Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have just been hired by XZU's financial planning department. Your first job is to help XZU determine how much money XZU should accrue on

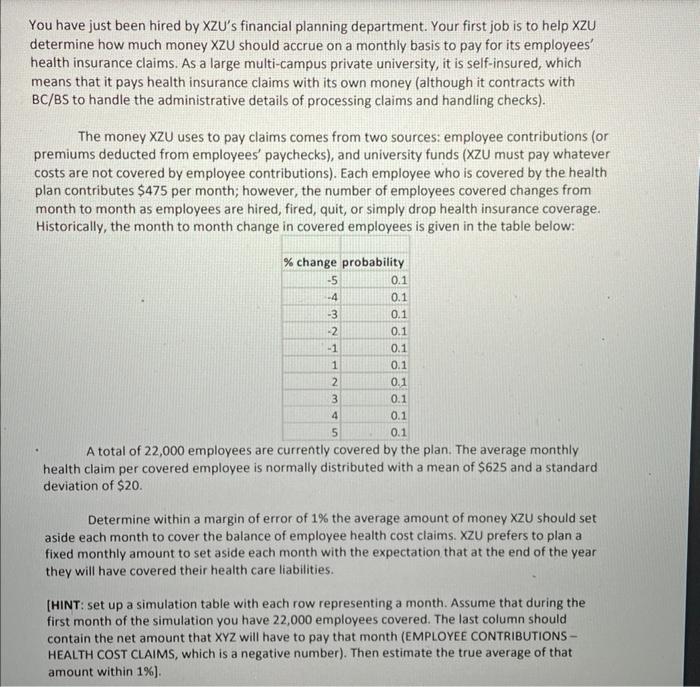

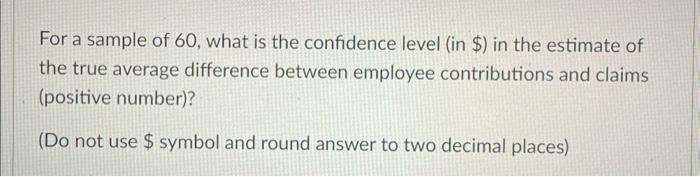

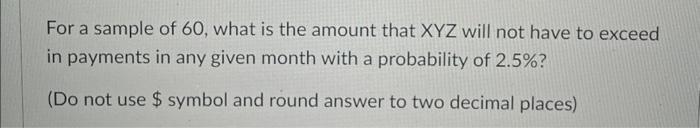

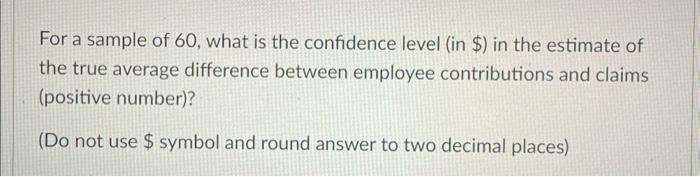

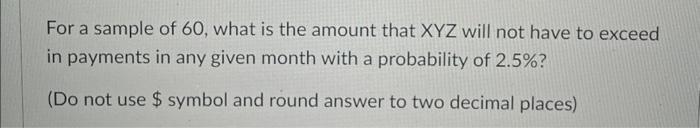

You have just been hired by XZU's financial planning department. Your first job is to help XZU determine how much money XZU should accrue on a monthly basis to pay for its employees' health insurance claims. As a large multi-campus private university, it is self-insured, which means that it pays health insurance claims with its own money (although it contracts with BC/BS to handle the administrative details of processing claims and handling checks). The money XZU uses to pay claims comes from two sources: employee contributions (or premiums deducted from employees' paychecks), and university funds (XZU must pay whatever costs are not covered by employee contributions). Each employee who is covered by the health plan contributes $475 per month; however, the number of employees covered changes from month to month as employees are hired, fired, quit, or simply drop health insurance coverage. Historically, the month to month change in covered employees is given in the table below: A total of 22,000 employees are currently covered by the plan. The average monthly health claim per covered employee is normally distributed with a mean of $625 and a standard deviation of $20. Determine within a margin of error of 1% the average amount of money XZU should set aside each month to cover the balance of employee health cost claims. XZU prefers to plan a fixed monthly amount to set aside each month with the expectation that at the end of the year they will have covered their health care liabilities. [HINT: set up a simulation table with each row representing a month. Assume that during the first month of the simulation you have 22,000 employees covered. The last column should contain the net amount that XYZ will have to pay that month (EMPLOYEE CONTRIBUTIONS HEALTH COST CLAIMS, which is a negative number). Then estimate the true average of that amount within 1% ]. For a sample of 60 , what is the confidence level (in \$) in the estimate of the true average difference between employee contributions and claims (positive number)? (Do not use \$symbol and round answer to two decimal places) For a sample of 60 , what is the amount that XYZ will not have to exceed in payments in any given month with a probability of 2.5% ? (Do not use $ symbol and round answer to two decimal places) You have just been hired by XZU's financial planning department. Your first job is to help XZU determine how much money XZU should accrue on a monthly basis to pay for its employees' health insurance claims. As a large multi-campus private university, it is self-insured, which means that it pays health insurance claims with its own money (although it contracts with BC/BS to handle the administrative details of processing claims and handling checks). The money XZU uses to pay claims comes from two sources: employee contributions (or premiums deducted from employees' paychecks), and university funds (XZU must pay whatever costs are not covered by employee contributions). Each employee who is covered by the health plan contributes $475 per month; however, the number of employees covered changes from month to month as employees are hired, fired, quit, or simply drop health insurance coverage. Historically, the month to month change in covered employees is given in the table below: A total of 22,000 employees are currently covered by the plan. The average monthly health claim per covered employee is normally distributed with a mean of $625 and a standard deviation of $20. Determine within a margin of error of 1% the average amount of money XZU should set aside each month to cover the balance of employee health cost claims. XZU prefers to plan a fixed monthly amount to set aside each month with the expectation that at the end of the year they will have covered their health care liabilities. [HINT: set up a simulation table with each row representing a month. Assume that during the first month of the simulation you have 22,000 employees covered. The last column should contain the net amount that XYZ will have to pay that month (EMPLOYEE CONTRIBUTIONS HEALTH COST CLAIMS, which is a negative number). Then estimate the true average of that amount within 1% ]. For a sample of 60 , what is the confidence level (in \$) in the estimate of the true average difference between employee contributions and claims (positive number)? (Do not use \$symbol and round answer to two decimal places) For a sample of 60 , what is the amount that XYZ will not have to exceed in payments in any given month with a probability of 2.5% ? (Do not use $ symbol and round answer to two decimal places)

