You have obtained the following share prices from Yahoo Finance. Company 1 is listed on the London Stock Exchange. You want to estimate the

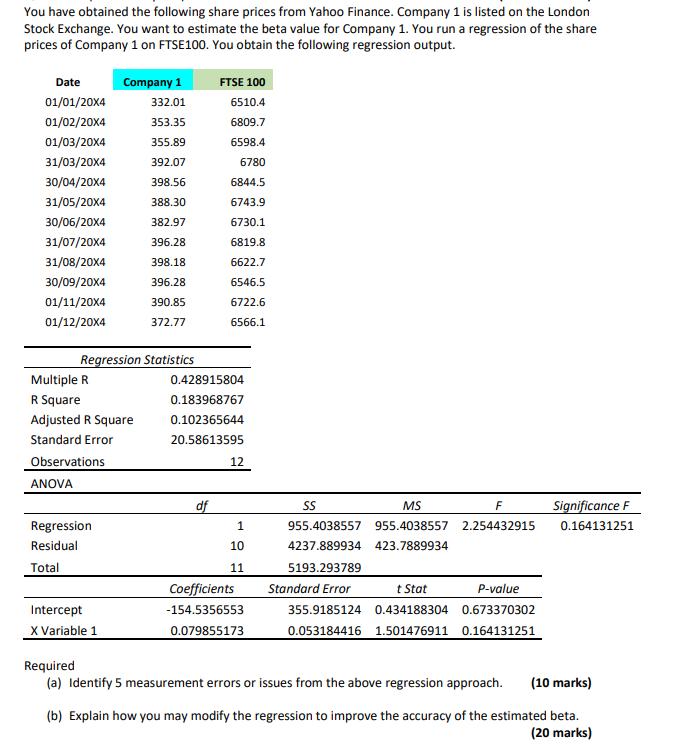

You have obtained the following share prices from Yahoo Finance. Company 1 is listed on the London Stock Exchange. You want to estimate the beta value for Company 1. You run a regression of the share prices of Company 1 on FTSE100. You obtain the following regression output. Date 01/01/20X4 01/02/20X4 01/03/20X4 31/03/20X4 30/04/20X4 31/05/20X4 30/06/20X4 31/07/20X4 31/08/20X4 30/09/20X4 01/11/20X4 01/12/20X4 Company 1 332.01 353.35 355.89 Regression Statistics Multiple R R Square Adjusted R Square Standard Error Observations ANOVA Regression Residual Total Intercept X Variable 1 392.07 398.56 388.30 382.97 396.28 398.18 396.28 390.85 372.77 FTSE 100 6510.4 6809.7 6598.4 6780 6844.5 6743.9 6730.1 6819.8 6622.7 6546.5 6722.6 6566.1 0.428915804 0.183968767 0.102365644 20.58613595 df 12 1 10 11 Coefficients -154.5356553 0.079855173 SS MS 955.4038557 955.4038557 4237.889934 423.7889934 5193.293789 Standard Error F 2.254432915 t Stat P-value 355.9185124 0.434188304 0.673370302 0.053184416 1.501476911 0.164131251 Significance F 0.164131251 Required (a) Identify 5 measurement errors or issues from the above regression approach. (10 marks) (b) Explain how you may modify the regression to improve the accuracy of the estimated beta. (20 marks)

Step by Step Solution

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started