Answered step by step

Verified Expert Solution

Question

1 Approved Answer

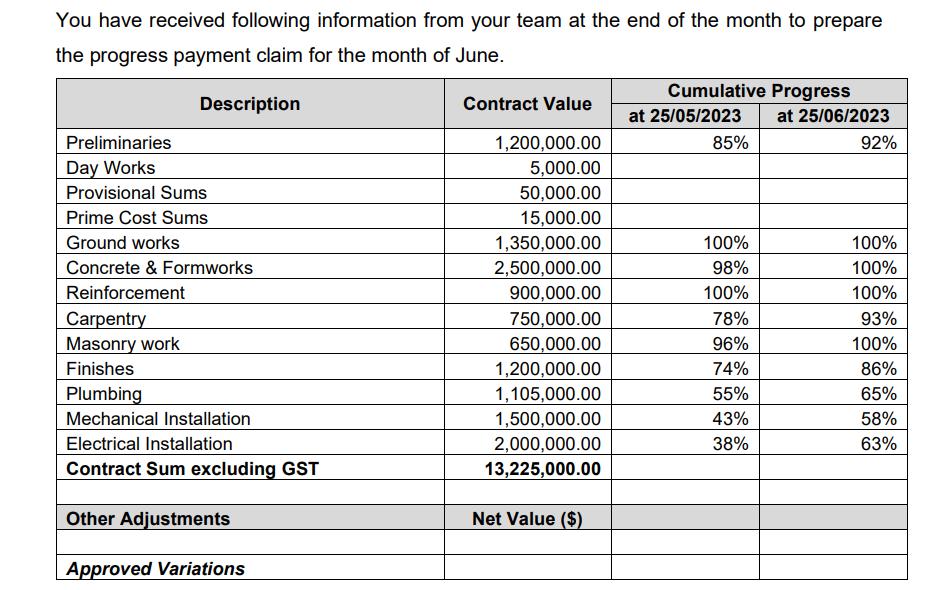

You have received following information from your team at the end of the month to prepare the progress payment claim for the month of

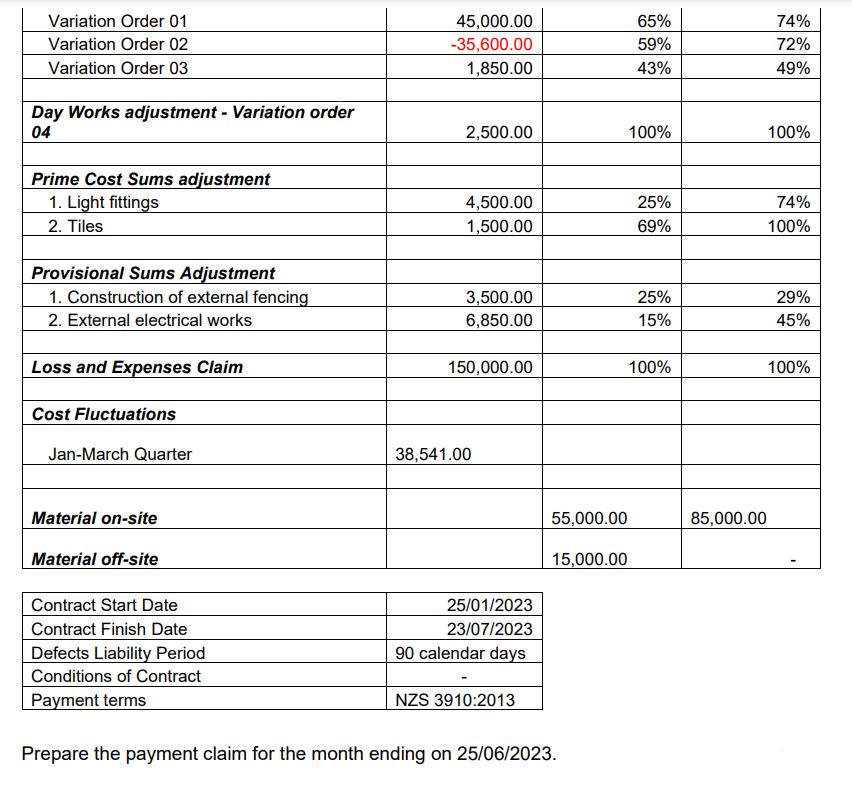

You have received following information from your team at the end of the month to prepare the progress payment claim for the month of June. Preliminaries Day Works Description Provisional Sums Prime Cost Sums Ground works Concrete & Formworks Reinforcement Carpentry Masonry work Finishes Plumbing Mechanical Installation Electrical Installation Contract Sum excluding GST Other Adjustments Approved Variations Contract Value 1,200,000.00 5,000.00 50,000.00 15,000.00 1,350,000.00 2,500,000.00 900,000.00 750,000.00 650,000.00 1,200,000.00 1,105,000.00 1,500,000.00 2,000,000.00 13,225,000.00 Net Value ($) Cumulative Progress at 25/05/2023 85% 100% 98% 100% 78% 96% 74% 55% 43% 38% at 25/06/2023 92% 100% 100% 100% 93% 100% 86% 65% 58% 63% Variation Order 01 Variation Order 02 Variation Order 03 Day Works adjustment - Variation order 04 Prime Cost Sums adjustment 1. Light fittings 2. Tiles Provisional Sums Adjustment 1. Construction of external fencing 2. External electrical works Loss and Expenses Claim Cost Fluctuations Jan-March Quarter Material on-site Material off-site Contract Start Date Contract Finish Date Defects Liability Period Conditions of Contract Payment terms 45,000.00 -35,600.00 1,850.00 2,500.00 4,500.00 1,500.00 3,500.00 6,850.00 150,000.00 38,541.00 25/01/2023 23/07/2023 90 calendar days NZS 3910:2013 55,000.00 15,000.00 Prepare the payment claim for the month ending on 25/06/2023. 65% 59% 43% 100% 25% 69% 25% 15% 100% 85,000.00 74% 72% 49% 100% 74% 100% 29% 45% 100%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION To prepare the payment claim for the month ending on 25062023 we need to calculate the progress percentages for each item and determine the corresponding amounts to be claimed Heres the break...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started