Question

You have just completed and analysis of the capital budgeting investments for next year. The companys project have an average required rate of return of

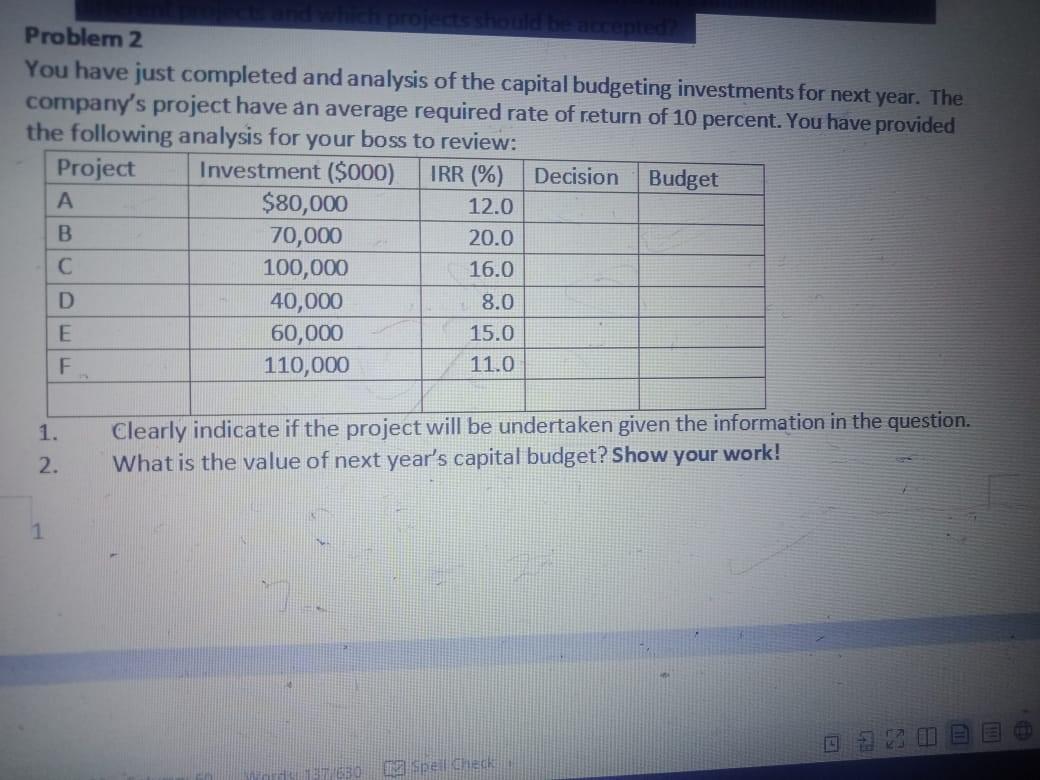

You have just completed and analysis of the capital budgeting investments for next year. The companys project have an average required rate of return of 10 percent. You have provided the following analysis for your boss to review: Project Investment ($000) IRR (%) Decision Budget A $80,000 12.0 B 70,000 20.0 C 100,000 16.0 D 40,000 8.0 E 60,000 15.0 F 110,000 11.0 1. Clearly indicate if the project will be undertaken given the information in the question. 2. What is the value of next years capital budget? Show your work! 3. Project D has the lowest IRR. What does this imply about the NPV of the project?

You have just completed and analysis of the capital budgeting investments for next year. The companys project have an average required rate of return of 10 percent. You have provided the following analysis for your boss to review: Project Investment ($000) IRR (%) Decision Budget A $80,000 12.0 B 70,000 20.0 C 100,000 16.0 D 40,000 8.0 E 60,000 15.0 F 110,000 11.0 1. Clearly indicate if the project will be undertaken given the information in the question. 2. What is the value of next years capital budget? Show your work! 3. Project D has the lowest IRR. What does this imply about the NPV of the project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started