Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have recently been appointed as assistant to the financial controller of Chaffinch plc, a manufacturing company. He has asked you to help with the

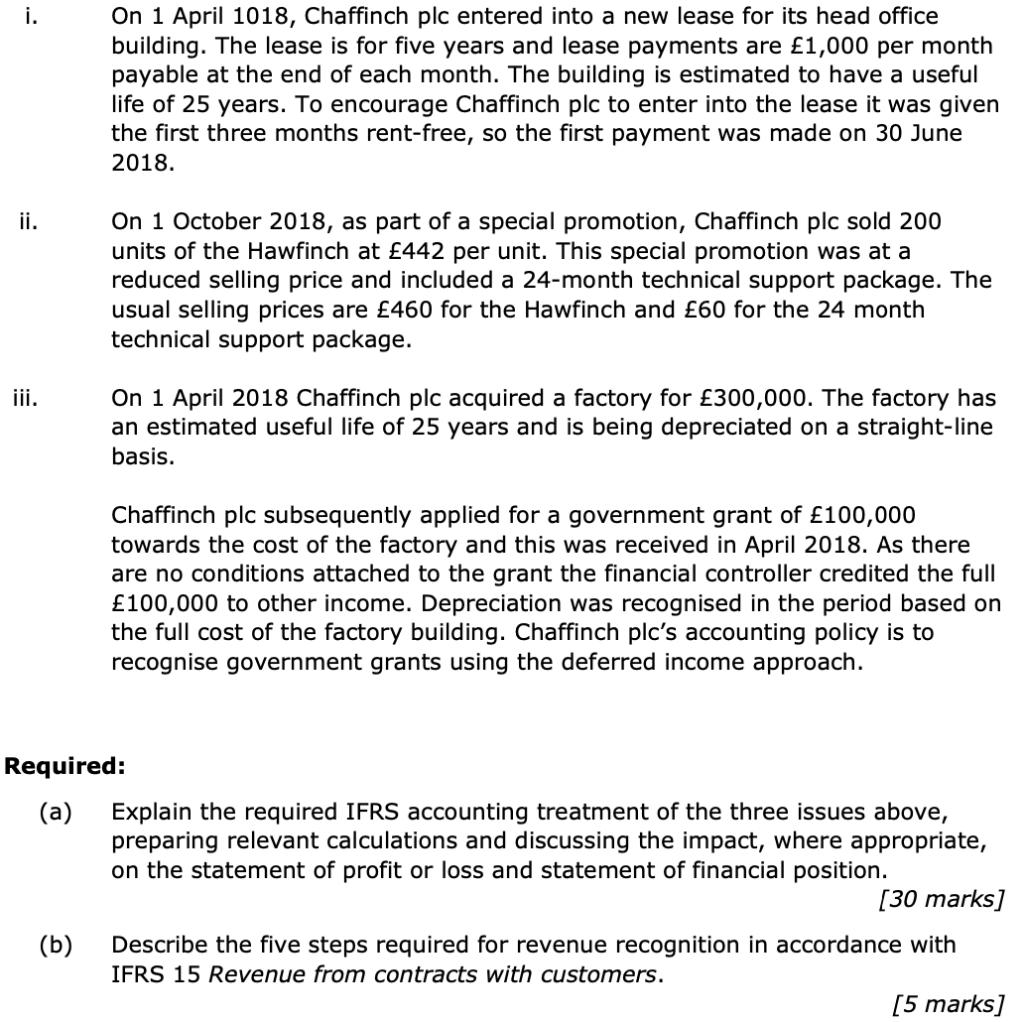

You have recently been appointed as assistant to the financial controller of Chaffinch plc, a manufacturing company. He has asked you to help with the finalisation of the financial statements for the year ended 31 December 2018. There are a number of outstanding issues which still need to be resolved.

The following outstanding issues have been identified:

i. ii. iii. On 1 April 1018, Chaffinch plc entered into a new lease for its head office building. The lease is for five years and lease payments are 1,000 per month payable at the end of each month. The building is estimated to have a useful life of 25 years. To encourage Chaffinch plc to enter into the lease it was given the first three months rent-free, so the first payment was made on 30 June 2018. (b) On 1 October 2018, as part of a special promotion, Chaffinch plc sold 200 units of the Hawfinch at 442 per unit. This special promotion was at a reduced selling price and included a 24-month technical support package. The usual selling prices are 460 for the Hawfinch and 60 for the 24 month technical support package. On 1 April 2018 Chaffinch plc acquired a factory for 300,000. The factory has an estimated useful life of 25 years and is being depreciated on a straight-line basis. Chaffinch plc subsequently applied for a government grant of 100,000 towards the cost of the factory and this was received in April 2018. As there are no conditions attached to the grant the financial controller credited the full 100,000 to other income. Depreciation was recognised in the period based on the full cost of the factory building. Chaffinch plc's accounting policy is to recognise government grants using the deferred income approach. Required: (a) Explain the required IFRS accounting treatment of the three issues above, preparing relevant calculations and discussing the impact, where appropriate, on the statement of profit or loss and statement of financial position. [30 marks] Describe the five steps required for revenue recognition in accordance with IFRS 15 Revenue from contracts with customers. [5 marks]

Step by Step Solution

★★★★★

3.39 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1Rent liability per month is 1000 The lesser has waived the rent for initial 3 months So ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started