Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have recently been appointed in the credit department of Stranded Bank. One of your main tasks is to do credit evaluations of the

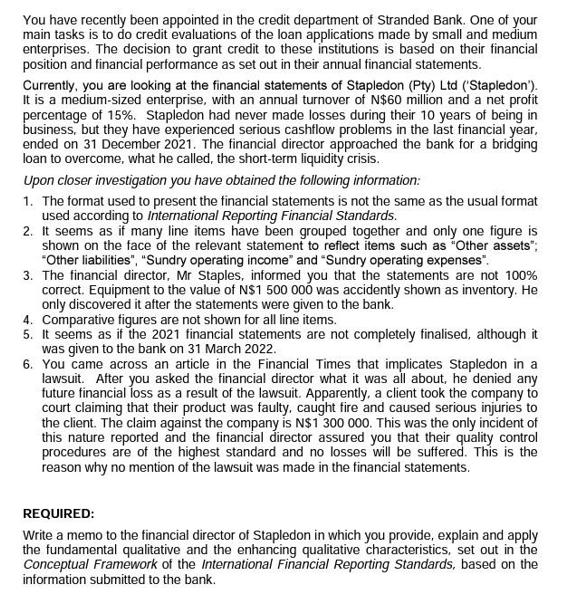

You have recently been appointed in the credit department of Stranded Bank. One of your main tasks is to do credit evaluations of the loan applications made by small and medium enterprises. The decision to grant credit to these institutions is based on their financial position and financial performance as set out in their annual financial statements. Currently, you are looking at the financial statements of Stapledon (Pty) Ltd (Stapledon'). It is a medium-sized enterprise, with an annual turnover of N$60 million and a net profit percentage of 15%. Stapledon had never made losses during their 10 years of being in business, but they have experienced serious cashflow problems in the last financial year, ended on 31 December 2021. The financial director approached the bank for a bridging loan to overcome, what he called, the short-term liquidity crisis. Upon closer investigation you have obtained the following information: 1. The format used to present the financial statements is not the same as the usual format used according to International Reporting Financial Standards. 2. It seems as if many line items have been grouped together and only one figure is shown on the face of the relevant statement to reflect items such as "Other assets"; "Other liabilities", "Sundry operating income" and "Sundry operating expenses". 3. The financial director, Mr Staples, informed you that the statements are not 100% correct. Equipment to the value of N$1 500 000 was accidently shown as inventory. He only discovered it after the statements were given to the bank. 4. Comparative figures are not shown for all line items. 5. It seems as if the 2021 financial statements are not completely finalised, although it was given to the bank on 31 March 2022. 6. You came across an article in the Financial Times that implicates Stapledon in a lawsuit. After you asked the financial director what it was all about, he denied any future financial loss as a result of the lawsuit. Apparently, a client took the company to court claiming that their product was faulty, caught fire and caused serious injuries to the client. The claim against the company is N$1 300 000. This was the only incident of this nature reported and the financial director assured you that their quality control procedures are of the highest standard and no losses will be suffered. This is the reason why no mention of the lawsuit was made in the financial statements. REQUIRED: Write a memo to the financial director of Stapledon in which you provide, explain and apply the fundamental qualitative and the enhancing qualitative characteristics, set out in the Conceptual Framework of the International Financial Reporting Standards, based on the information submitted to the bank.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Memorandum To Mr Staples Financial Director of Stapledon Pty Ltd From Your Name Credit Department of Stranded Bank Subject Qualitative Characteristics ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started