Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have just been hired as a management trainee by Toronto-based Mr. Dressup, a nationwide distributor of designer Caps. The company has exclusive distribution

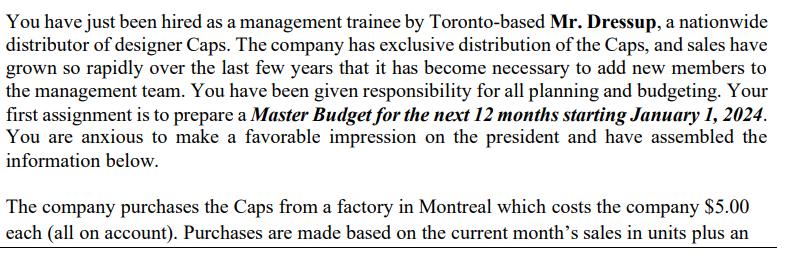

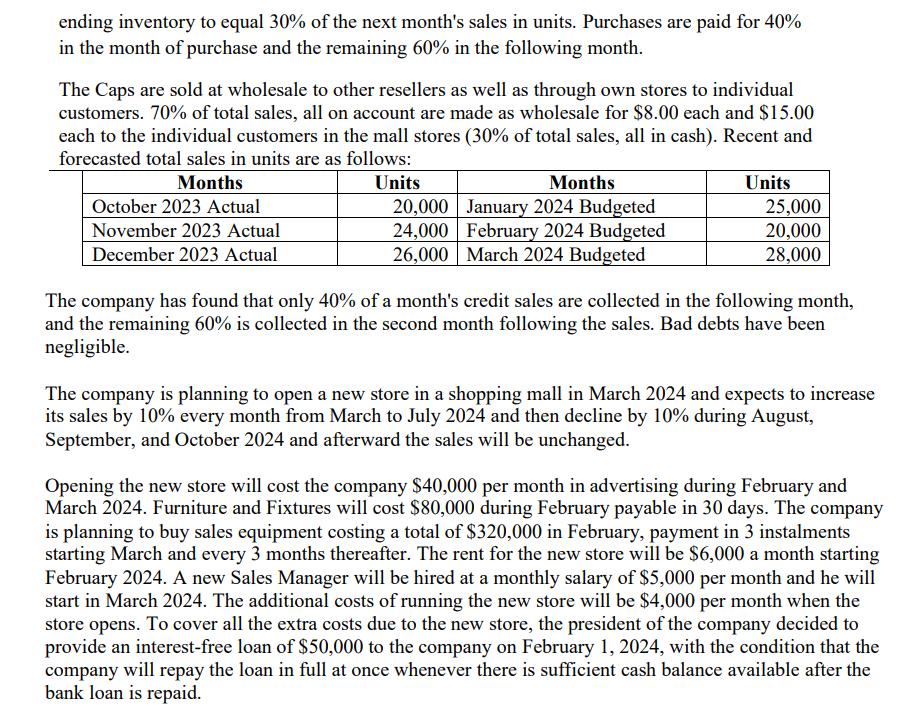

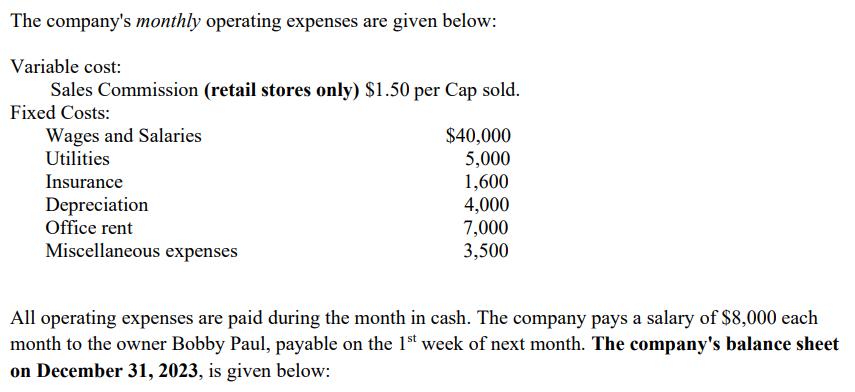

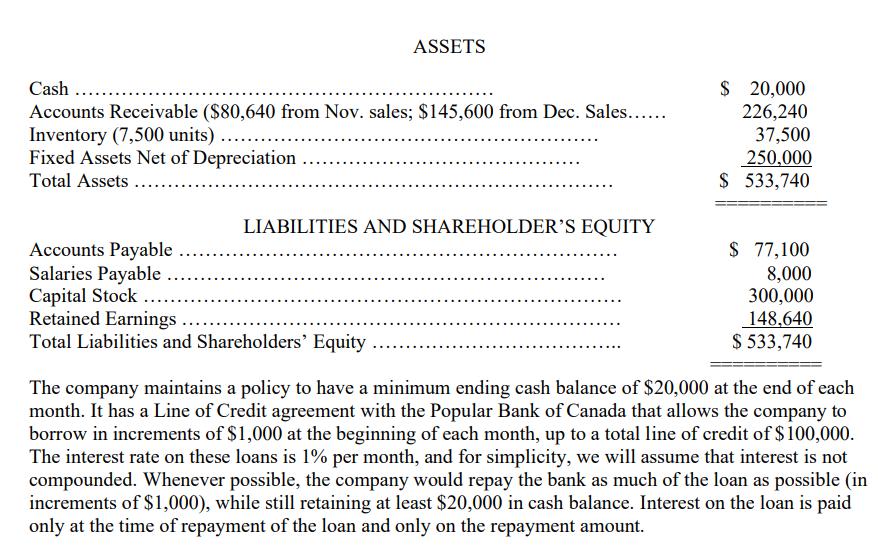

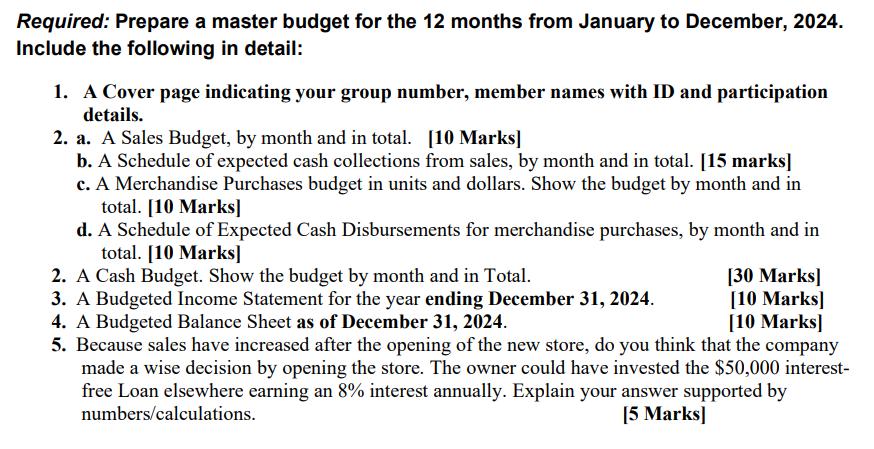

You have just been hired as a management trainee by Toronto-based Mr. Dressup, a nationwide distributor of designer Caps. The company has exclusive distribution of the Caps, and sales have grown so rapidly over the last few years that it has become necessary to add new members to the management team. You have been given responsibility for all planning and budgeting. Your first assignment is to prepare a Master Budget for the next 12 months starting January 1, 2024. You are anxious to make a favorable impression on the president and have assembled the information below. The company purchases the Caps from a factory in Montreal which costs the company $5.00 each (all on account). Purchases are made based on the current month's sales in units plus an ending inventory to equal 30% of the next month's sales in units. Purchases are paid for 40% in the month of purchase and the remaining 60% in the following month. The Caps are sold at wholesale to other resellers as well as through own stores to individual customers. 70% of total sales, all on account are made as wholesale for $8.00 each and $15.00 each to the individual customers in the mall stores (30% of total sales, all in cash). Recent and forecasted total sales in units are as follows: Months October 2023 Actual November 2023 Actual December 2023 Actual Units Months 20,000 January 2024 Budgeted 24,000 February 2024 Budgeted 26,000 March 2024 Budgeted Units 25,000 20,000 28,000 The company has found that only 40% of a month's credit sales are collected in the following month, and the remaining 60% is