Answered step by step

Verified Expert Solution

Question

1 Approved Answer

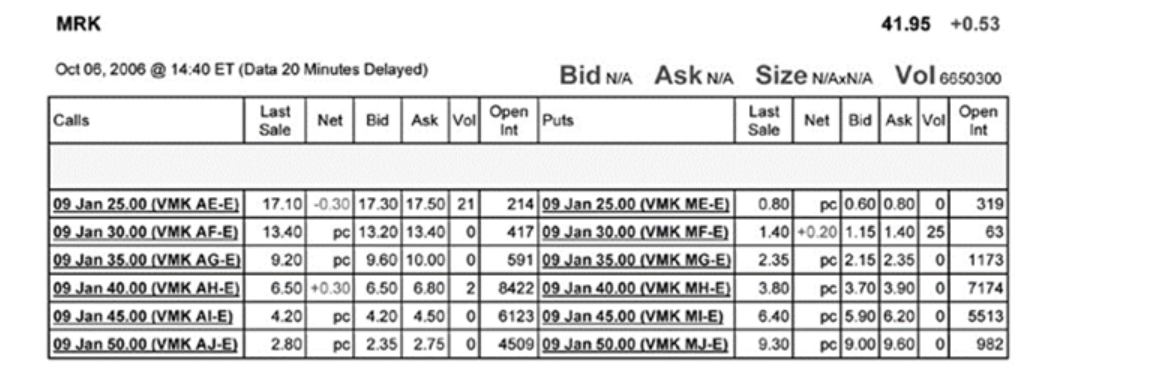

You have decided to purchase 10 call option contracts on Merck in January 2009 at an exercise price of $ 45 per share. How will

You have decided to purchase 10 call option contracts on Merck in January 2009 at an exercise price of $ 45 per share. How will this transaction be? (You have decided to buy 10 January 2009 call options on Merck with an exercise price of $ 45 per share.)

Options

out-of-the-money

more information is needed.

at-the-money

in the money

MRK 41.95 +0.53 Oct 08, 2006 @ 14:40 ET (Data 20 Minutes Delayed) Bid NA Ask NA Size NAxN/A Vol 6650300 Calls Last Net Bid Ask Voll Open Puts Last Sale Int Sale Net Bid Askvoll Open Int 09 Jan 25.00 (VMK AE-E) 09 Jan 30.00 (VMK AF-E) 09 Jan 35.00 (VMK AG-E 09 Jan 40.00 (VMK AH-E) 09 Jan 45.00 (VMK AI-E) 09 Jan 50.00 (VMK AJ-E) 17.10] -0.30 17.30 17.50 211 21409 Jan 25.00 (VMK ME-E) 13.40 PC 13.20 13.40 ol 417 09 Jan 30.00 (VMK MF-E) 9.20 pcl 9.60 10.00 0 591 09 Jan 35.00 (VMK MG-E) 6.50 +0.30 6.50 6.80 2 8422 09 Jan 40.00 (VMK MH-E) 4.20 pcl 4.20 4.50 0 6123 09 Jan 45.00 (VMK MI-E) 2.80 pc 2.35 2.75 0 4509 09 Jan 50.00 (VMK MJ-E) 0.80 pcl0.60 0.80l o 319 1.40 -0.20 1.15 1.40 25 63 2.35 pc 2.15 2.35 of 1173 pc|3.70 3.90 0 7174 6.40 pc 5.90/6.20 0 5513 9.30 pc 9.00 9.60 0 982 3.80Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started