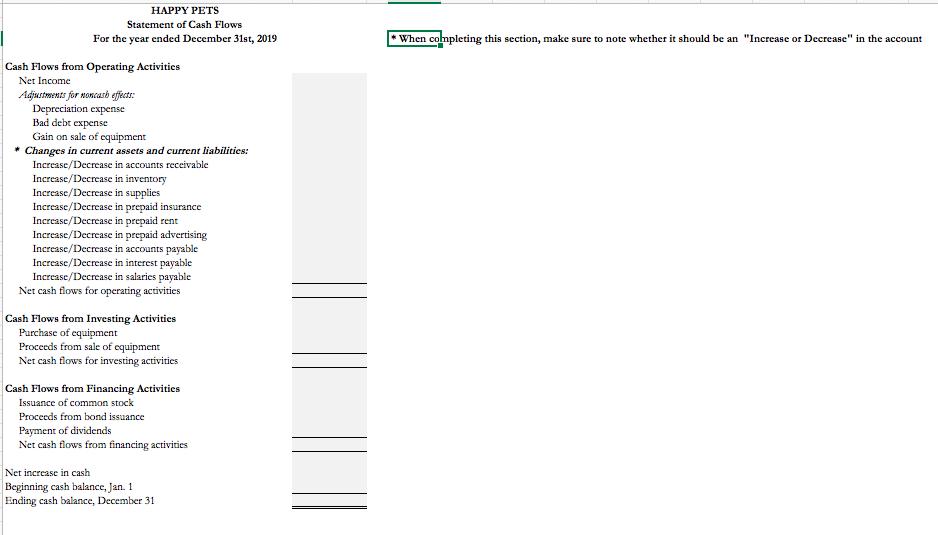

You have decided to open a dog-walking company. Happy Pets was incorporated on January 1st, 2019. The business maintains a retail pet store, providing gourmet dog food and treats, and also provides a full range of pet care services, including grooming, dog-walking, and boarding. During the year, your company engages in many business transactions. Download the Excel spreadsheet Happy Pets Inc. for your company in the module folder. The spreadsheet includes the following tabs: January 1st February 8th March 1st March 31st April 1st April 10th May 15th May 30th June 1st June 30th July 25th July 31st August 2nd August 6th September 15th September 29th October 13th October 29th November 1st November 15th December 15th Common stock is issued in exchange for cash in the amount of . The company purchases and pays for 170 units of gourmet dog food at a price of $25 per unit. The company pays cash for a one-year insurance policy in the amount of. Rent on a retail space for 12 months is paid in the amount of. Grooming and boarding equipment with a useful life of 2 years is purchased for cash in the amount of ...... Grooming supplies purchased on account in the amount of. The company purchases and pays for another 380 units of gourmet dog food at a price of $29 per unit Grooming services are performed on account in the amount of The company pays for advertisements to be run for the next 12 months in the amount of . The company issues a 5-year notes payable with their bank for $100,000 and interest at an annual rate of 6%. Interest is due on June 30th each year and the principal will be paid in full at the end of the 5 year period. Dog-walking services are performed on account in the amount of ....... 105 units of gourmet dog food are sold for $70 per unit with terms 2/10, n/30. The sale is recorded using the gross method in the amount of (see note e for cost flow assumptions). Boarding services are provided on account in the amount of The company receives full payment from the customer for the July 31st sale. Pet sitting services are performed on account in the amount of Customer payments are received for services previously provided in the amount of 100 units of gourmet dog food are sold for $73 per unit with terms 2/10, n/30. The sale is recorded using the net method in the amount of The company receives payment for half of the October 13th sale Equipment originally purchased on April 1st for $2400 is sold for $2000 cash A bookkeeper is hired to help the company with daily accounting taxes and annual tax preparation The bookkeeper is paid $4,500 for the previous month's services 395,000 4,250 3,900 13,480 22,000 1,540 11,020 12,625 964 100,000 14,522 7,350 6,380 7,203 6,345 1,350 7,300 3,650 4,500 Units 170 380 -105 -100 Unit Cost 25 29 29 29 REQUIRED: 1. 2. 3 4 5. 6. 7. 8. 9. Additional information: a. Grooming supplies on hand at the end of the month are as follows: b. The year-end balance reported at the end of the year for the Allowance for Doubtful Accounts is estimated as 4% of outstanding receivables at the end of the year c. The Company uses a perpetual inventory system and accounts for costs using the First-In-First-Out cost flow assumption. On December 31st, a count of ending inventory reveals that there are 345 bags of dog food on hand. d. All revenue is recorded in the "Sales Revenue" account and reported net of cash discounts on the income statement. e. The effective interest method is used to amortize bond premiums and discounts f. Adjustments are made at the end of the year for prepaid insurance, rent, advertising, depreciation, and interest expense. g. The bookkeeper is paid a salary of $4,500 on the 15th of every month. h. The company declared dividends of $750 for the year i. Assume selling expenses include advertising and supplies expense. All other expenses, other than depreciation and interest expense, are considered general & administrative. 