collected in the second month following the sales. Bad debts have been negligible. The company is planning to open a new store in a shopping mall in March 2024 and expects to increase its sales by 10% every month from March to July 2024 and then decline by 10% during August, September, and October 2024 and afterward the sales will be unchanged. Opening the new store will cost the company $40,000 per month in advertising during February and March 2024. Furniture and Fixtures will cost $80,000 during February payable in 30 days. The company is planning to buy sales equipment costing a total of $320,000 in February, payment in 3 instalments starting March and every 3 months thereafter. The rent for the new store will be $6,000 a month starting February 2024. A new Sales Manager will be hired at a monthly salary of $5,000 per month and he will start in March 2024. The additional costs of running the new store will be $4,000 per month when the store opens. To cover all the extra costs due to the new store, the president of the company decided to provide an interest-free loan of $50,000 to the company on February 1, 2024, with the condition that the company will repay the loan in full at once whenever there is sufficient cash balance available after the bank loan is repaid. The company's monthly operating expenses are given below: Variable cost: Sales Commission (retail stores only) $1.50 per Cap sold. Fixed Costs: Wages and Salaries Utilities Insurance Depreciation Office rent Miscellaneous expenses $40,000 5,000 1,600 4,000 7,000 3,500 All operating expenses are paid during the month in cash. The company pays a salary of $8,000 each month to the owner Bobby Paul, payable on the 1st week of next month. The company's balance sheet on December 31, 2023, is given below: ASSETS Cash Accounts Receivable ($80,640 from Nov. sales; $145,600 from Dec. Sales...... Inventory (7,500 units) $ 20,000 226,240 37,500 Fixed Assets Net of Depreciation Total Assets 250,000 $ 533,740 LIABILITIES AND SHAREHOLDER'S EQUITY Accounts Payable ... $ 77,100 Salaries Payable 8,000 Capital Stock .... 