Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have just been hired by Dell Computers in their capital budgeting division. Your first assignment is to determine the free cash flows of

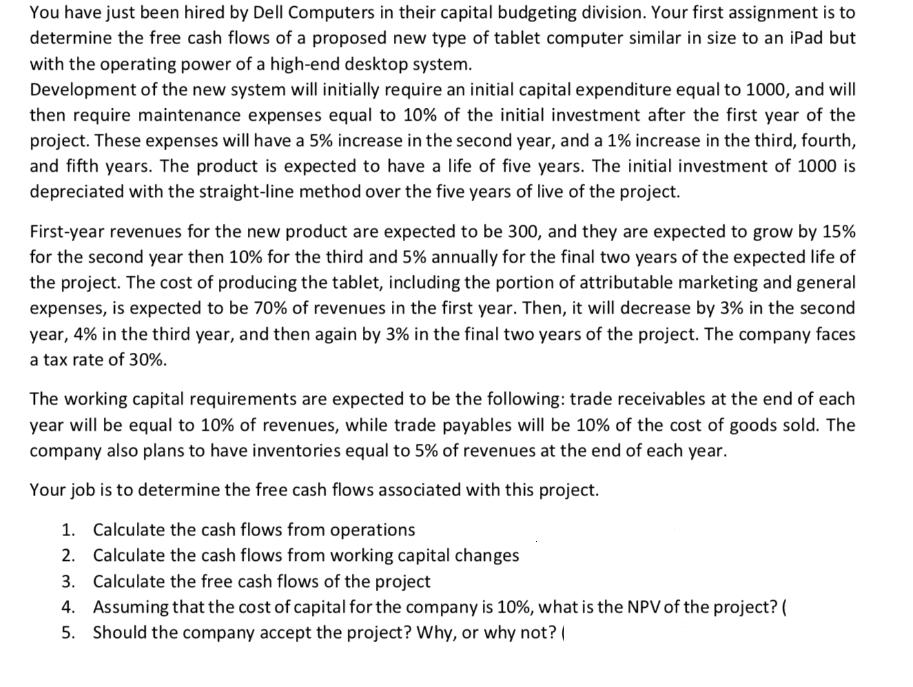

You have just been hired by Dell Computers in their capital budgeting division. Your first assignment is to determine the free cash flows of a proposed new type of tablet computer similar in size to an iPad but with the operating power of a high-end desktop system. Development of the new system will initially require an initial capital expenditure equal to 1000, and will then require maintenance expenses equal to 10% of the initial investment after the first year of the project. These expenses will have a 5% increase in the second year, and a 1% increase in the third, fourth, and fifth years. The product is expected to have a life of five years. The initial investment of 1000 is depreciated with the straight-line method over the five years of live of the project. First-year revenues for the new product are expected to be 300, and they are expected to grow by 15% for the second year then 10% for the third and 5% annually for the final two years of the expected life of the project. The cost of producing the tablet, including the portion of attributable marketing and general expenses, is expected to be 70% of revenues in the first year. Then, it will decrease by 3% in the second year, 4% in the third year, and then again by 3% in the final two years of the project. The company faces a tax rate of 30%. The working capital requirements are expected to be the following: trade receivables at the end of each year will be equal to 10% of revenues, while trade payables will be 10% of the cost of goods sold. The company also plans to have inventories equal to 5% of revenues at the end of each year. Your job is to determine the free cash flows associated with this project. 1. Calculate the cash flows from operations 2. Calculate the cash flows from working capital changes 3. Calculate the free cash flows of the project 4. Assuming that the cost of capital for the company is 10%, what is the NPV of the project? ( 5. Should the company accept the project? Why, or why not? |

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer A D F H Year 1 2 3 4 2 Initial Investment 1000 3 Cost of Capital 01 4 Maintainence Expenses C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started