924 PART A Prepare journal entries for each transaction listed above (with descriptions). Post journal entries to the general ledger accounts. Prepare an unadjusted trial balance. Prepare all necessary adjusting journal entries (with descriptions). and post to the general ledger. Prepare an adjusted trial balance on December 31st. Prepare closing entries, post to the general ledger, and carryforward balances to January 1st of the next year. Prepare the following financial statements on December 31st (ignore income taxes): a. Income Statement (multi-step, see Example 5.2 in textbook) b. Statement of Stockholders' Equity c. Balance Sheet (classified) d. Statement of Cash Flows (indirect method) Include a ratio analysis of your company and include the industry averages. Refer to Yahoo Finance or a comparable financial site to locate industry averages for your company. Calculate at least one ratio from each category listed: Liquidity, Solvency, and Profitability, and provide an explanation on what it means to the company (See Chapter 3 in the textbook, pages 128-133 and Chapter 4 in the textbook, pages 193 - 199). Rename the excel file Lastname PortfolioProject Option2.xls and submit your completed project online. Date Accounts Journal Debit Credit Prepaid Insurance Prepaid Rent Prepaid Advertising ASSETS Allowance for Doubtful Accounts Supplies Equipment Accounts Payable Interest Payabla Notes Payable LIABILITIES Dividends Payable Salaries Payable STOCKHOLDERS' EQUITY Common Stock Retained Earnings Cash Discounts TEMPORARY ACCOUNTS Cost of Gands Sold Bad Debt Experie Gain on Sale Dividend Adve Exp Rent Expense Depreciati Salaries Experat Sales revenue (net) Cost of goods sold Gross profit HAPPY PETS Income Statement For the year ended December 31, 2019 Operating expenses: Selling expenses General & administrative expenses Depreciation expense Total operating expenses Operating Income Other items: Interest expense Gain on sale of equipment Net Income Beginning Balance Issuance of Stock Add: Net Income Less: Dividends Ending Balance HAPPY PETS Statement of Stockholders' Equity For the Year Ended December 31st, 2019 Common Stock Retained Earnings Total ASSETS Current assets: Cash Accounts receivable Less: Allowance for doubtful accounts Inventory Supplies Prepaid insurance Prepaid rent Prepaid advertising Total current assets Long-term assets: Equipment Less: Accumulated depreciation Total long term assets TOTAL ASSETS LIABILITIES Current Liabilities: Accounts payable Interest payable Salaries payable Dividends payable Balance Sheet As of December 31st, 2019 Total Current Liabilities Long Term Liabilities Notes payable Total Liabilities STOCKHOLDERS' EQUITY Common Stock Retained Earnings Total Stockholders' Equity TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY HAPPY PETS Statement of Cash Flows For the year ended December 31st, 2019 Cash Flows from Operating Activities Net Income Adjustments for noncash effects: Depreciation expense Bad debt expense Gain on sale of equipment * Changes in current assets and current liabilities: Increase/Decrease in accounts receivable Increase/Decrease in inventory Increase/Decrease in supplies Increase/Decrease in prepaid insurance Increase/Decrease in prepaid rent Increase/Decrease in prepaid advertising Increase/Decrease in accounts payable Increase/Decrease in interest payable Increase/Decrease in salaries payable Net cash flows for operating activities Cash Flows from Investing Activities Purchase of equipment Proceeds from sale of equipment Net cash flows for investing activities Cash Flows from Financing Activities Issuance of common stock Proceeds from bond issuance Payment of dividends Net cash flows from financing activities Net increase in cash Beginning cash balance, Jan. 1 Ending cash balance, December 31 When completing this section, make sure to note whether it should be an "Increase or Decrease" in the account

Step by Step Solution

★★★★★

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Question Please hit LIKE button if this helped For any further explanation please put your query in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started