You have just been employed as an investment analyst in an investment bank. You took over from someone who left with a number of

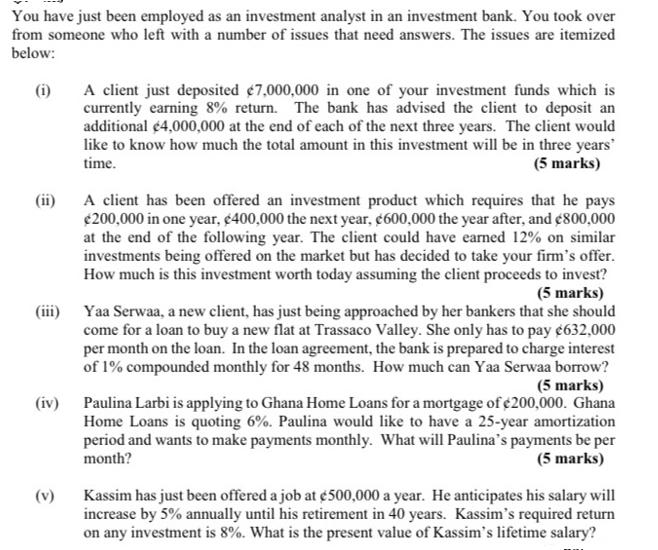

You have just been employed as an investment analyst in an investment bank. You took over from someone who left with a number of issues that need answers. The issues are itemized below: (i) (ii) A client has been offered an investment product which requires that he pays 200,000 in one year, $400,000 the next year, c600,000 the year after, and $800,000 at the end of the following year. The client could have earned 12% on similar investments being offered on the market but has decided to take your firm's offer. How much is this investment worth today assuming the client proceeds to invest? (5 marks) (iii) A client just deposited $7,000,000 in one of your investment funds which is currently earning 8% return. The bank has advised the client to deposit an additional $4,000,000 at the end of each of the next three years. The client would like to know how much the total amount in this investment will be in three years' time. (5 marks) (v) Yaa Serwaa, a new client, has just being approached by her bankers that she should come for a loan to buy a new flat at Trassaco Valley. She only has to pay $632,000 per month on the loan. In the loan agreement, the bank is prepared to charge interest of 1% compounded monthly for 48 months. How much can Yaa Serwaa borrow? (5 marks) (iv) Paulina Larbi is applying to Ghana Home Loans for a mortgage of $200,000. Ghana Home Loans is quoting 6%. Paulina would like to have a 25-year amortization period and wants to make payments monthly. What will Paulina's payments be per month? (5 marks) Kassim has just been offered a job at 500,000 a year. He anticipates his salary will increase by 5% annually until his retirement in 40 years. Kassim's required return on any investment is 8%. What is the present value of Kassim's lifetime salary?

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started