Question

You have just been hired as a financial analyst at Baruch College Fund in New York. Your responsibility is to analyze potential investment opportunities and

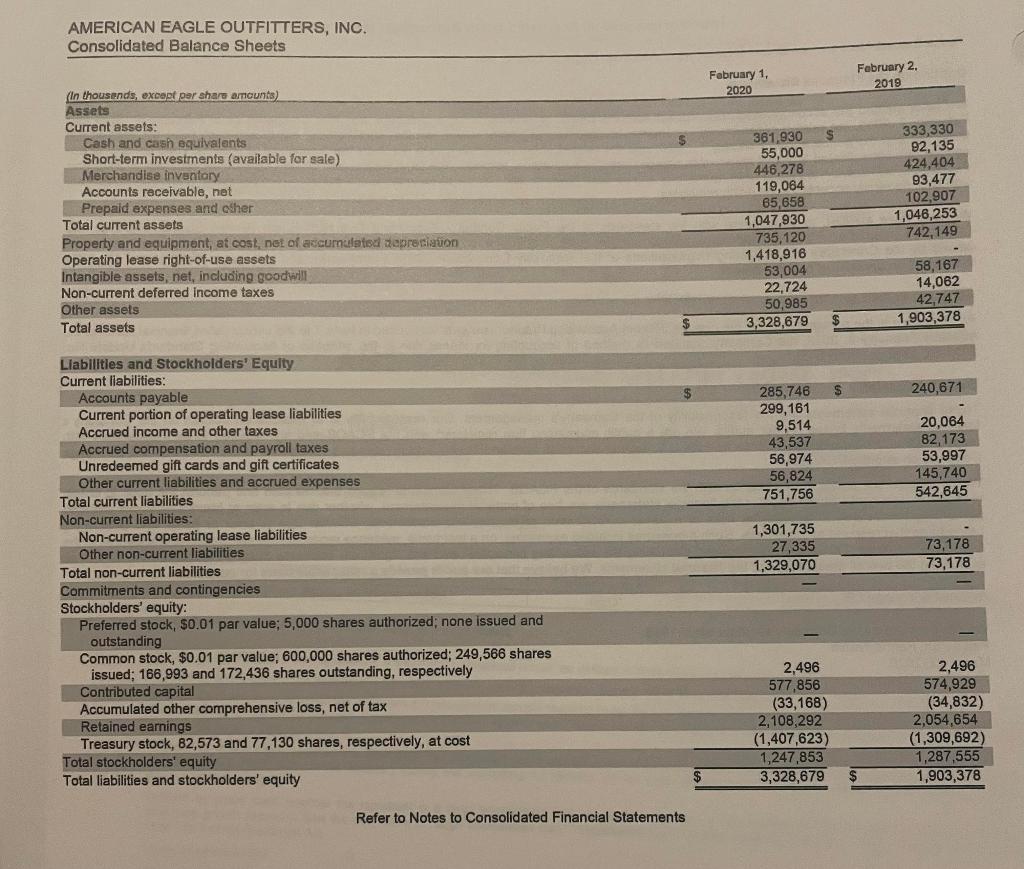

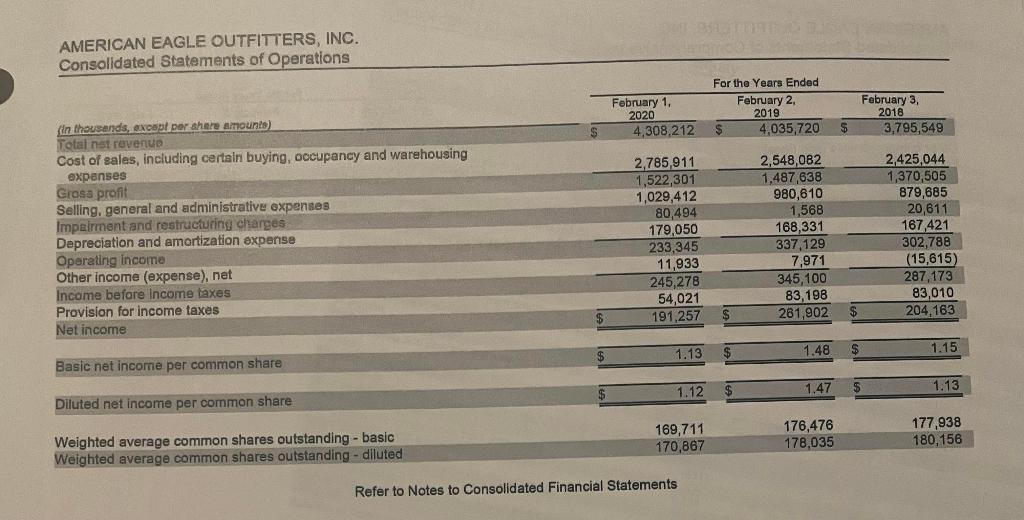

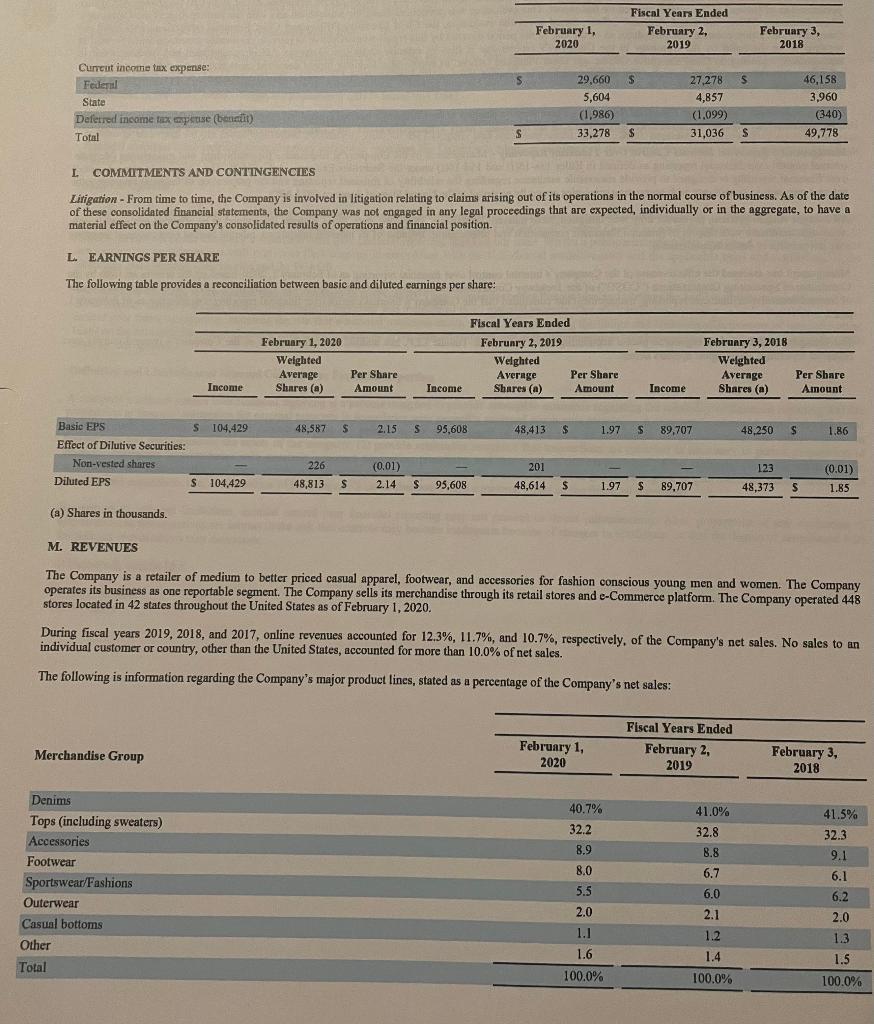

You have just been hired as a financial analyst at Baruch College Fund in New York. Your responsibility is to analyze potential investment opportunities and present your research findings to the fund manager. The fund manager has assigned you to analyze the financial positions of two successful retailer companies in USA: American Eagle Outfitters and The Buckle Company. The financial statements issued by American Eagle Outfitters and The Buckle Company in 2020 are in Appendix A and B of the textbook.

You are required to write a two-page, double-spaced memo analyzing the financial statements.[1] Your report should include, but not limited to, the discussions of the questions below that the fund manager has raised. Use these questions as a way to organize your thoughts as you prepare the report. Submit a hard copy of your memo to the fund manager (your recitation instructor) before the due date specified on the syllabus. No late memo will be accepted. In addition, prepare a 1015-minute presentation using PowerPoint to be presented in class on the due date specified on the syllabus. All group members must participate in the presentation.

Part I: American Eagle Outfitters, Inc.

1. Determine whether the trend in net sales has been increasing or decreasing for the past three years.

2. Where is accounts receivable reported? Explain why using net sales to calculate the receivables turnover ratio might not be a good indicator of a company's ability to efficiently manage receivables for a retail company like American Eagle, which typically sells clothing for cash.

3. Does American Eagle report an allowance for uncollectible accounts in the balance sheet? If so, how much is reported for the most recent year

Part II: The Buckle Inc.

1. Determine whether the trend in net sales has been increasing or decreasing for the past three years.

2. In which financial statement is the balance of accounts receivable reported? Explain why using net sales to calculate the receivables turnover ratio might not be a good indicator of a company's ability to efficiently manage receivables for a retail company like The Buckle, which typically sells clothing for cash.

3. Does The Buckle report an allowance for uncollectible accounts in the balance sheet? If so, how much is reported for the most recent year?

Part III: Comparative Analysis

1.Try to estimate each company's ratio of total current receivables to total current assets. Do you see problems with either company's management of receivables?

All information required to answer the question is on ACC 2101 SMAR - Principles of Accounting I am having trouble understanding how to solve the problem so if you can explain it that would be wonderful

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started