Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have just been hired by FAB Corporation, the manufacturer of a revolutionary new garage door opening device. The president asked you to review

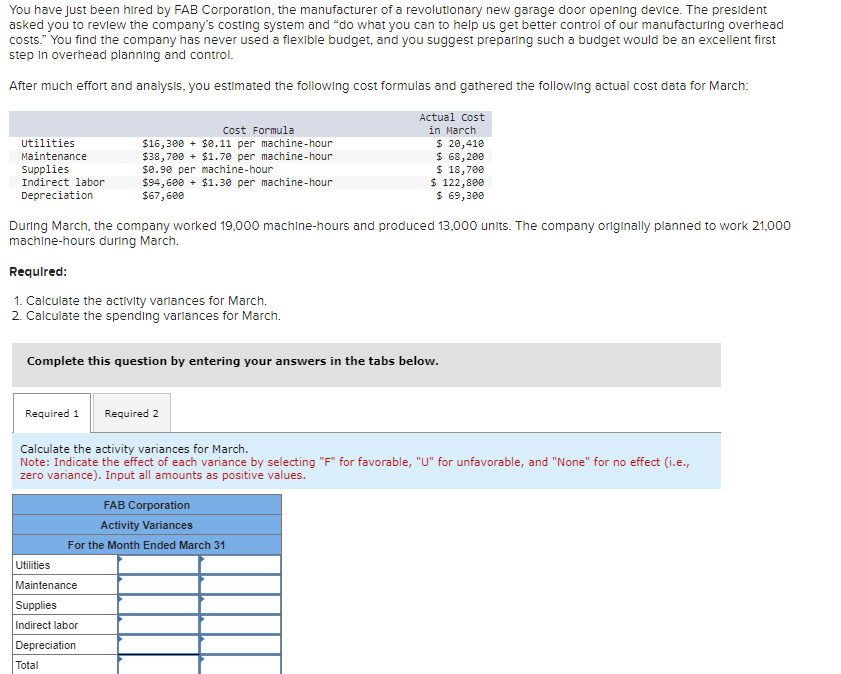

You have just been hired by FAB Corporation, the manufacturer of a revolutionary new garage door opening device. The president asked you to review the company's costing system and "do what you can to help us get better control of our manufacturing overhead costs." You find the company has never used a flexible budget, and you suggest preparing such a budget would be an excellent first step in overhead planning and control. After much effort and analysis, you estimated the following cost formulas and gathered the following actual cost data for March: Utilities Maintenance Supplies Indirect labor Depreciation Cost Formula $16,300 + $0.11 per machine-hour $38,700 + $1.70 per machine-hour $0.90 per machine-hour $94,600 + $1.30 per machine-hour $67,600 Actual Cost in March $ 20,410 $ 68,200 $ 18,700 $ 122,800 $ 69,300 During March, the company worked 19,000 machine-hours and produced 13,000 units. The company originally planned to work 21,000 machine-hours during March. Required: 1. Calculate the activity variances for March. 2. Calculate the spending variances for March. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Calculate the activity variances for March. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. FAB Corporation Activity Variances For the Month Ended March 31 Utilities Maintenance Supplies Indirect labor Depreciation Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started