Question: You have just been hired as a management trainee by Toronto-based Capri Fashions Inc., u nationwide distributor of designer Caps. The company has exclusive

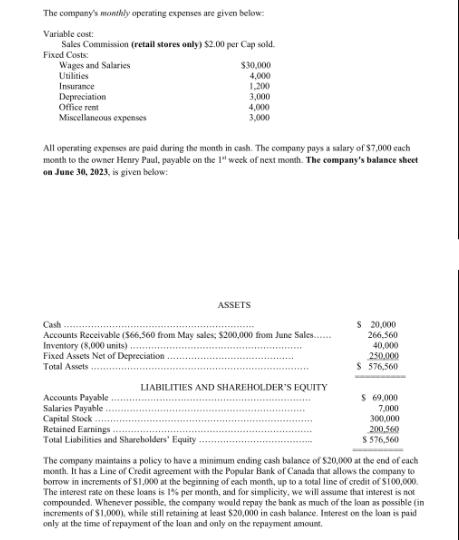

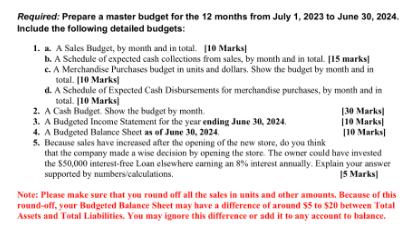

You have just been hired as a management trainee by Toronto-based Capri Fashions Inc., u nationwide distributor of designer Caps. The company has exclusive distribution of the Caps, and sales have grown so rapidly over the last few years that it has become necessary to add new members to the management team. You have been given responsibility for all planning and budgeting. Your first assignment is to prepare a Master Budget for the next 12 months starting July 1, 2023. You are anxious to make a favorable impression on the president and have assembled the information below. The company purchases the Caps from a factory in Montreal which costs the company $5.00 each (all on account). Purchases are made based on the current month's sales in units plus an ending inventory to equal 40% of the next month's sales in units. Purchases are paid for 40% in the month of purchase and the remaining 60% in the following month. The Caps are sold at wholesale to other resellers as well as through own stores to individual customers. 80% of total sales, all on account are made as wholesale for $8.00 cach and $15.00 each to the individual customers in the mall stores (20% of total sales, all in cash). Recent and forecasted total sales in units are as follows: Months Units Months March 2023 Actual April 2023 Actual 20,000 June 2023 Actual 24,000 July 2023 Budgeted 26,000 August Budgeted May 2023 Actual Units 25,000 20,000 24,000 The company has found that only 60% of a month's credit sales are collected in the following month, and the remaining 40% is collected in the second month following the sales. Bad debts have been negligible. The company's monthly operating expenses are given below: Variable cost: Sales Commission (retail stores only) $2.00 per Cap sold. Fixed Costs: Wages and Salaries Utilities Insurance Depreciation Office rent Miscellaneous expenses $30,000 4,000 1,200 3,000 All operating expenses are paid during the month in cash. The company pays a salary of $7,000 each month to the owner Henry Puul, payable on the 1" week of next month. The company's balance sheet on June 30, 2023, is given below: Fixed Assets Net of Depreciation Total Assets 4,000 3,000 Cash Accounts Receivable ($66,560 from May sales; $200,000 from June Sales....... Inventory (8,000 units). Accounts Payable Salaries Payable Capital Stock Retained Earnings Total Liabilities and Shareholders' Equity ASSETS LIABILITIES AND SHAREHOLDER'S EQUITY $ 20,000 266,560 40,000 250,000 $ 576,560 $ 69,000 7,000 300,000 200.560 $ 576,560 The company maintains a policy to have a minimum ending cash balance of $20,000 at the end of each month. It has a Line of Credit agreement with the Popular Bank of Canada that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total line of credit of $100,000. The interest rate on these loans is 1% per month, and for simplicity, we will assume that interest is not compounded. Whenever possible, the company would repay the bank as much of the loan as possible (in increments of $1,000), while still retaining at least $20,000 in cash balance. Interest on the loan is paid only at the time of repayment of the loan and only on the repayment amount. Required: Prepare a master budget for the 12 months from July 1, 2023 to June 30, 2024. Include the following detailed budgets: 1. a. A Sales Budget, by month and in total. [10 Marks] b. A Schedule of expected cash collections from sales, by month and in total. [15 marks] c. A Merchandise Purchases budget in units and dollars. Show the budget by month and in total. [10 Marks] d. A Schedule of Expected Cash Disbursements for merchandise purchases, by month and in total. [10 Marks] 2. A Cash Budget. Show the budget by month. 3. A Budgeted Income Statement for the year ending June 30, 2024. 4. A Budgeted Balance Sheet as of June 30, 2024. 5. Because sales have increased after the opening of the new store, do you think that the company made a wise decision by opening the store. The owner could have invested the $50,000 interest-free Loan elsewhere earning an 8% interest annually. Explain your answer supported by numbers/calculations. 15 Marks] [30 Marks [10 Marks [10 Marks] Note: Please make sure that you round off all the sales in units and other amounts. Because of this round-off, your Budgeted Balance Sheet may have a difference of around $5 to $20 between Total Assets and Total Liabilities. You may ignore this difference or add it to any account to balance.

Step by Step Solution

3.52 Rating (176 Votes )

There are 3 Steps involved in it

1 a Here is a Sales Budget for Capri Fashions Inc for the 12 months from July 1 20... View full answer

Get step-by-step solutions from verified subject matter experts