Answered step by step

Verified Expert Solution

Question

1 Approved Answer

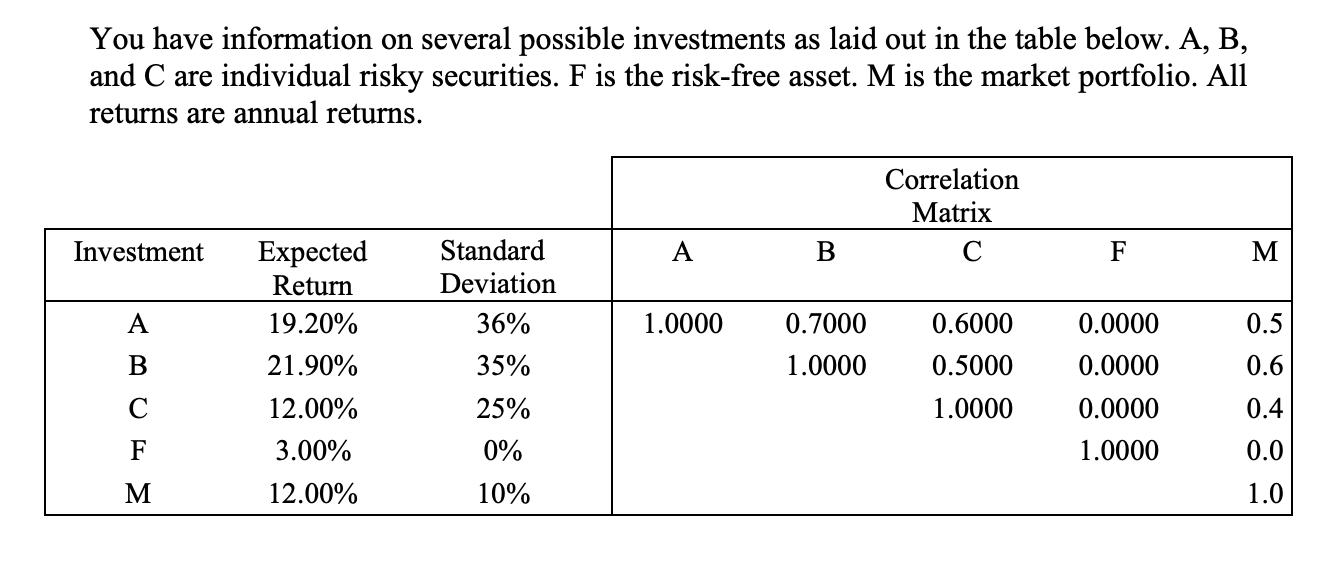

You have information on several possible investments as laid out in the table below. A, B, and C are individual risky securities. F is

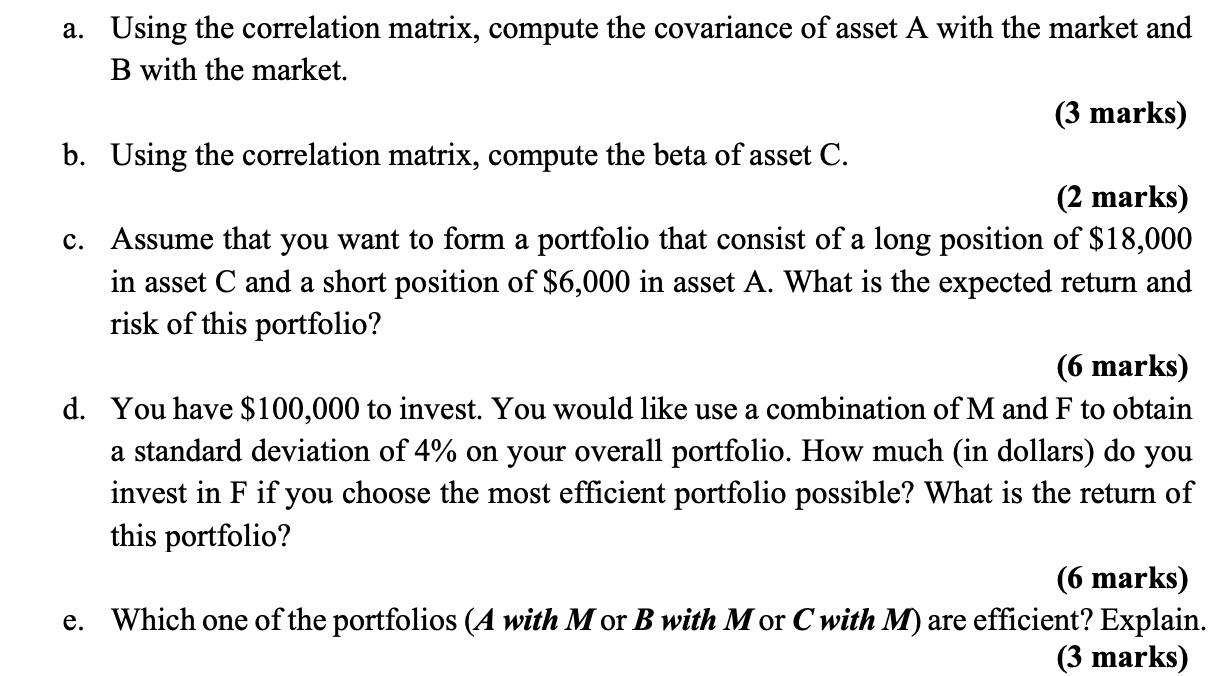

You have information on several possible investments as laid out in the table below. A, B, and C are individual risky securities. F is the risk-free asset. M is the market portfolio. All returns are annual returns. Investment A B C F M Expected Return 19.20% 21.90% 12.00% 3.00% 12.00% Standard Deviation 36% 35% 25% 0% 10% A 1.0000 B 0.7000 1.0000 Correlation Matrix C 0.6000 0.5000 1.0000 F 0.0000 0.0000 0.0000 1.0000 M 0.5 0.6 0.4 0.0 1.0 a. Using the correlation matrix, compute the covariance of asset A with the market and B with the market. (3 marks) b. Using the correlation matrix, compute the beta of asset C. (2 marks) Assume that you want to form a portfolio that consist of a long position of $18,000 in asset C and a short position of $6,000 in asset A. What is the expected return and risk of this portfolio? C. (6 marks) d. You have $100,000 to invest. You would like use a combination of M and F to obtain a standard deviation of 4% on your overall portfolio. How much (in dollars) do you invest in F if you choose the most efficient portfolio possible? What is the return of this portfolio? (6 marks) e. Which one of the portfolios (A with Mor B with M or C with M) are efficient? Explain. (3 marks)

Step by Step Solution

★★★★★

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started