Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have estimated that the present value of all future free cash flows of Venice Surf Co. is $295 million. The company has nonoperating

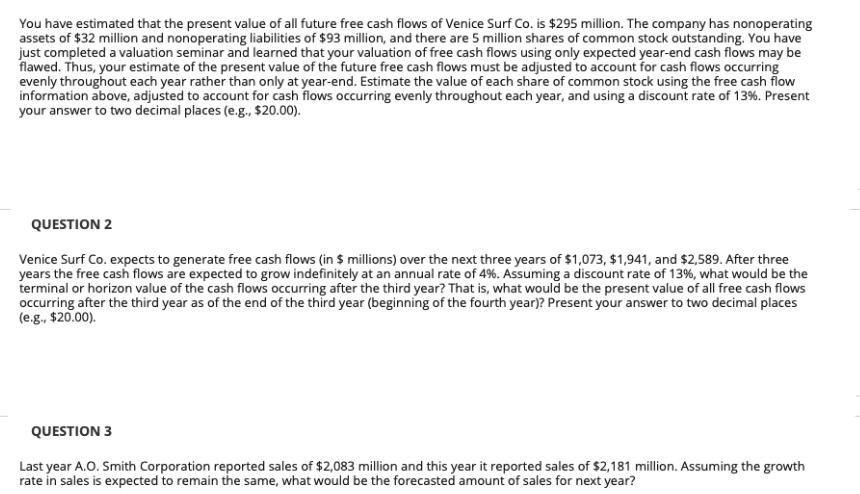

You have estimated that the present value of all future free cash flows of Venice Surf Co. is $295 million. The company has nonoperating assets of $32 million and nonoperating liabilities of $93 million, and there are 5 million shares of common stock outstanding. You have just completed a valuation seminar and learned that your valuation of free cash flows using only expected year-end cash flows may be flawed. Thus, your estimate of the present value of the future free cash flows must be adjusted to account for cash flows occurring evenly throughout each year rather than only at year-end. Estimate the value of each share of common stock using the free cash flow information above, adjusted to account for cash flows occurring evenly throughout each year, and using a discount rate of 13%. Present your answer to two decimal places (e.g., $20.00). QUESTION 2 Venice Surf Co. expects to generate free cash flows (in $ millions) over the next three years of $1,073, $1,941, and $2,589. After three years the free cash flows are expected to grow indefinitely at an annual rate of 4%. Assuming a discount rate of 13%, what would be the terminal or horizon value of the cash flows occurring after the third year? That is, what would be the present value of all free cash flows occurring after the third year as of the end of the third year (beginning of the fourth year)? Present your answer to two decimal places (e.g., $20.00). QUESTION 3 Last year A.O. Smith Corporation reported sales of $2,083 million and this year it reported sales of $2,181 million. Assuming the growth rate in sales is expected to remain the same, what would be the forecasted amount of sales for next year?

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer to Question 1 To adjust for cash flows occurring evenly throughout each year we need to use the annuity formula to calculate the present value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started