Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have just inherited $1,000,000 and are considering a number of investment options. Among the investment projects offered you there is a service/gas station

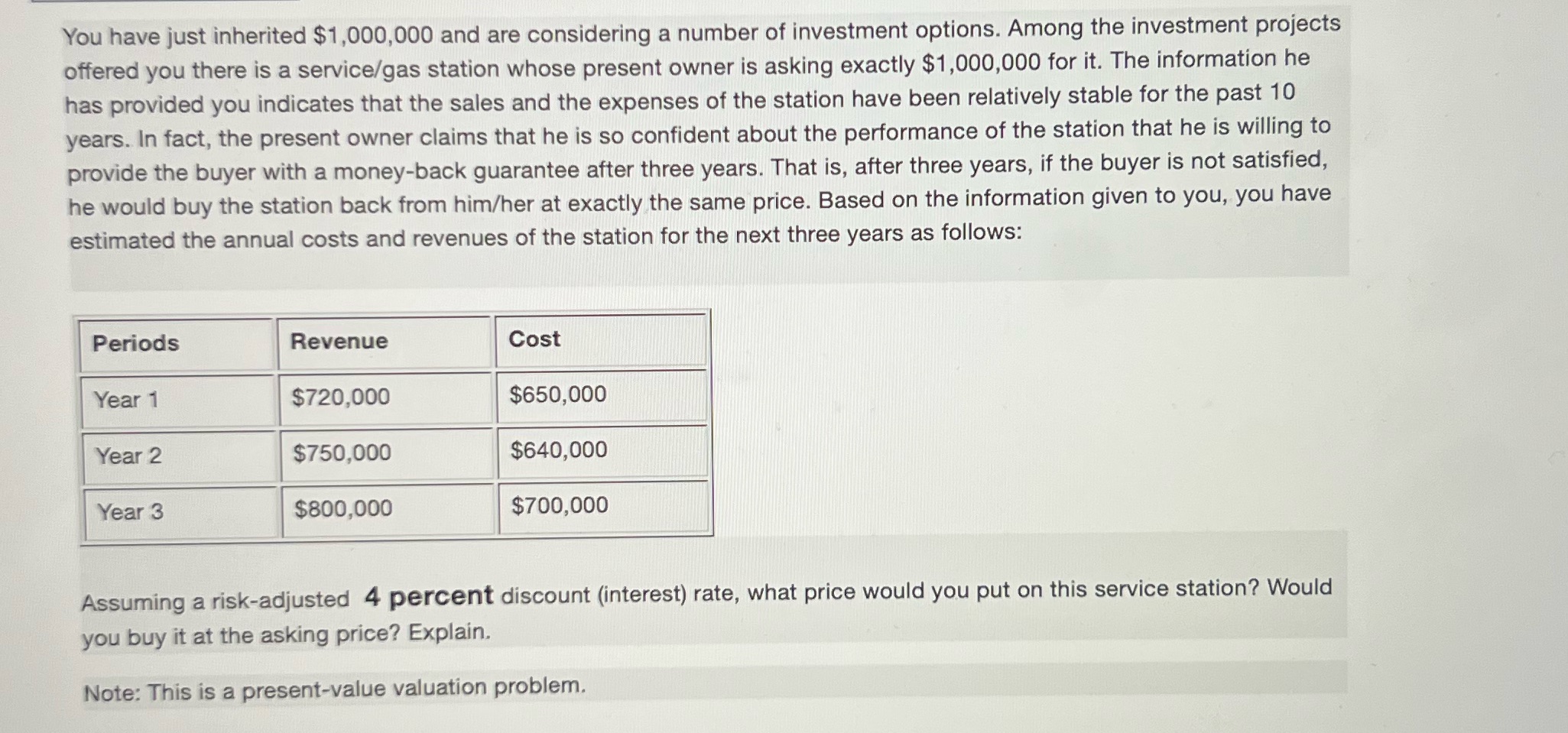

You have just inherited $1,000,000 and are considering a number of investment options. Among the investment projects offered you there is a service/gas station whose present owner is asking exactly $1,000,000 for it. The information he has provided you indicates that the sales and the expenses of the station have been relatively stable for the past 10 years. In fact, the present owner claims that he is so confident about the performance of the station that he is willing to provide the buyer with a money-back guarantee after three years. That is, after three years, if the buyer is not satisfied, he would buy the station back from him/her at exactly the same price. Based on the information given to you, you have estimated the annual costs and revenues of the station for the next three years as follows: Periods Revenue Cost Year 1 $720,000 $650,000 Year 2 $750,000 $640,000 Year 3 $800,000 $700,000 Assuming a risk-adjusted 4 percent discount (interest) rate, what price would you put on this service station? Would you buy it at the asking price? Explain. Note: This is a present-value valuation problem.

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

This is a present value PV problem where we need to consider the future cash flows profits of the gas station and discount them back to their present ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started