300,000 Retained Earnings ..... 148,640 $ 533,740 Total Liabilities and Shareholders' Equity ... The company maintains a policy to have a minimum ending cash balance of $20,000 at the end of each month. It has a Line of Credit agreement with the Popular Bank of Canada that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total line of credit of $100,000. The interest rate on these loans is 1% per month, and for simplicity, we will assume that interest is not compounded. Whenever possible, the company would repay the bank as much of the loan as possible (in increments of $1,000), while still retaining at least $20,000 in cash balance. Interest on the loan is paid only at the time of repayment of the loan and only on the repayment amount. Required: Prepare a master budget for the 12 months from January to December, 2024. Include the following in detail: 1. A Cover page indicating your group number, member names with ID and participation details. 2. a. A Sales Budget, by month and in total. [10 Marks] b. A Schedule of expected cash collections from sales, by month and in total. [15 marks] c. A Merchandise Purchases budget in units and dollars. Show the budget by month and in total. [10 Marks] d. A Schedule of Expected Cash Disbursements for merchandise purchases, by month and in total. [10 Marks] 2. A Cash Budget. Show the budget by month and in Total. 3. A Budgeted Income Statement for the year ending December 31, 2024. 4. A Budgeted Balance Sheet as of December 31, 2024. [30 Marks] [10 Marks] [10 Marks] 5. Because sales have increased after the opening of the new store, do you think that the company made a wise decision by opening the store. The owner could have invested the $50,000 interest- free Loan elsewhere earning an 8% interest annually. Explain your answer supported by numbers/calculations. [5 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started