Answered step by step

Verified Expert Solution

Question

1 Approved Answer

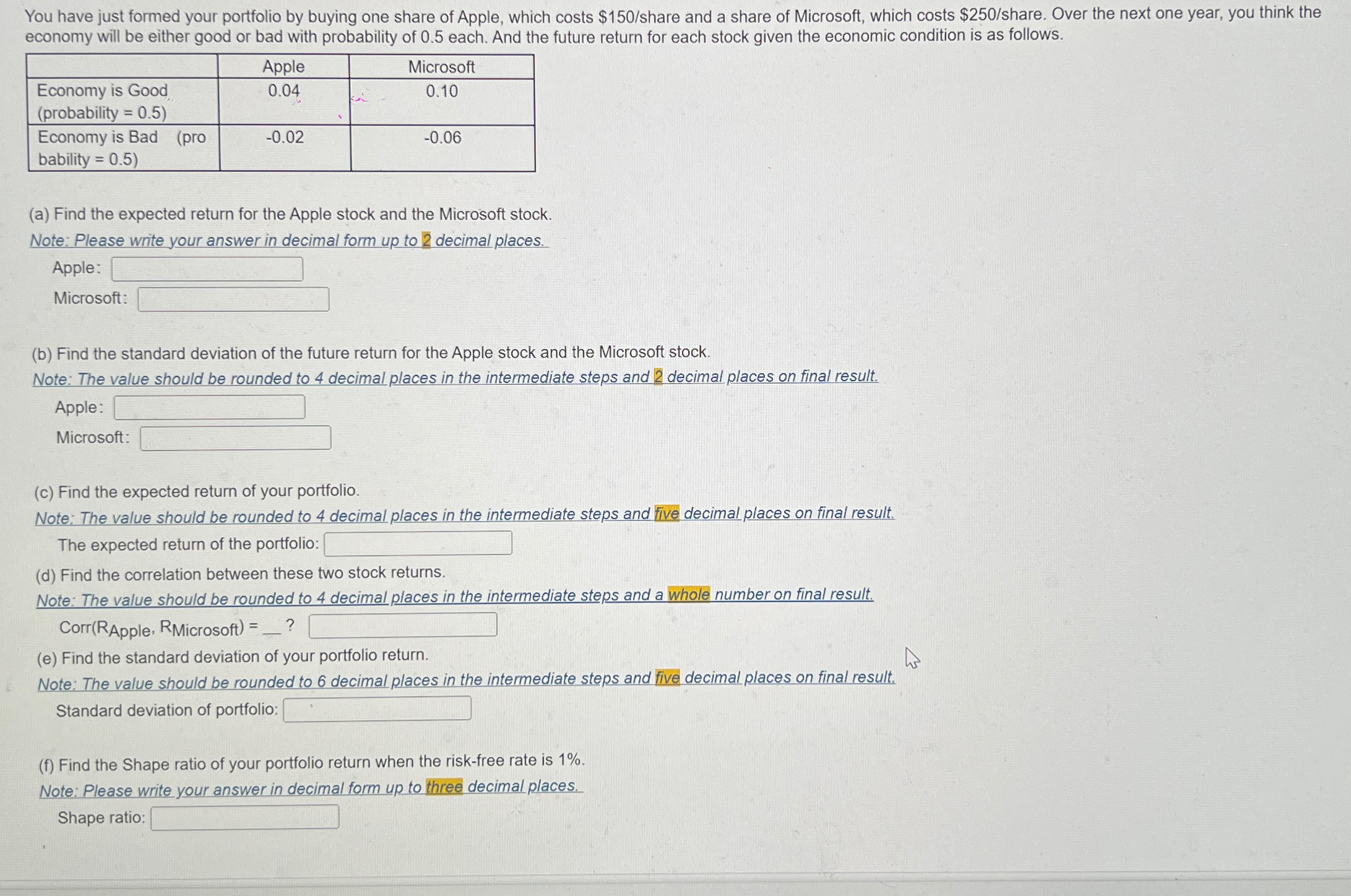

You have just formed your portfolio by buying one share of Apple, which costs $ 1 5 0 ? share and a share of Microsoft,

You have just formed your portfolio by buying one share of Apple, which costs $ share and a share of Microsoft, which costs $ share. Over the next one year, you think the economy will be either good or bad with probability of each. And the future return for each stock given the economic condition is as follows.

tableApple,MicrosofttableEconomy is Goodprobability tableEconomy is Bad probability

a Find the expected return for the Apple stock and the Microsoft stock.

Note: Please write your answer in decimal form up to decimal places.

Apple:

Microsoft:

b Find the standard deviation of the future return for the Apple stock and the Microsoft stock.

Note: The value should be rounded to decimal places in the intermediate steps and decimal places on final result.

Apple:

Microsoft:

c Find the expected return of your portfolio.

Note: The value should be rounded to decimal places in the intermediate steps and five decimal places on final result.

The expected return of the portfolio:

d Find the correlation between these two stock returns.

Note: The value should be rounded to decimal places in the intermediate steps and a whole number on final result.

CorrRApple RMicrosoft

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started