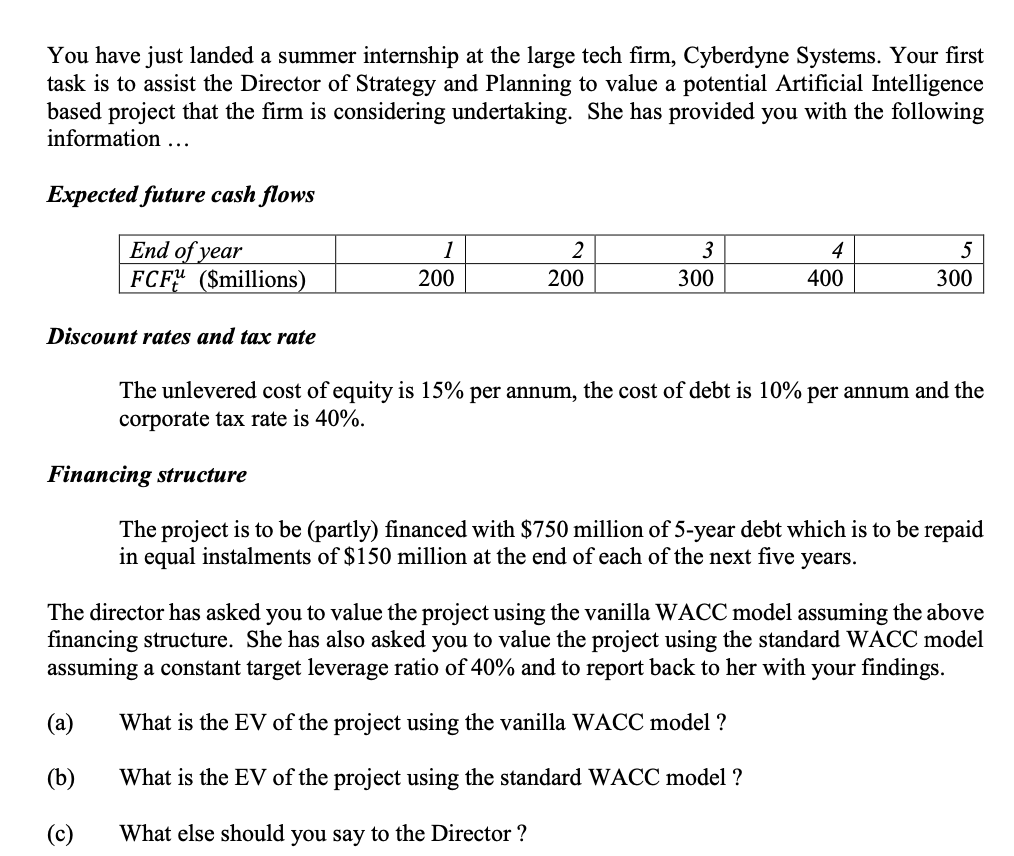

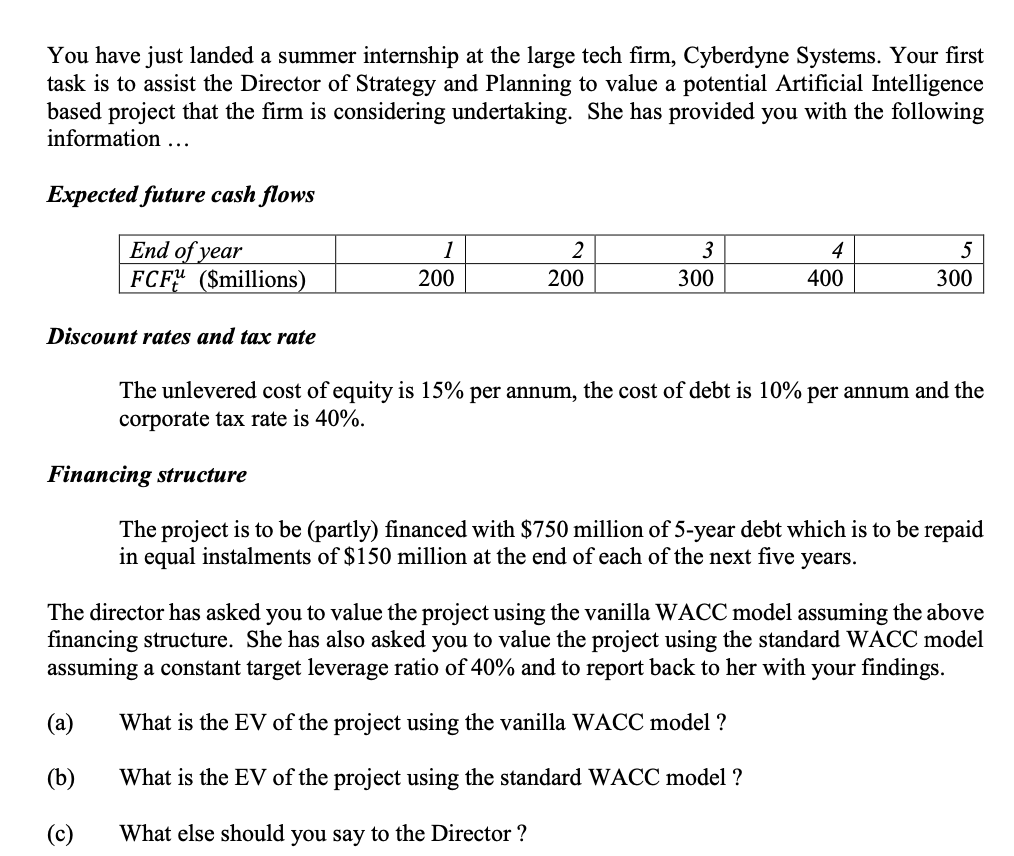

You have just landed a summer internship at the large tech firm, Cyberdyne Systems. Your first task is to assist the Director of Strategy and Planning to value a potential Artificial Intelligence based project that the firm is considering undertaking. She has provided you with the following information ... Expected future cash flows End of year FCF ($millions) 1 200 2 200 3 300 4 400 5 300 Discount rates and tax rate The unlevered cost of equity is 15% per annum, the cost of debt is 10% per annum and the corporate tax rate is 40%. Financing structure The project is to be (partly) financed with $750 million of 5-year debt which is to be repaid in equal instalments of $150 million at the end of each of the next five years. The director has asked you to value the project using the vanilla WACC model assuming the above financing structure. She has also asked you to value the project using the standard WACC model assuming a constant target leverage ratio of 40% and to report back to her with your findings. (a) What is the EV of the project using the vanilla WACC model ? (b) What is the EV of the project using the standard WACC model ? (c) What else should you say to the Director ? You have just landed a summer internship at the large tech firm, Cyberdyne Systems. Your first task is to assist the Director of Strategy and Planning to value a potential Artificial Intelligence based project that the firm is considering undertaking. She has provided you with the following information ... Expected future cash flows End of year FCF ($millions) 1 200 2 200 3 300 4 400 5 300 Discount rates and tax rate The unlevered cost of equity is 15% per annum, the cost of debt is 10% per annum and the corporate tax rate is 40%. Financing structure The project is to be (partly) financed with $750 million of 5-year debt which is to be repaid in equal instalments of $150 million at the end of each of the next five years. The director has asked you to value the project using the vanilla WACC model assuming the above financing structure. She has also asked you to value the project using the standard WACC model assuming a constant target leverage ratio of 40% and to report back to her with your findings. (a) What is the EV of the project using the vanilla WACC model ? (b) What is the EV of the project using the standard WACC model ? (c) What else should you say to the Director