Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have identified the following five risks for your audit client, Moon Pty Ltd: a. Overstatement of assets, due to the possibility that some

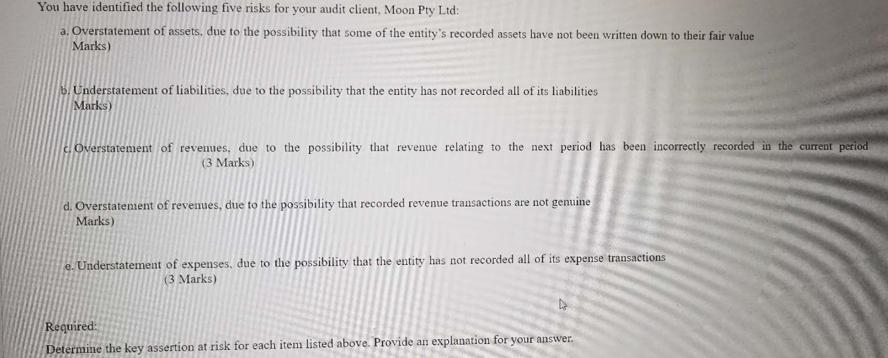

You have identified the following five risks for your audit client, Moon Pty Ltd: a. Overstatement of assets, due to the possibility that some of the entity's recorded assets have not been written down to their fair value Marks) b. Understatement of liabilities, due to the possibility that the entity has not recorded all of its liabilities Marks) Overstatement of revenues, due to the possibility that revenue relating to the next period has been incorrectly recorded in the current period (3 Marks) d. Overstatement of revenues, due to the possibility that recorded revenue transactions are not genuine Marks) e. Understatement of expenses, due to the possibility that the entity has not recorded all of its expense transactions (3 Marks) Required: Determine the key assertion at risk for each item listed above. Provide an explanation for your answer.

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Key assertion at risk Valuation Explanation The risk of overstatement of assets indicates that the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started