Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have recently been hired as a fund manager in the portfolio management team of a bank. Your Director, John Tan has arranged a

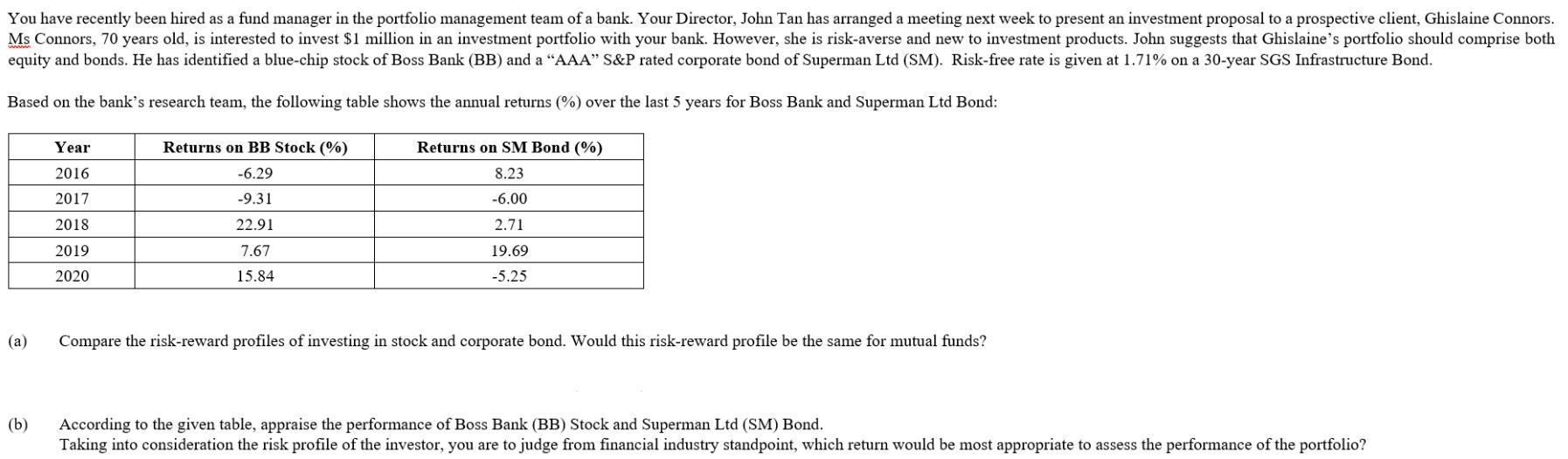

You have recently been hired as a fund manager in the portfolio management team of a bank. Your Director, John Tan has arranged a meeting next week to present an investment proposal to a prospective client, Ghislaine Connors. Ms Connors, 70 years old, is interested to invest $1 million in an investment portfolio with your bank. However, she is risk-averse and new to investment products. John suggests that Ghislaine's portfolio should comprise both equity and bonds. He has identified a blue-chip stock of Boss Bank (BB) and a "AAA" S&P rated corporate bond of Superman Ltd (SM). Risk-free rate is given at 1.71% on a 30-year SGS Infrastructure Bond. Based on the bank's research team, the following table shows the annual returns (%) over the last 5 years for Boss Bank and Superman Ltd Bond: (a) (b) Year 2016 2017 2018 2019 2020 Returns on BB Stock (%) -6.29 -9.31 22.91 7.67 15.84 Returns on SM Bond (%) 8.23 -6.00 2.71 19.69 -5.25 Compare the risk-reward profiles of investing in stock and corporate bond. Would this risk-reward profile be the same for mutual funds? According to the given table, appraise the performance of Boss Bank (BB) Stock and Superman Ltd (SM) Bond. Taking into consideration the risk profile of the investor, you are to judge from financial industry standpoint, which return would be most appropriate to assess the performance of the portfolio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Year BB stock X XM XM 2 SM bondY YM YM 2 2016 629 1245 15510 823 4354 1896 2017 931 1547 23944 6 9...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started