Answered step by step

Verified Expert Solution

Question

1 Approved Answer

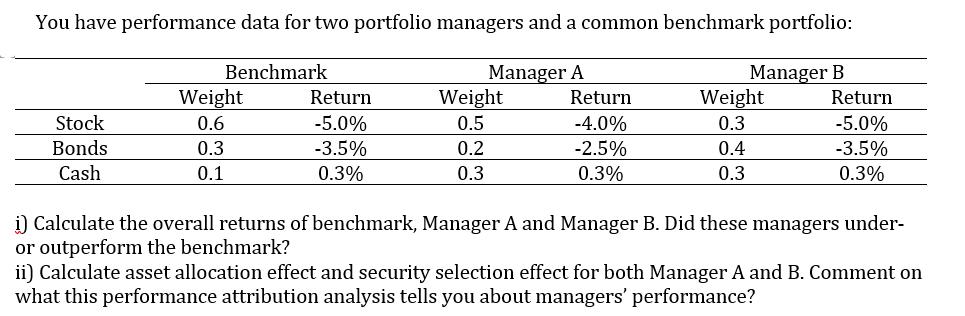

You have performance data for two portfolio managers and a common benchmark portfolio: Manager A Stock Bonds Cash Benchmark Weight 0.6 0.3 0.1 Return

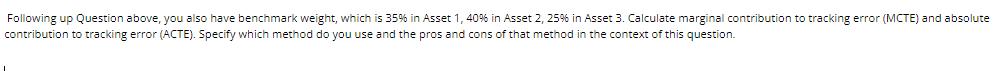

You have performance data for two portfolio managers and a common benchmark portfolio: Manager A Stock Bonds Cash Benchmark Weight 0.6 0.3 0.1 Return -5.0% -3.5% 0.3% Weight 0.5 0.2 0.3 Return -4.0% -2.5% 0.3% Manager B Weight 0.3 0.4 0.3 Return -5.0% -3.5% 0.3% i) Calculate the overall returns of benchmark, Manager A and Manager B. Did these managers under- or outperform the benchmark? ii) Calculate asset allocation effect and security selection effect for both Manager A and B. Comment on what this performance attribution analysis tells you about managers' performance? Following up Question above, you also have benchmark weight, which is 35% in Asset 1, 40% in Asset 2, 25% in Asset 3. Calculate marginal contribution to tracking error (MCTE) and absolute contribution to tracking error (ACTE). Specify which method do you use and the pros and cons of that method in the context of this question.

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

i The overall returns for the benchmark Manager A and Manager B are Benchmark return 40 Manager A re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started