You have just been hired by XZU's financial planning department. Your first job is to help XZU determine how much money XZU should accrue on a monthly basis to pay for its employees' health insurance claims. As a large multi-campus private university, it is self-insured, which means that it pays health insurance claims with its own money (although it contracts with BC/BS to handle the administrative details of processing claims and handling checks). The money XZU uses to pay claims comes from two sources: employee contributions (or premiums deducted from employees' paychecks), and university funds (XZU must pay whatever costs are not covered by employee contributions). Each employee who is covered by the health plan contributes $475 per month; however, the number of employees covered changes from month to month as employees are hired, fired, quit, or simply drop health insurance coverage. Historically, the month to month change in covered employees is given in the table below: A total of 22,000 employees are currently covered by the plan. The average monthly health claim per covered employee is normally distributed with a mean of $625 and a standard deviation of $20. Determine within a margin of error of 1% the average amount of money XZU should set aside each month to cover the balance of employee health cost claims. XZU prefers to plan a fixed monthly amount to set aside each month with the expectation that at the end of the year they will have covered their health care liabilities. [HINT: set up a simulation table with each row representing a month. Assume that during the first month of the simulation you have 22,000 employees covered. The last column should contain the net amount that XYZ will have to pay that month (EMPLOYEE CONTRIBUTIONS HEALTH COST CLAIMS, which is a negative number). Then estimate the true average of that amount within 1% ]. For a sample of 60 , what is the confidence level (in \$) in the estimate of the true average difference between employee contributions and claims (positive number)? (Do not use \$symbol and round answer to two decimal places) For a sample of 60 , what is the amount that XYZ will not have to exceed in payments in any given month with a probability of 2.5% ? (Do not use $ symbol and round answer to two decimal places) You have just been hired by XZU's financial planning department. Your first job is to help XZU determine how much money XZU should accrue on a monthly basis to pay for its employees' health insurance claims. As a large multi-campus private university, it is self-insured, which means that it pays health insurance claims with its own money (although it contracts with BC/BS to handle the administrative details of processing claims and handling checks). The money XZU uses to pay claims comes from two sources: employee contributions (or premiums deducted from employees' paychecks), and university funds (XZU must pay whatever costs are not covered by employee contributions). Each employee who is covered by the health plan contributes $475 per month; however, the number of employees covered changes from month to month as employees are hired, fired, quit, or simply drop health insurance coverage. Historically, the month to month change in covered employees is given in the table below: A total of 22,000 employees are currently covered by the plan. The average monthly health claim per covered employee is normally distributed with a mean of $625 and a standard deviation of $20. Determine within a margin of error of 1% the average amount of money XZU should set aside each month to cover the balance of employee health cost claims. XZU prefers to plan a fixed monthly amount to set aside each month with the expectation that at the end of the year they will have covered their health care liabilities. [HINT: set up a simulation table with each row representing a month. Assume that during the first month of the simulation you have 22,000 employees covered. The last column should contain the net amount that XYZ will have to pay that month (EMPLOYEE CONTRIBUTIONS HEALTH COST CLAIMS, which is a negative number). Then estimate the true average of that amount within 1% ]. For a sample of 60 , what is the confidence level (in \$) in the estimate of the true average difference between employee contributions and claims (positive number)? (Do not use \$symbol and round answer to two decimal places) For a sample of 60 , what is the amount that XYZ will not have to exceed in payments in any given month with a probability of 2.5% ? (Do not use $ symbol and round answer to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started