Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have just started a new job and are thrilled to learn that your new employer offers a 401(k) retirement plan to its employees.

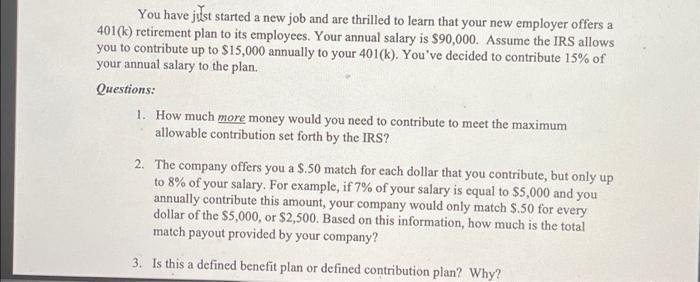

You have just started a new job and are thrilled to learn that your new employer offers a 401(k) retirement plan to its employees. Your annual salary is $90,000. Assume the IRS allows you to contribute up to $15,000 annually to your 401(k). You've decided to contribute 15% of your annual salary to the plan. Questions: 1. How much more money would you need to contribute to meet the maximum allowable contribution set forth by the IRS? 2. The company offers you a $.50 match for each dollar that you contribute, but only up to 8% of your salary. For example, if 7% of your salary is equal to $5,000 and you annually contribute this amount, your company would only match $.50 for every dollar of the $5,000, or $2,500. Based on this information, how much is the total match payout provided by your company? 3. Is this a defined benefit plan or defined contribution plan? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 To calculate the amount more you need to contribute to meet the maximum allowable contribution set forth by the IRS we need to find the difference b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started