Question

You have finished your university degree, conducted interviews, and have received two job offers in different countries. Both jobs require you to commit to a

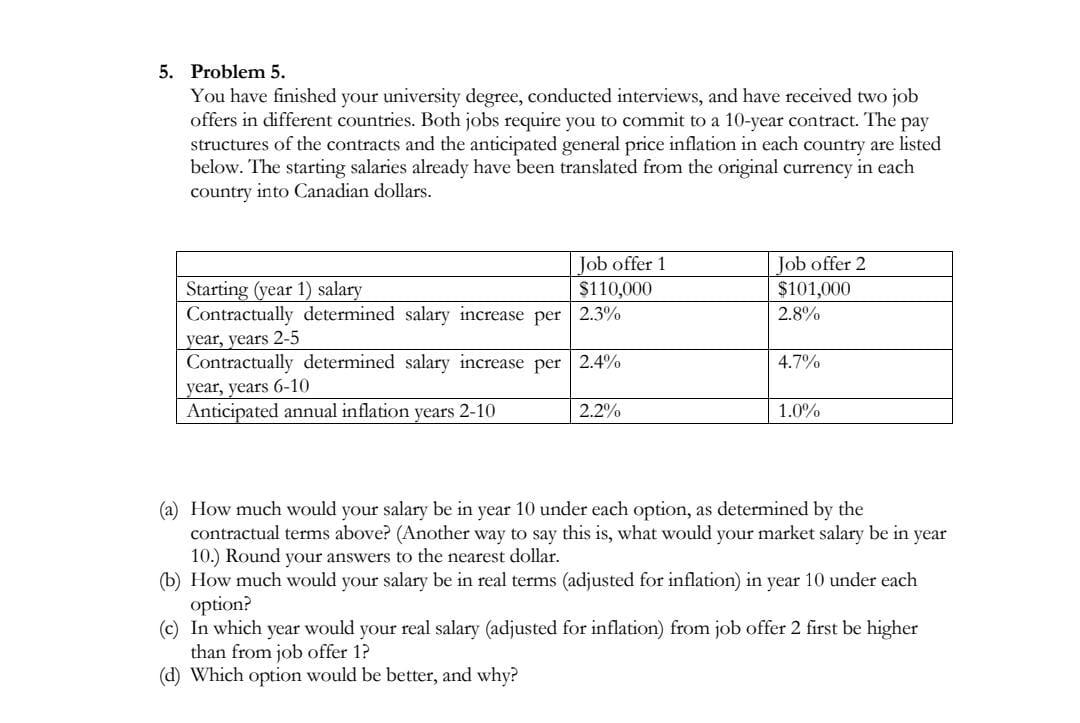

You have finished your university degree, conducted interviews, and have received two job offers in different countries. Both jobs require you to commit to a 10-year contract. The pay structures of the contracts and the anticipated general price inflation in each country are listed below. The starting salaries already have been translated from the original currency in each country into Canadian dollars. Job offer 1 Job offer 2 Starting (year 1) salary $110,000 $101,000 Contractually determined salary increase per year, years 2-5 2.3% 2.8% Contractually determined salary increase per year, years 6-10 2.4% 4.7% Anticipated annual inflation years 2-10 2.2% 1.0% (a) How much would your salary be in year 10 under each option, as determined by the contractual terms above? (Another way to say this is, what would your market salary be in year 10.) Round your answers to the nearest dollar. (b) How much would your salary be in real terms (adjusted for inflation) in year 10 under each option? (c) In which year would your real salary (adjusted for inflation) from job offer 2 first be higher than from job offer 1? (d) Which option would be better, and why?

You have finished your university degree, conducted interviews, and have received two job offers in different countries. Both jobs require you to commit to a 10-year contract. The pay structures of the contracts and the anticipated general price inflation in each country are listed below. The starting salaries already have been translated from the original currency in each country into Canadian dollars. Job offer 1 Job offer 2 Starting (year 1) salary $110,000 $101,000 Contractually determined salary increase per year, years 2-5 2.3% 2.8% Contractually determined salary increase per year, years 6-10 2.4% 4.7% Anticipated annual inflation years 2-10 2.2% 1.0% (a) How much would your salary be in year 10 under each option, as determined by the contractual terms above? (Another way to say this is, what would your market salary be in year 10.) Round your answers to the nearest dollar. (b) How much would your salary be in real terms (adjusted for inflation) in year 10 under each option? (c) In which year would your real salary (adjusted for inflation) from job offer 2 first be higher than from job offer 1? (d) Which option would be better, and why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started